Please give correct answers. Thanks

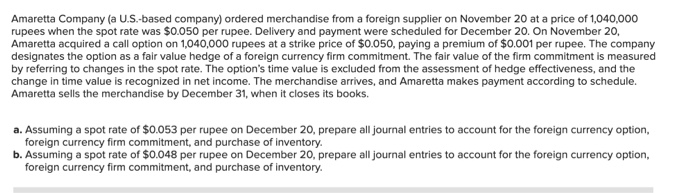

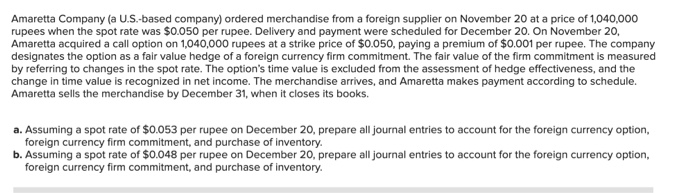

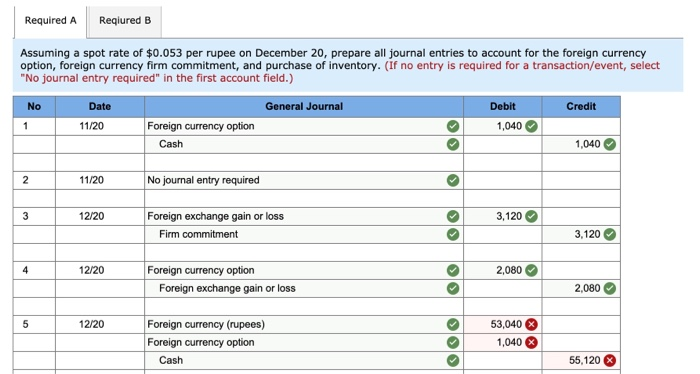

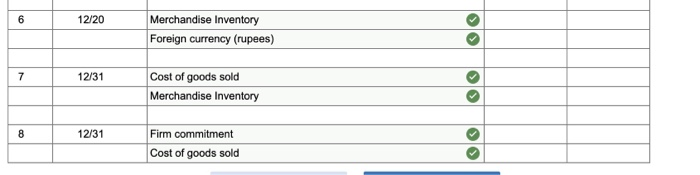

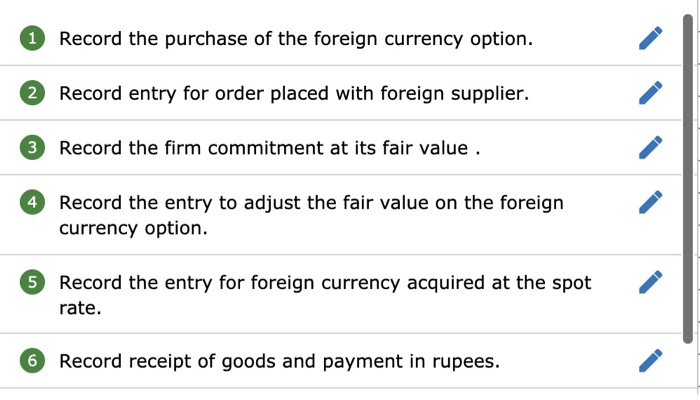

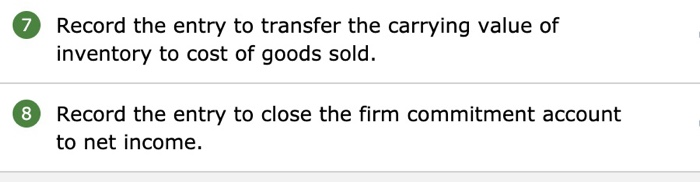

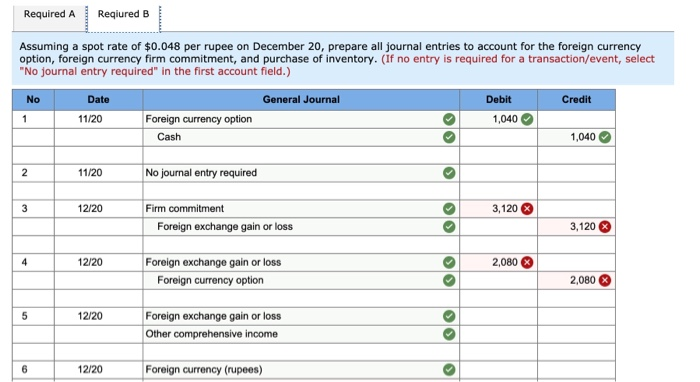

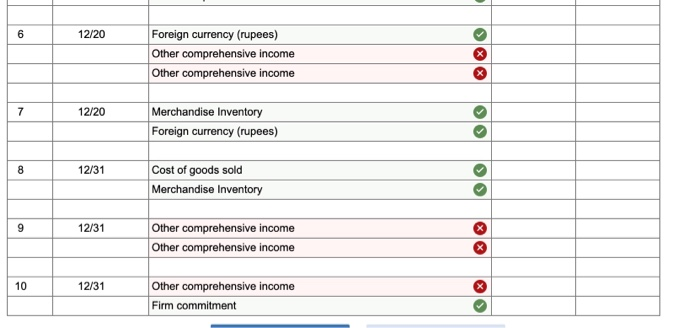

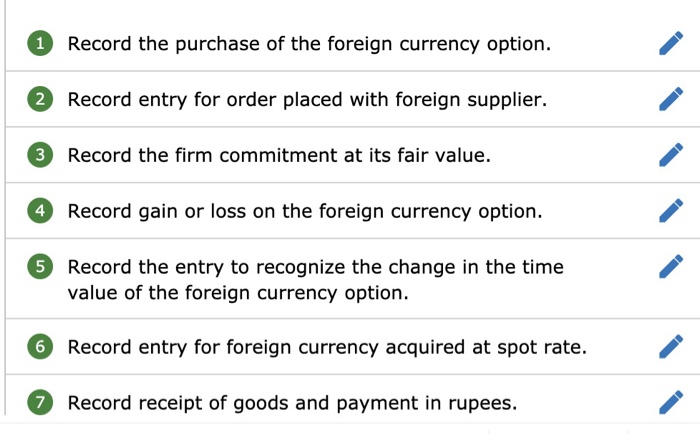

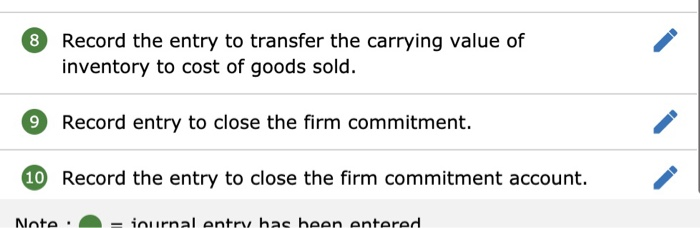

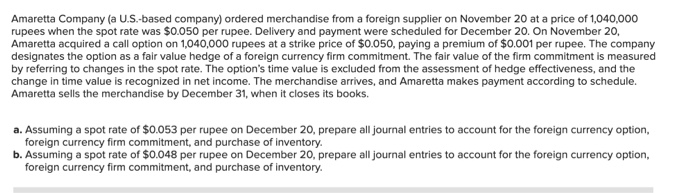

Amaretta Company (a U.S.-based company) ordered merchandise from a foreign supplier on November 20 at a price of 1,040,000 rupees when the spot rate was $0.050 per rupee. Delivery and payment were scheduled for December 20. On November 20, Amaretta acquired a call option on 1,040,000 rupees at a strike price of $0.050, paying a premium of $0.001 per rupee. The company designates the option as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured by referring to changes in the spot rate. The option's time value is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income. The merchandise arrives, and Amaretta makes payment according to schedule. Amaretta sells the merchandise by December 31, when it closes its books. a. Assuming a spot rate of $0.053 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. b. Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. Required A Reqiured B Assuming a spot rate of $0.053 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Date General Journal Debit Credit 11/20 Foreign currency option 1,040 Cash 1,040 No 1 2 2 11/20 No journal entry required 3 12/20 3,120 Foreign exchange gain or loss Firm commitment 3,120 4 12/20 > 2,080 Foreign currency option Foreign exchange gain or loss 2,080 5 12/20 Foreign currency (rupees) Foreign currency option Cash 53,040 1,040 55,120 6 12/20 Merchandise Inventory Foreign currency (rupees) 7 12/31 Cost of goods sold Merchandise Inventory 8 12/31 > Firm commitment Cost of goods sold Record the purchase of the foreign currency option. Record entry for order placed with foreign supplier. 3 Record the firm commitment at its fair value. 4 Record the entry to adjust the fair value on the foreign currency option. 5 Record the entry for foreign currency acquired at the spot rate. 6 Record receipt of goods and payment in rupees. 7 Record the entry to transfer the carrying value of inventory to cost of goods sold. 8 Record the entry to close the firm commitment account to net income. Required A Regiured B Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Debit Credit 11/20 Foreign currency option 1,040 Cash 1,040 No Date General Journal 1 2 11/20 No journal entry required N 3 12/20 3,120 Firm commitment Foreign exchange gain or loss 00 3,120 4 12/20 2,080 Foreign exchange gain or loss Foreign currency option lo 2,080 5 12/20 > Foreign exchange gain or loss Other comprehensive income 6 12/20 Foreign currency (rupees) 6 12/20 Foreign currency (rupees) Other comprehensive income Other comprehensive income 7 12/20 Merchandise Inventory Foreign currency (rupees) 8 12/31 Cost of goods sold Merchandise Inventory 9 12/31 Other comprehensive income Other comprehensive income 10 12/31 X Other comprehensive income Firm commitment Record the purchase of the foreign currency option. 2 Record entry for order placed with foreign supplier. 3 Record the firm commitment at its fair value. Record gain or loss on the foreign currency option. Record the entry to recognize the change in the time value of the foreign currency option. 6 Record entry for foreign currency acquired at spot rate. Record receipt of goods and payment in rupees. 8 Record the entry to transfer the carrying value of inventory to cost of goods sold. 9 Record entry to close the firm commitment. 10 Record the entry to close the firm commitment account. Note inurnal entry has been entered Amaretta Company (a U.S.-based company) ordered merchandise from a foreign supplier on November 20 at a price of 1,040,000 rupees when the spot rate was $0.050 per rupee. Delivery and payment were scheduled for December 20. On November 20, Amaretta acquired a call option on 1,040,000 rupees at a strike price of $0.050, paying a premium of $0.001 per rupee. The company designates the option as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured by referring to changes in the spot rate. The option's time value is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income. The merchandise arrives, and Amaretta makes payment according to schedule. Amaretta sells the merchandise by December 31, when it closes its books. a. Assuming a spot rate of $0.053 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. b. Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. Required A Reqiured B Assuming a spot rate of $0.053 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Date General Journal Debit Credit 11/20 Foreign currency option 1,040 Cash 1,040 No 1 2 2 11/20 No journal entry required 3 12/20 3,120 Foreign exchange gain or loss Firm commitment 3,120 4 12/20 > 2,080 Foreign currency option Foreign exchange gain or loss 2,080 5 12/20 Foreign currency (rupees) Foreign currency option Cash 53,040 1,040 55,120 6 12/20 Merchandise Inventory Foreign currency (rupees) 7 12/31 Cost of goods sold Merchandise Inventory 8 12/31 > Firm commitment Cost of goods sold Record the purchase of the foreign currency option. Record entry for order placed with foreign supplier. 3 Record the firm commitment at its fair value. 4 Record the entry to adjust the fair value on the foreign currency option. 5 Record the entry for foreign currency acquired at the spot rate. 6 Record receipt of goods and payment in rupees. 7 Record the entry to transfer the carrying value of inventory to cost of goods sold. 8 Record the entry to close the firm commitment account to net income. Required A Regiured B Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Debit Credit 11/20 Foreign currency option 1,040 Cash 1,040 No Date General Journal 1 2 11/20 No journal entry required N 3 12/20 3,120 Firm commitment Foreign exchange gain or loss 00 3,120 4 12/20 2,080 Foreign exchange gain or loss Foreign currency option lo 2,080 5 12/20 > Foreign exchange gain or loss Other comprehensive income 6 12/20 Foreign currency (rupees) 6 12/20 Foreign currency (rupees) Other comprehensive income Other comprehensive income 7 12/20 Merchandise Inventory Foreign currency (rupees) 8 12/31 Cost of goods sold Merchandise Inventory 9 12/31 Other comprehensive income Other comprehensive income 10 12/31 X Other comprehensive income Firm commitment Record the purchase of the foreign currency option. 2 Record entry for order placed with foreign supplier. 3 Record the firm commitment at its fair value. Record gain or loss on the foreign currency option. Record the entry to recognize the change in the time value of the foreign currency option. 6 Record entry for foreign currency acquired at spot rate. Record receipt of goods and payment in rupees. 8 Record the entry to transfer the carrying value of inventory to cost of goods sold. 9 Record entry to close the firm commitment. 10 Record the entry to close the firm commitment account. Note inurnal entry has been entered