Answered step by step

Verified Expert Solution

Question

1 Approved Answer

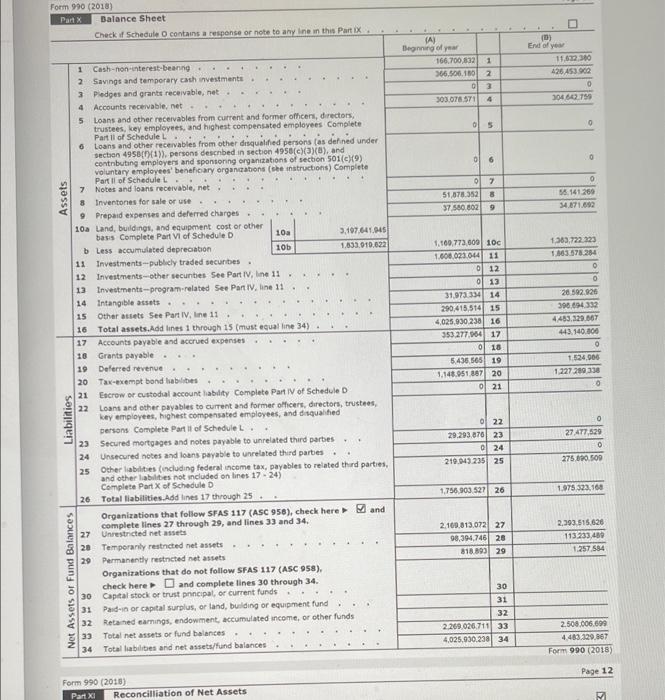

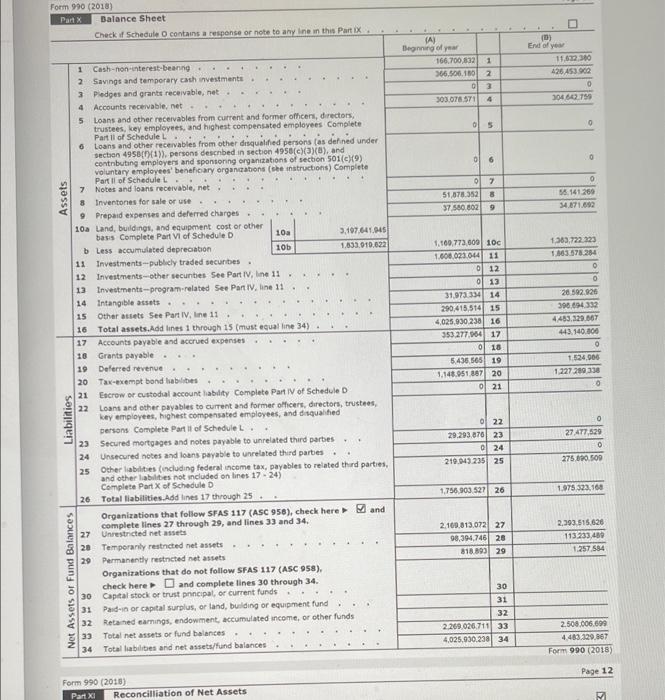

Please give 3 ratios from the balance sheet and the formula you used to get the ratios. What value does the ratio provide about the

Please give 3 ratios from the balance sheet and the formula you used to get the ratios. What value does the ratio provide about the company.

Form 990 (2018) Part Balance Sheet Check of Schedule contains a response or not to any line in this parti (A) Beginning of year 166,700,832 1 366.500.180 2 0 3 303.078 571 4 (3) End of you 11.622 300 426 45390 0 304642751 5 O 0 o 6 0 0 51,078.352 37580.802 Assets 7 8 ells 56.141.269 34.871.692 9 1,363.722 323 1.863.578.254 0 0 1 Cash-non-interest-beaning 2 Savings and temporary cash investments 3 Pledges and grants receivable, net 4 Accounts receivable.net 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees Complete Partil of ScheduleL 6 Loans and other receivables from other disqualified persons (as defined under section 495B(1). persons descnbed in section 4950(c)(3)(b), and contributing employers and sponsoring organizations of section 501(c)(9) voluntary employees' beneficary organizations (se instructions) Complete Part Il of Schedule 7 Notes and loans receivable, net 8 Inventones for sale or use. 9 Prepaid expenses and deferred charges. 10a Land, buildings, and equipment cost or other bass Complete Part VI of Schedule D 100 3.107.641.245 bless accumulated depreciation 10b 1.833,010,022 11 Investments-publicly traded securites. 12 Investments-other secuntes See Part IV line 11 13 Investments--program-related See Part IV. line 11 14 Intangible assets. 15 Other assets See Part IV, line 11 16 Total assets.Add lines 1 through 15 (must equal line 34). 17 Accounts payable and accrued expenses 18 Grants payable 19 Deferred revenue 20 Tax-exempt bond liabilibes 21 Escrow or custodial accountability Complete Part IV of Schedule D 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons Complete Partit of ScheduleL. 23 Secured mortgages and notes payable to unrelated third parties 24 Unsecured notes and loans payable to unrelated third parties 25 Other labilities (including federal income tax, payables to related third parties, and other abilities not included on line 17-24) Complete Part X of Schedule D 26 Total liabilities.Add lines 17 through 25. Organizations that follow SFAS 117 (ASC 956), check here and complete lines 27 through 29, and lines 33 and 34. 27 Unrestricted net assets 20 Temporarily restricted net assets 20 Permanently restricted net assets Organizations that do not follow SFAS 117 (ASC 958). check here and complete lines 30 through 34. 30 Capital stock or trust principal, or current funds 31 Paid-in or capital surplus, or land, building or equipment fund 32 Retained earnings, endowment, accumulated income, or other funds 33 Total net assets or fund balances 34 Total abilities and net assets/fund balances 1.160,773,600 100 1.600.023044 11 O 12 0 13 31.973.334 14 290,415,514 15 4,025,030 238 16 353.277,064 17 o 18 5.436.565 19 51148951387 20 21 28 592.926 396,694332 4483,120.167 443.140.800 1.524.900 1.227289330 Liabilities 0 o 22 29.293.870 23 24 219.043 235 25 27.477.529 0 275.000 500 1.756.903.527 26 1.975,323,166 2.100.813.0721 27 98.394,746 28 818.893 29 2.393.515.626 113.233.48 1.257 584 Net Assets or Fund Balances 30 31 32 2.269 026.711 33 4,025.930 230 34 2.500.006.699 4.463.329,867 Form 990 2018) Page 12 Form 990 (2015) Part XI Reconciliation of Net Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started