Please give a detailed explanation for part C (bottom left). The correct answer is already there, but I struggle to understand the intuition behind the three equations that have Wa, Wb, Wc, and why they are equal to 2,1,1

is there any trick to figure out when to long or short the synthetic portfolio?

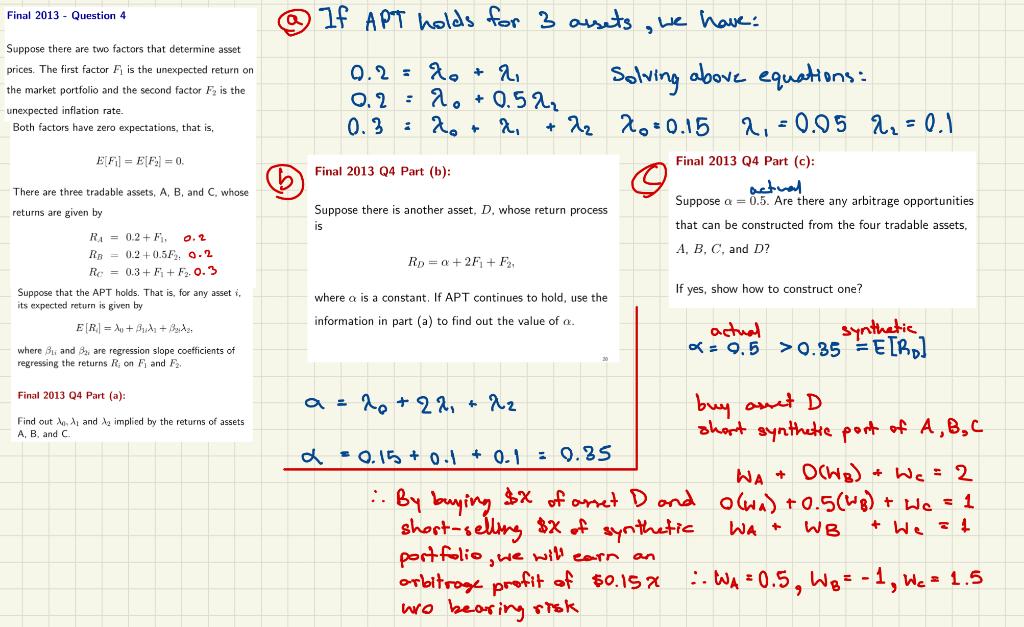

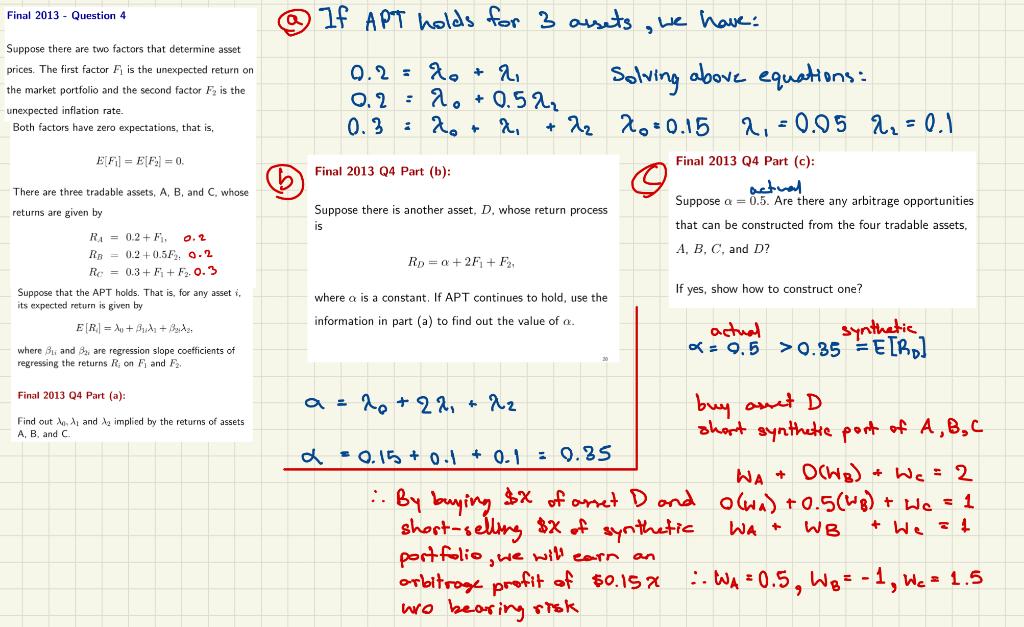

Final 2013 - Question 4 (a) If APT holds for 3 assets, we have: Suppose there are two factors that determine asset prices. The first factor F1 is the unexpected return of the market portfolio and the second factor F2 is the 0.2=0+1 Solving above equations: unexpected inflation rate. Both factors have zero expectations, that is, 0.3=0+1+20=0.151=0.052=0.1 E[F1]=E[F2]=0 Final 2013 Q4 Part (b): Final 2013 Q4 Part (c): There are three tradable assets, A,B, and C, whose Suppose there is another asset, D, whose return process Suppose a=0.5. Are there any arbitrage opportunities returns are given by RA=0.2+F1,0.2RB=0.2+0.5F2:0.2RC=0.3+F1+F2.0.3 is that can be constructed from the four tradable assets, A,B,C, and D? RD=+2F1+F2 That is, for any asset where is a constant. If APT continues to hold, use the If yes, show how to construct one? E[R1]=1+111+312 information in part (a) to find out the value of . where 1i and 2i are regression slope coefficients of regressing the returns R1 on F1 and F2. Final 2013 Q4 Part (a): Find out 011 and 2 implied by the returns of assets A,B, and C. a=0+21+2=0.15+0.1+0.1=0.35buyaxectDshortsyntheteportofA,B,CA+D(WB)+C=2 By buying $x of arset D and O(WA)+0.5(WB)+WC=1 shost-selling $x of synthatic WA+WB+WC=1 portfolio, we will earn an orbitrage profit of $0.15xWA=0.5,WB=1,WC=1.5 wro bearing risk Final 2013 - Question 4 (a) If APT holds for 3 assets, we have: Suppose there are two factors that determine asset prices. The first factor F1 is the unexpected return of the market portfolio and the second factor F2 is the 0.2=0+1 Solving above equations: unexpected inflation rate. Both factors have zero expectations, that is, 0.3=0+1+20=0.151=0.052=0.1 E[F1]=E[F2]=0 Final 2013 Q4 Part (b): Final 2013 Q4 Part (c): There are three tradable assets, A,B, and C, whose Suppose there is another asset, D, whose return process Suppose a=0.5. Are there any arbitrage opportunities returns are given by RA=0.2+F1,0.2RB=0.2+0.5F2:0.2RC=0.3+F1+F2.0.3 is that can be constructed from the four tradable assets, A,B,C, and D? RD=+2F1+F2 That is, for any asset where is a constant. If APT continues to hold, use the If yes, show how to construct one? E[R1]=1+111+312 information in part (a) to find out the value of . where 1i and 2i are regression slope coefficients of regressing the returns R1 on F1 and F2. Final 2013 Q4 Part (a): Find out 011 and 2 implied by the returns of assets A,B, and C. a=0+21+2=0.15+0.1+0.1=0.35buyaxectDshortsyntheteportofA,B,CA+D(WB)+C=2 By buying $x of arset D and O(WA)+0.5(WB)+WC=1 shost-selling $x of synthatic WA+WB+WC=1 portfolio, we will earn an orbitrage profit of $0.15xWA=0.5,WB=1,WC=1.5 wro bearing risk