Answered step by step

Verified Expert Solution

Question

1 Approved Answer

.... please give detailed Salutation Han Electronics Inc. is an electronics retailer with a fitness equipment retailer subsidiary. Han is a mature company with declining

.... please give detailed Salutation

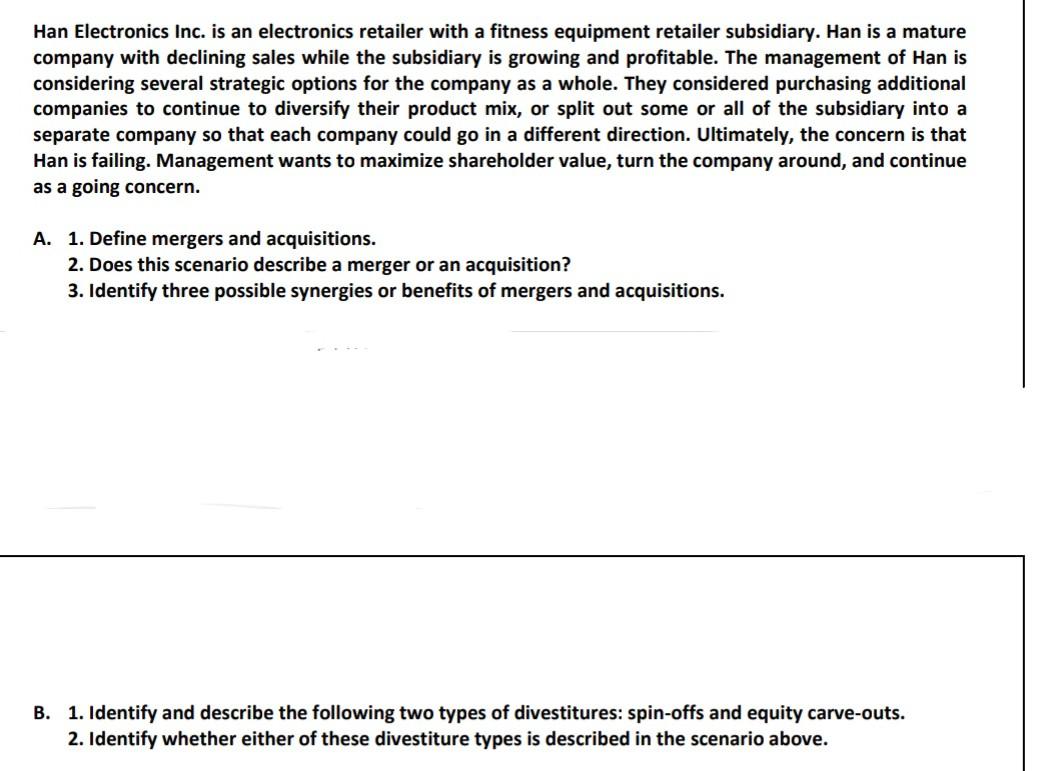

Han Electronics Inc. is an electronics retailer with a fitness equipment retailer subsidiary. Han is a mature company with declining sales while the subsidiary is growing and profitable. The management of Han is considering several strategic options for the company as a whole. They considered purchasing additional companies to continue to diversify their product mix, or split out some or all of the subsidiary into a separate company so that each company could go in a different direction. Ultimately, the concern is that Han is failing. Management wants to maximize shareholder value, turn the company around, and continue as a going concern. A. 1. Define mergers and acquisitions. 2. Does this scenario describe a merger or an acquisition? 3. Identify three possible synergies or benefits of mergers and acquisitions. B. 1. Identify and describe the following two types of divestitures: spin-offs and equity carve-outs. 2. Identify whether either of these divestiture types is described in the scenario aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started