Answered step by step

Verified Expert Solution

Question

1 Approved Answer

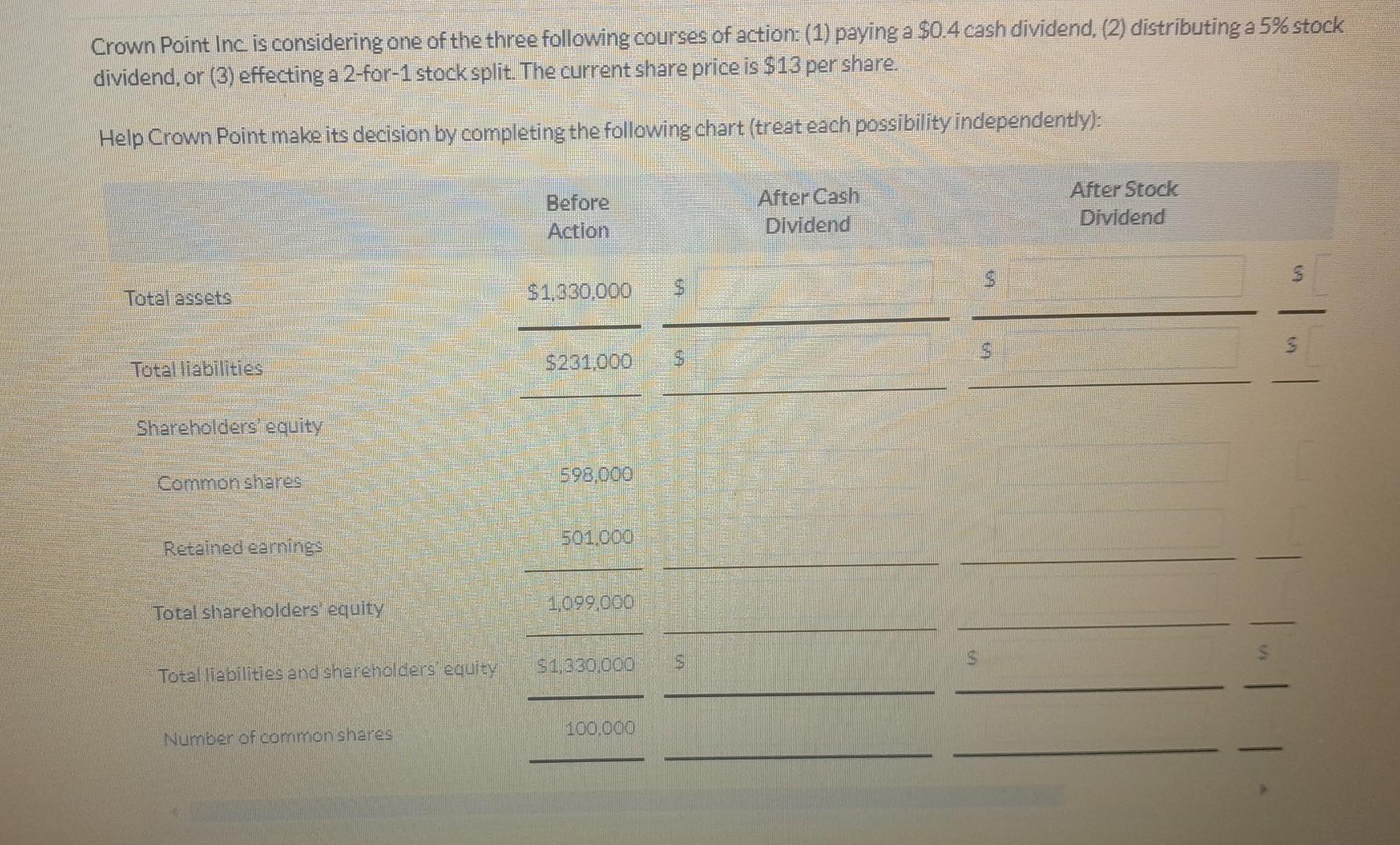

please give me answer Crown Point Inc is considering one of the three following courses of action: (1) paying a $0.4 cash dividend, (2) distributing

please give me answer

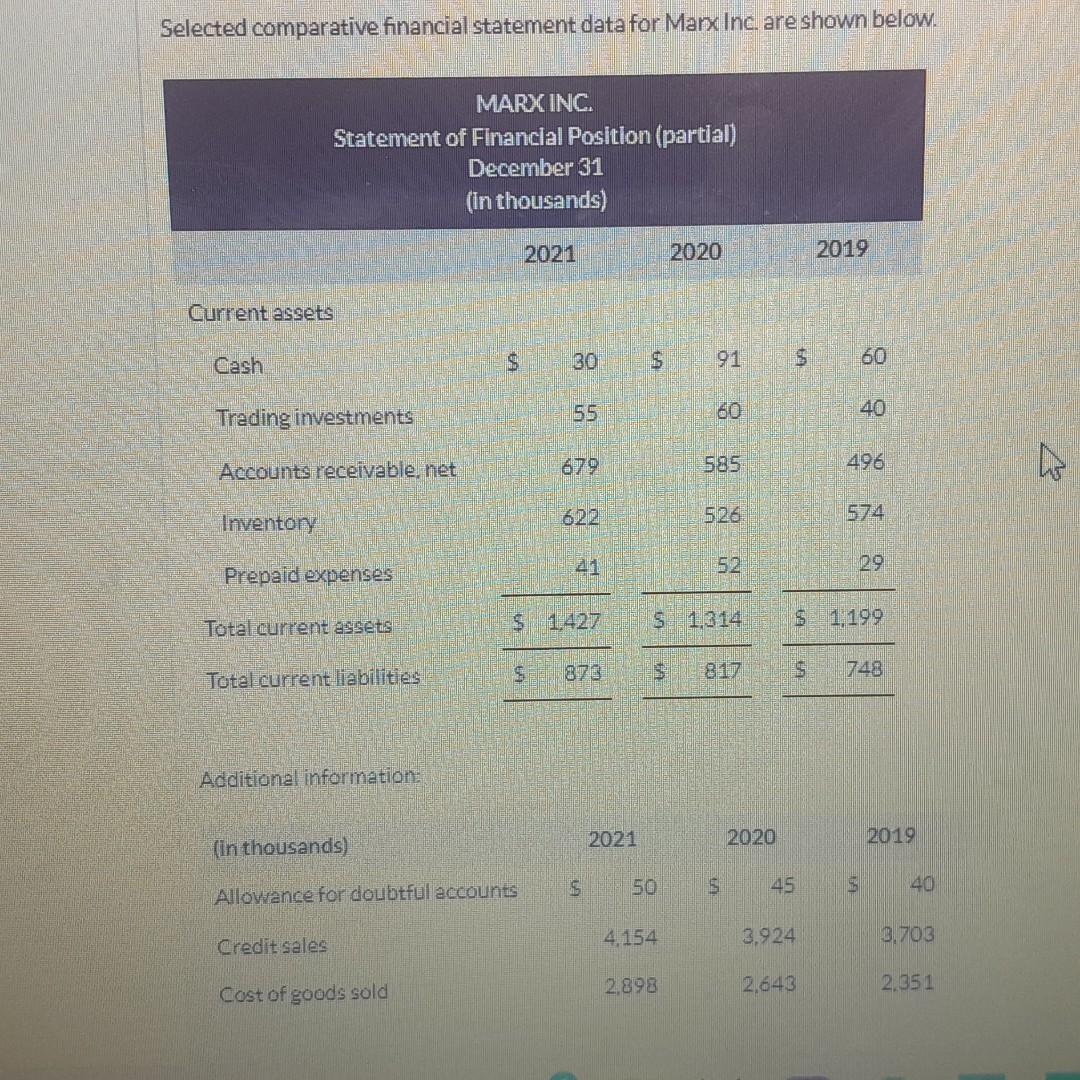

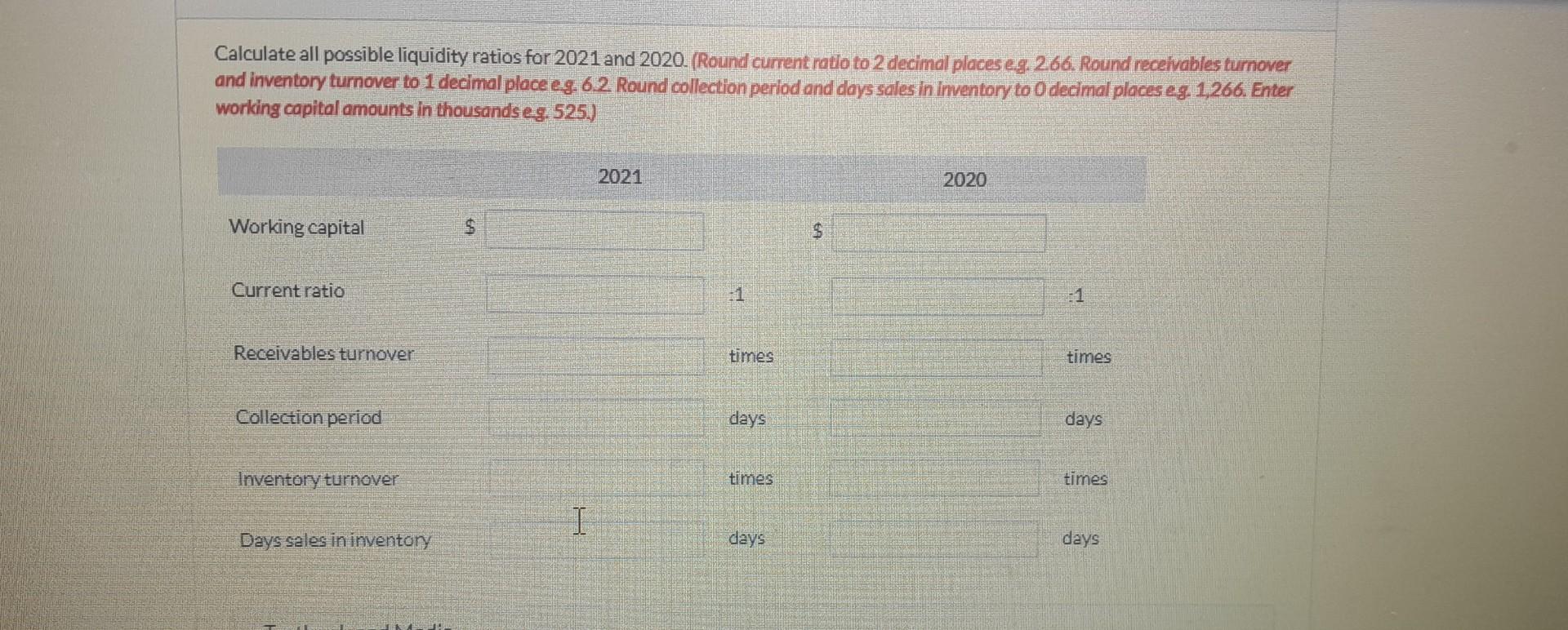

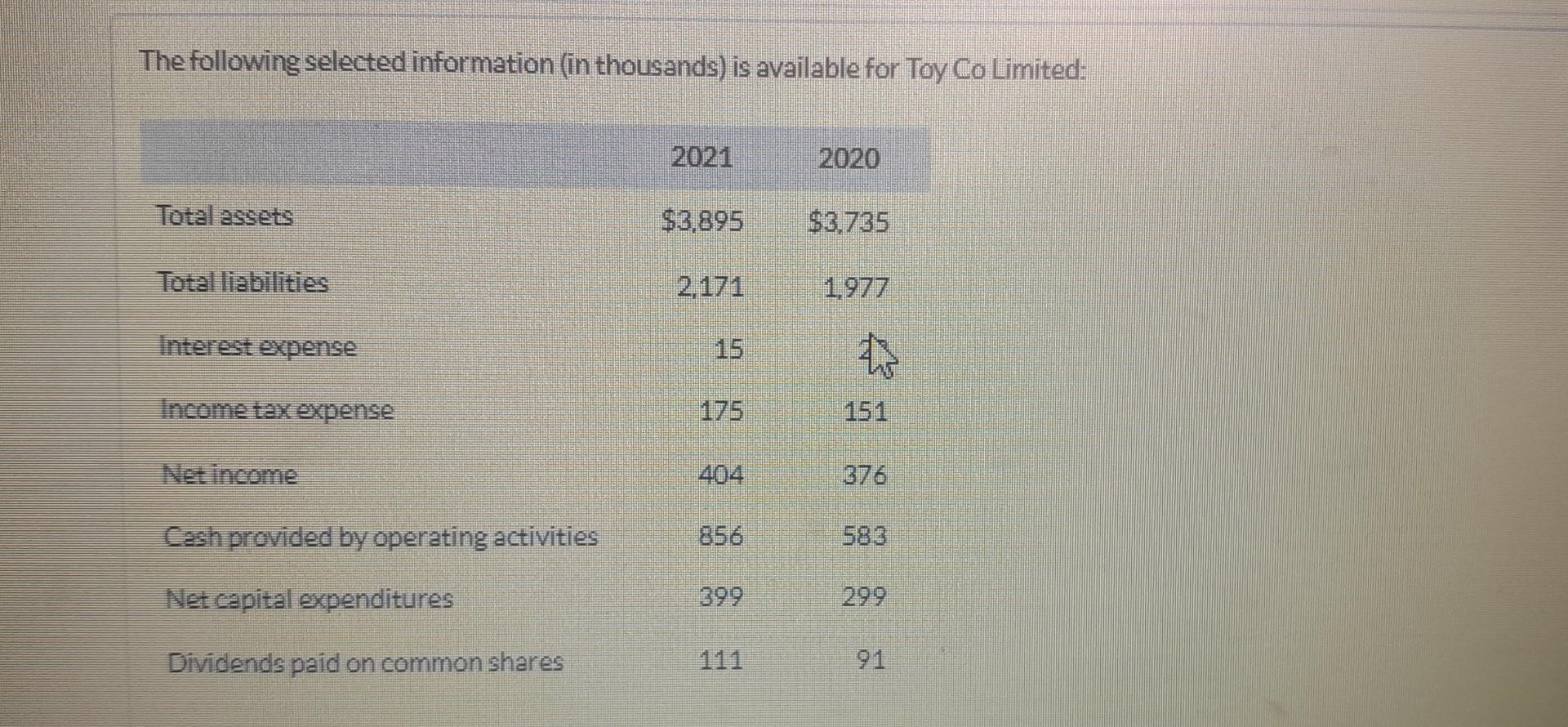

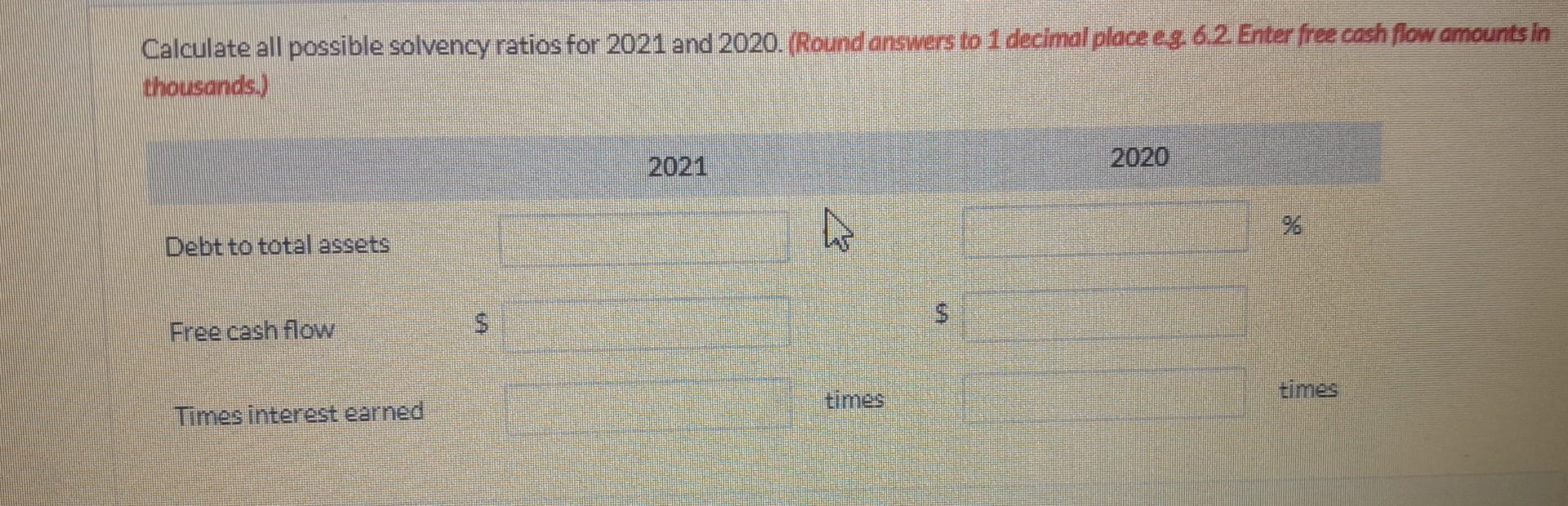

Crown Point Inc is considering one of the three following courses of action: (1) paying a $0.4 cash dividend, (2) distributing a 5% stock dividend, or (3) effecting a 2 -for-1 stock split. The current share price is $13 per share. Help Crown Point make its decision by completing the following chart (treat each possibility independently): Selected comparative financial statement data for Marx Inc. are shown below. MARXINC. Statement of Financial Position (partial) December 31 (in thousands) 202120202019 Current assets Additional information: Calculate all possible liquidity ratios for 2021 and 2020 . (Round current roto to 2 decimal places eg. 266 . Round recelvables turnover and inventory turnover to 1 decimal place eg. 6.2 Round collection period and days sales in inventory to 0 decimal places eg.1,266. Enter working capital amounts in thousandseg. 525.) The following selected information (in thousands) is available for Toy Co Limited: Calculate all possible solvency ratios for 2021 and 2020 . (Round answers to 1 decimal place eg. 6.2 Enter free cash flow amounts in thousands.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started