Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please FULLY solve ALL parts! QS 3-5 (Algo) Prepaid (deferred) expenses adjustments LO P1 For each separate case below, follow the three-step process for adjusting

please FULLY solve ALL parts!

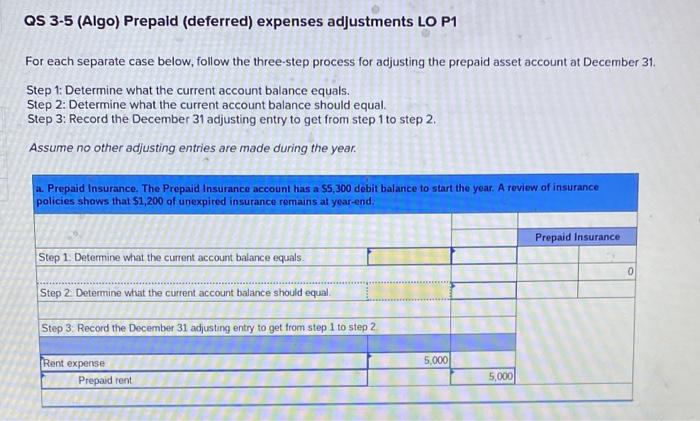

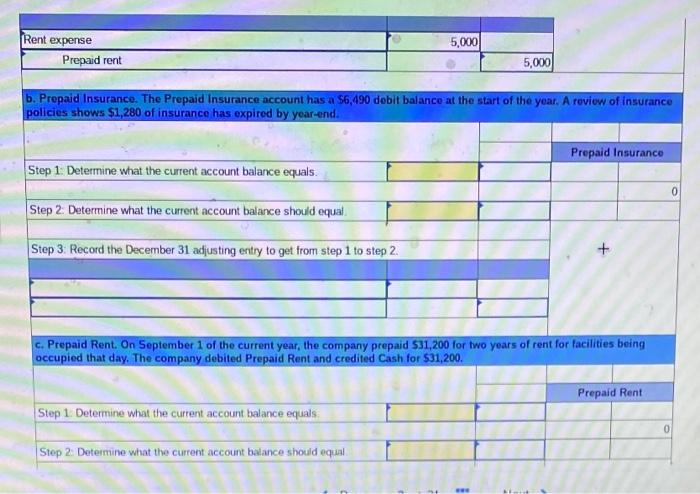

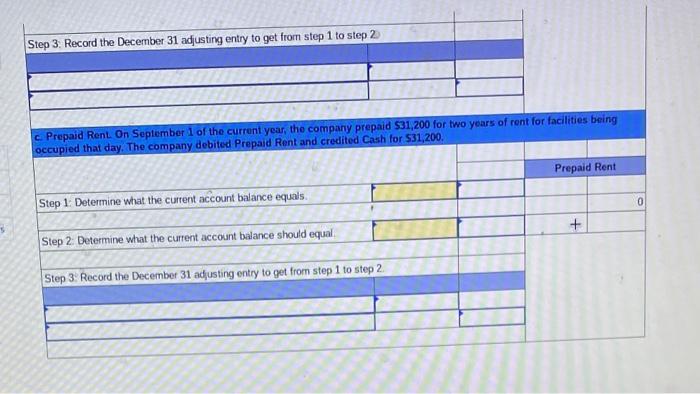

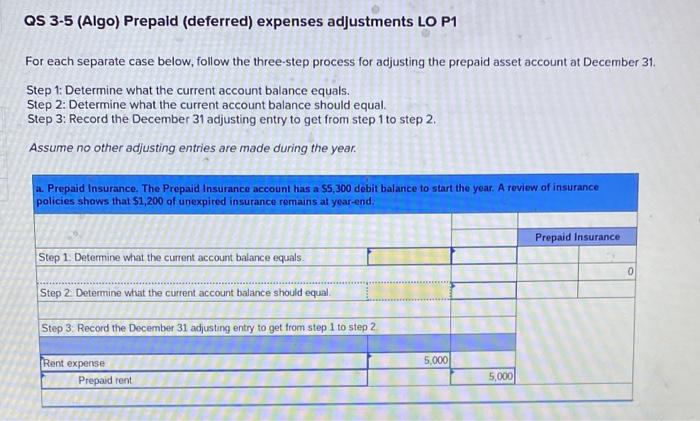

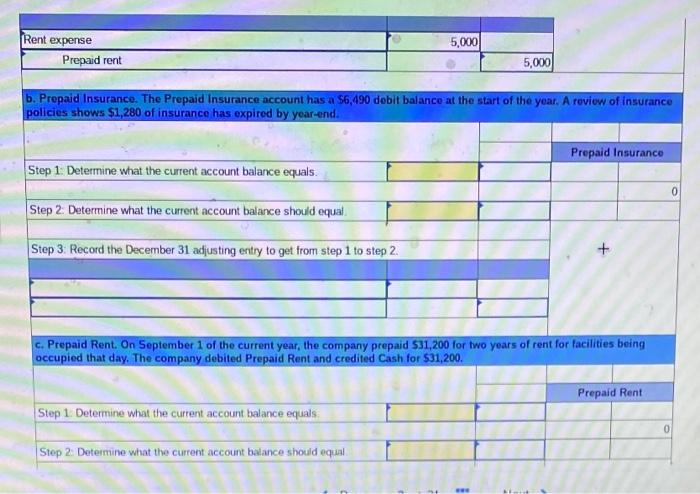

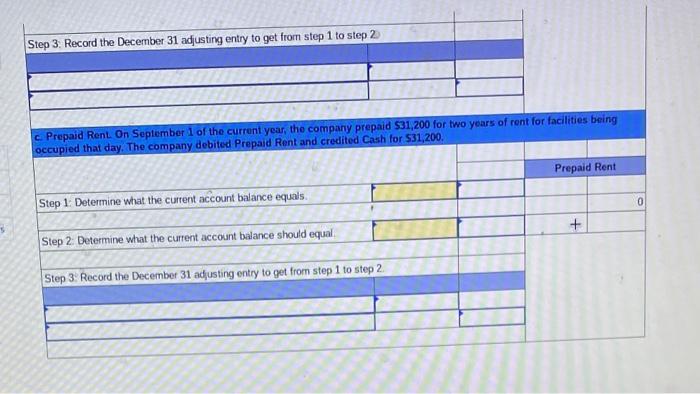

QS 3-5 (Algo) Prepaid (deferred) expenses adjustments LO P1 For each separate case below, follow the three-step process for adjusting the prepaid asset account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2 . Assume no other adjusting entries are made during the year. \begin{tabular}{|c|r|r|} \hline Rent expense & 5,000 & \\ \hline Prepaid rent & & 5,000 \\ \hline \end{tabular} b. Prepaid Insurance. The Prepaid Insurance account has a $6,490 debit balance at the start of the year. A reviow of insurance policies shows $1,280 of insurance has expired by year-end. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. c. Prepaid Rent. On September 1 of the current year, the company prepaid 531,200 for two years of rent for facilities being occupied that day. The company debited Prepaid Rent and credited Cash for $31,200. Step 1: Determine what the current account balance equals: Step 2: Determine what the current account balance should equal Step 3. Record the December 31 adjusting entry to get from step 1 to step 2 c. Prepaid RenL On September 1 of the current year, the company prepaid S31,200 for two years of rent for facilities being occupied that day. The company debited Prepaid Rent and credited Cash for $31,200. Step 1: Determine what the current account balance equals. Step 2. Determine what the current account balance should equal. Step 3: Record the December 31 adfusting entry to get from step 1 to step 2. QS 3-5 (Algo) Prepaid (deferred) expenses adjustments LO P1 For each separate case below, follow the three-step process for adjusting the prepaid asset account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2 . Assume no other adjusting entries are made during the year. \begin{tabular}{|c|r|r|} \hline Rent expense & 5,000 & \\ \hline Prepaid rent & & 5,000 \\ \hline \end{tabular} b. Prepaid Insurance. The Prepaid Insurance account has a $6,490 debit balance at the start of the year. A reviow of insurance policies shows $1,280 of insurance has expired by year-end. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. c. Prepaid Rent. On September 1 of the current year, the company prepaid 531,200 for two years of rent for facilities being occupied that day. The company debited Prepaid Rent and credited Cash for $31,200. Step 1: Determine what the current account balance equals: Step 2: Determine what the current account balance should equal Step 3. Record the December 31 adjusting entry to get from step 1 to step 2 c. Prepaid RenL On September 1 of the current year, the company prepaid S31,200 for two years of rent for facilities being occupied that day. The company debited Prepaid Rent and credited Cash for $31,200. Step 1: Determine what the current account balance equals. Step 2. Determine what the current account balance should equal. Step 3: Record the December 31 adfusting entry to get from step 1 to step 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started