Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give good explanations 9. Explain how stock options provide incentive alignment between managers and shareholders and ways they fail to do so. 10. Briefly

please give good explanations

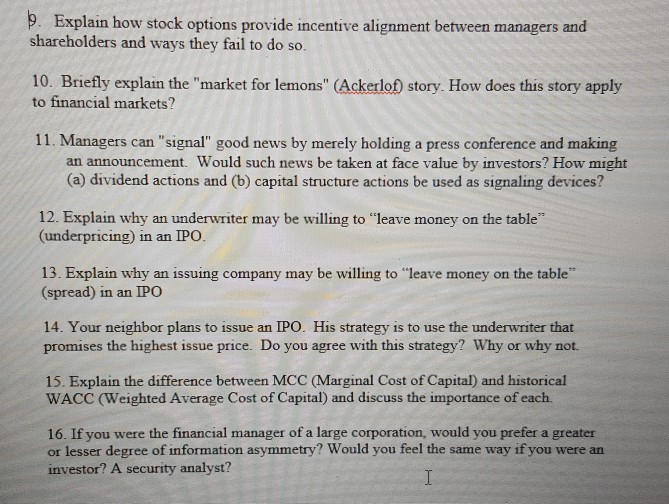

9. Explain how stock options provide incentive alignment between managers and shareholders and ways they fail to do so. 10. Briefly explain the "market for lemons" (Ackerlof story. How does this story apply to financial markets? 11. Managers can "signal" good news by merely holding a press conference and making an announcement. Would such news be taken at face value by investors? How might (a) dividend actions and (b) capital structure actions be used as signaling devices? 12. Explain why an underwriter may be willing to "leave money on the table (underpricing) in an PO 13. Explain why an issuing company may be willing to "leave money on the table" (spread) in an IPO 14. Your neighbor plans to issue an IPO. His strategy is to use the underwriter that promises the highest issue price. Do you agree with this strategy? Why or why not. 15. Explain the difference between MCC (Marginal Cost of Capital) and historical WACC (Weighted Average Cost of Capital) and discuss the importance of each 16. If you were the financial manager of a large corporation, would you prefer a greater or lesser degree of information asymmetry? Would you feel the same way if you were an investor? A security analystStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started