Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give answer for 2017, not 2020 *P10-11 Camco Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation

Please give answer for 2017, not 2020

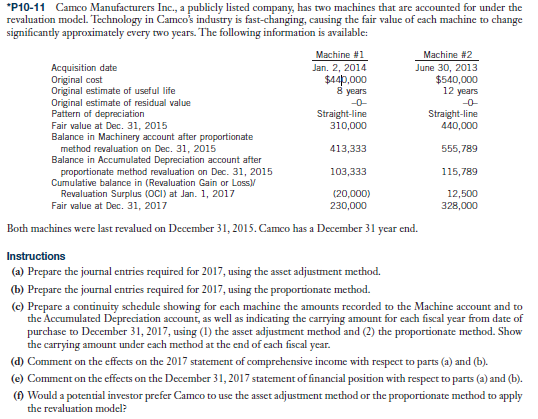

*P10-11 Camco Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Camco's industry is fast-changing, causing the fair value of each machine to change significantly approximately every two years. The following information is available: Machine #1 Machine #2 Acquisition date Jan. 2, 2014 June 30, 2013 Original cost $440,000 $540,000 Original estimate of useful life 8 years 12 years Original estimate of residual value Pattern of depreciation Straight-line Straight-line Fair value at Dec. 31, 2015 310,000 440,000 Balance in Machinery account after proportionate method revaluation on Dec. 31, 2015 413,333 555,789 Balance in Accumulated Depreciation account after proportionate method revaluation on Dec 31, 2015 103,333 115,789 Cumulative balance in (Revaluation Gain or Loss) Revaluation Surplus (OCI) at Jan. 1, 2017 (20,000) 12,500 Fair value at Dec. 31, 2017 230,000 328,000 Both machines were last revalued on December 31, 2015. Camco has a December 31 year end. Instructions (2) Prepare the journal entries required for 2017, using the asset adjustment method. (b) Prepare the journal entries required for 2017, using the proportionate method. (c) Prepare a continuity schedule showing for each machine the amounts recorded to the Machine account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2017, using (1) the asset adjustment method and (2) the proportionate method. Show the carrying amount under each method at the end of each fiscal year. (d) Comment on the effects on the 2017 statement of comprehensive income with respect to parts (a) and (b). (e) Comment on the effects on the December 31, 2017 statement of financial position with respect to parts (2) and (b). (1) Would a potential investor prefer Camco to use the asset adjustment method or the proportionate method to apply the revaluation modelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started