Answered step by step

Verified Expert Solution

Question

1 Approved Answer

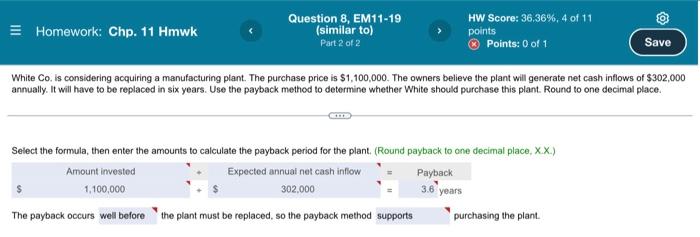

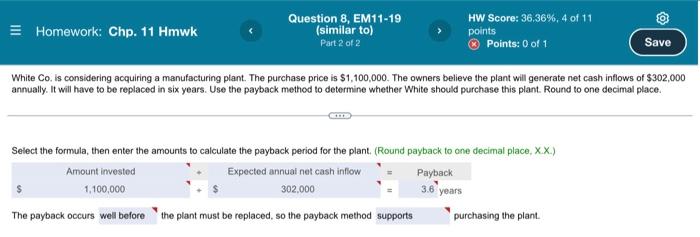

Please give calculations and answer all parts just like in the example. will upvote! Example Actual Peoblem Homework: Chp. 11 Hmwk Question 8, EM11-19 (similar

Please give calculations and answer all parts just like in the example. will upvote!

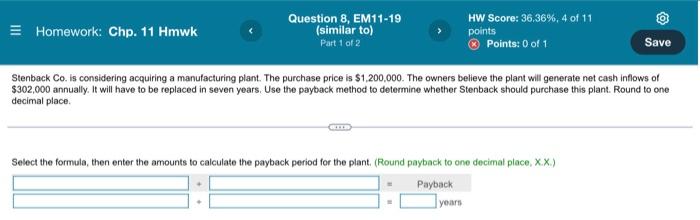

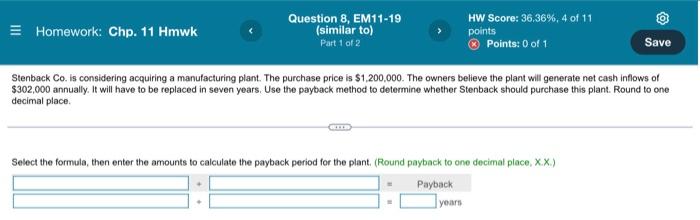

Homework: Chp. 11 Hmwk Question 8, EM11-19 (similar to) Part 2 of 2 HW Score: 36.36%, 4 of 11 points Points: 0 of 1 Save White Co. is considering acquiring a manufacturing plant. The purchase price is $1,100,000. The owners believe the plant will generate net cash inflows of $302,000 annually. It will have to be replaced in six years. Use the payback method to determine whether White should purchase this plant. Round to one decimal place. Select the formula, then enter the amounts to calculate the payback period for the plant. (Round payback to one decimal place, X.X.) Amount invested Expected annual net cash inflow 302.000 Payback 3.6 years 1,100,000 The payback occurs well before the plant must be replaced, so the payback method supports purchasing the plant. Question 8, EM11-19 (similar to) Part 1 of 2 HW Score: 36,36%, 4 of 11 points Homework: Chp. 11 Hmwk Points: 0 of 1 Save Stenback Co. is considering acquiring a manufacturing plant. The purchase price is $1,200,000. The owners believe the plant will generate net cash inflows of $302,000 annually. It will have to be replaced in seven years. Use the payback method to determine whether Stenback should purchase this plant. Round to one decimal place. Select the formula, then enter the amounts to calculate the payback period for the plant. (Round payback to one decimal place, X.X.) Payback years Example

Actual Peoblem

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started