Answered step by step

Verified Expert Solution

Question

1 Approved Answer

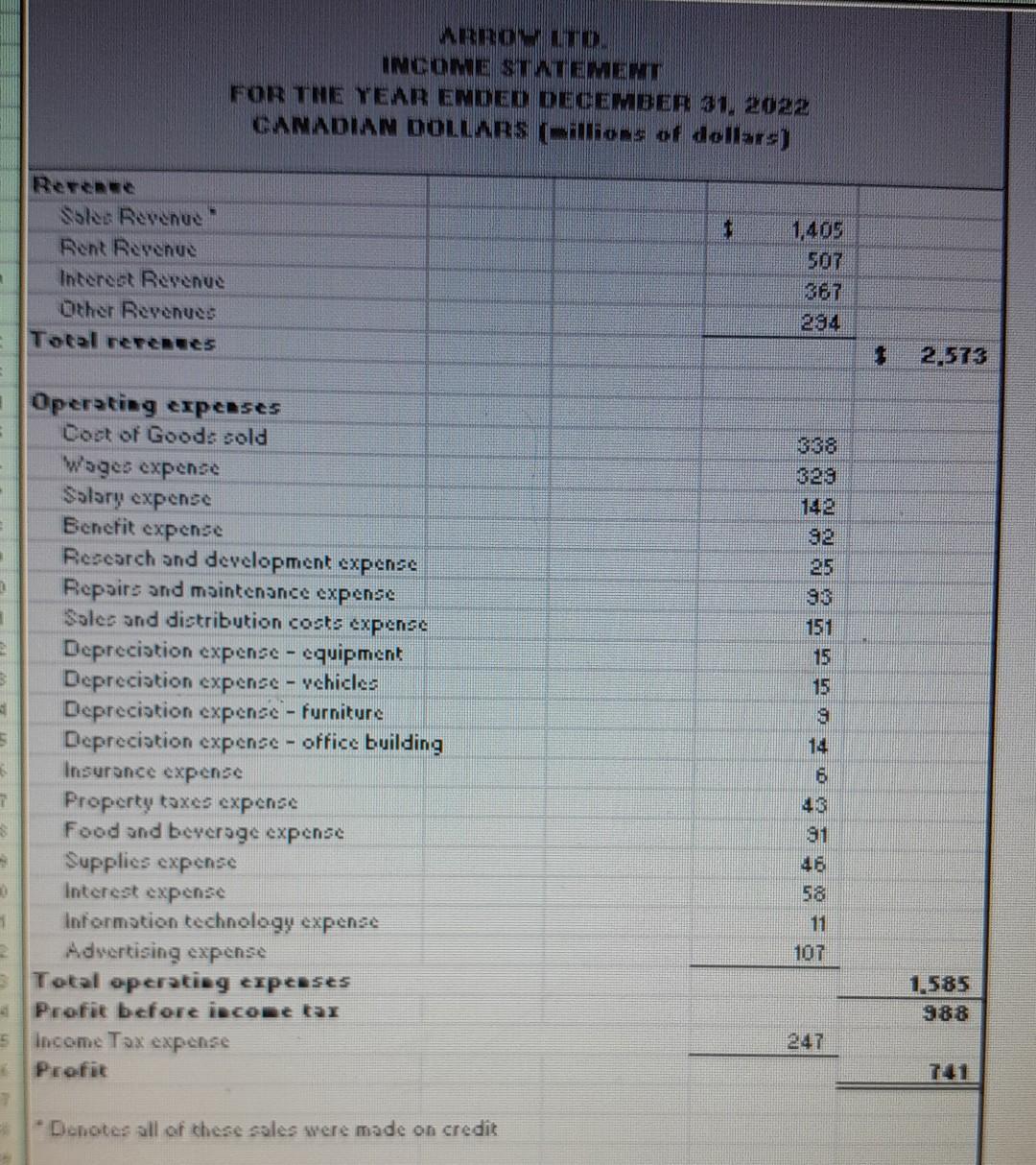

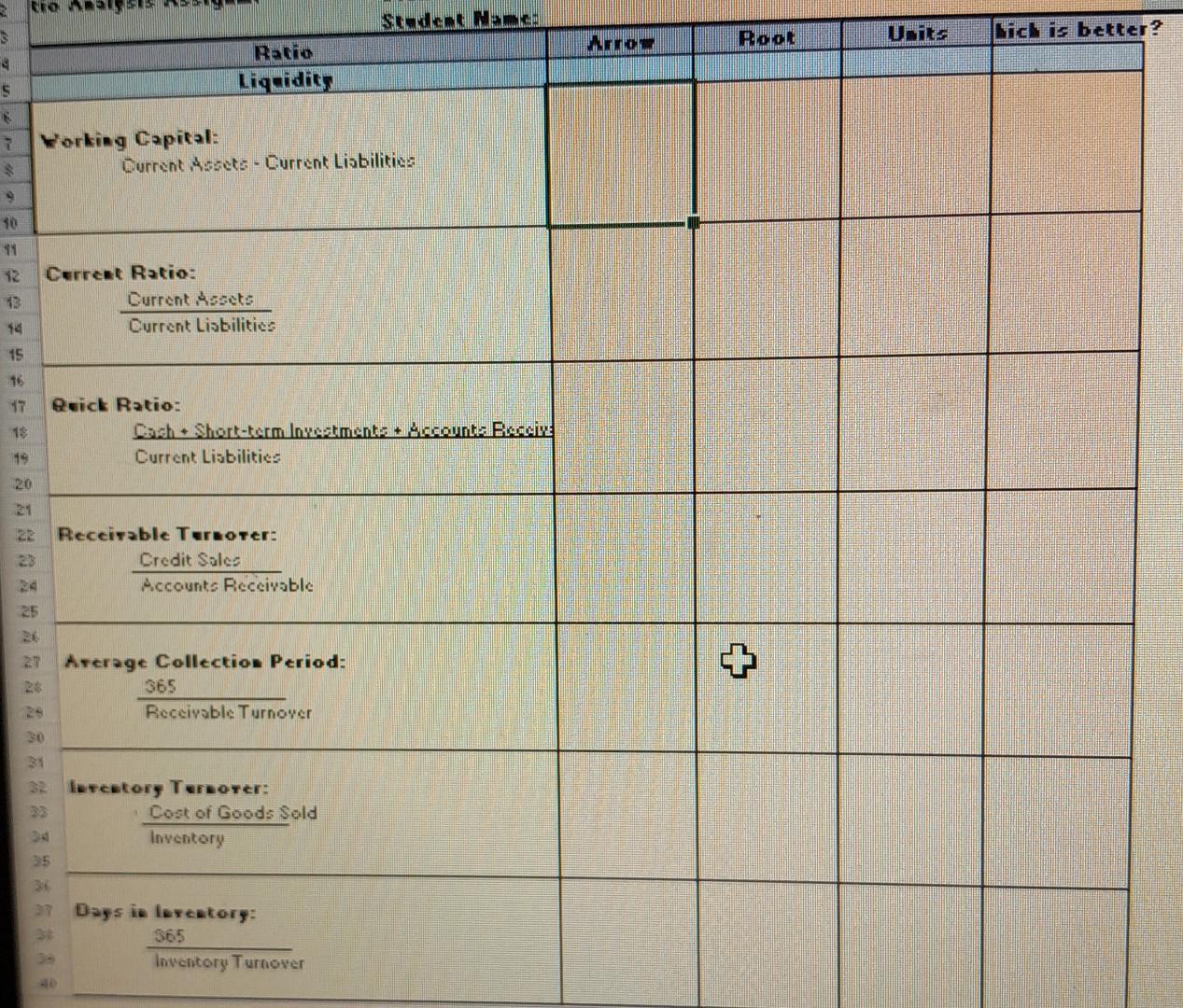

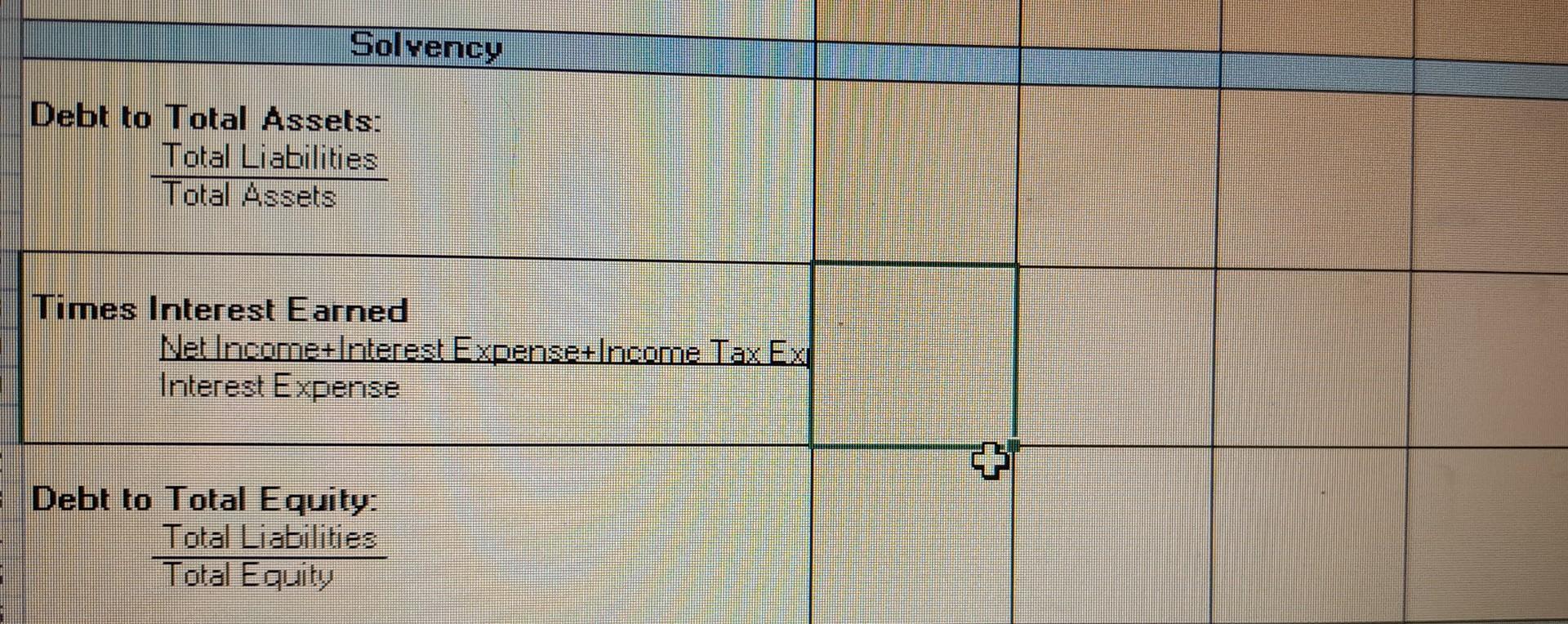

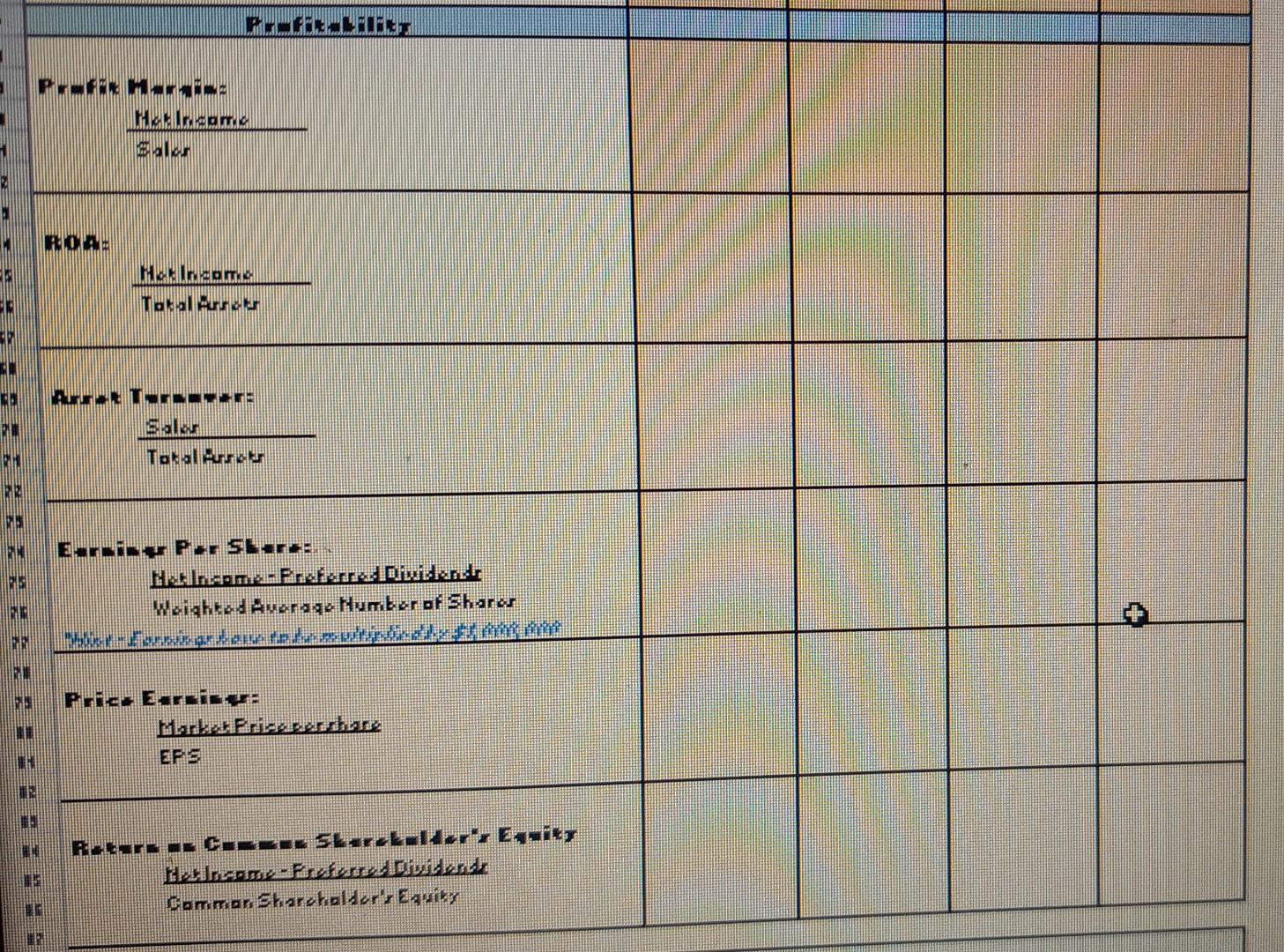

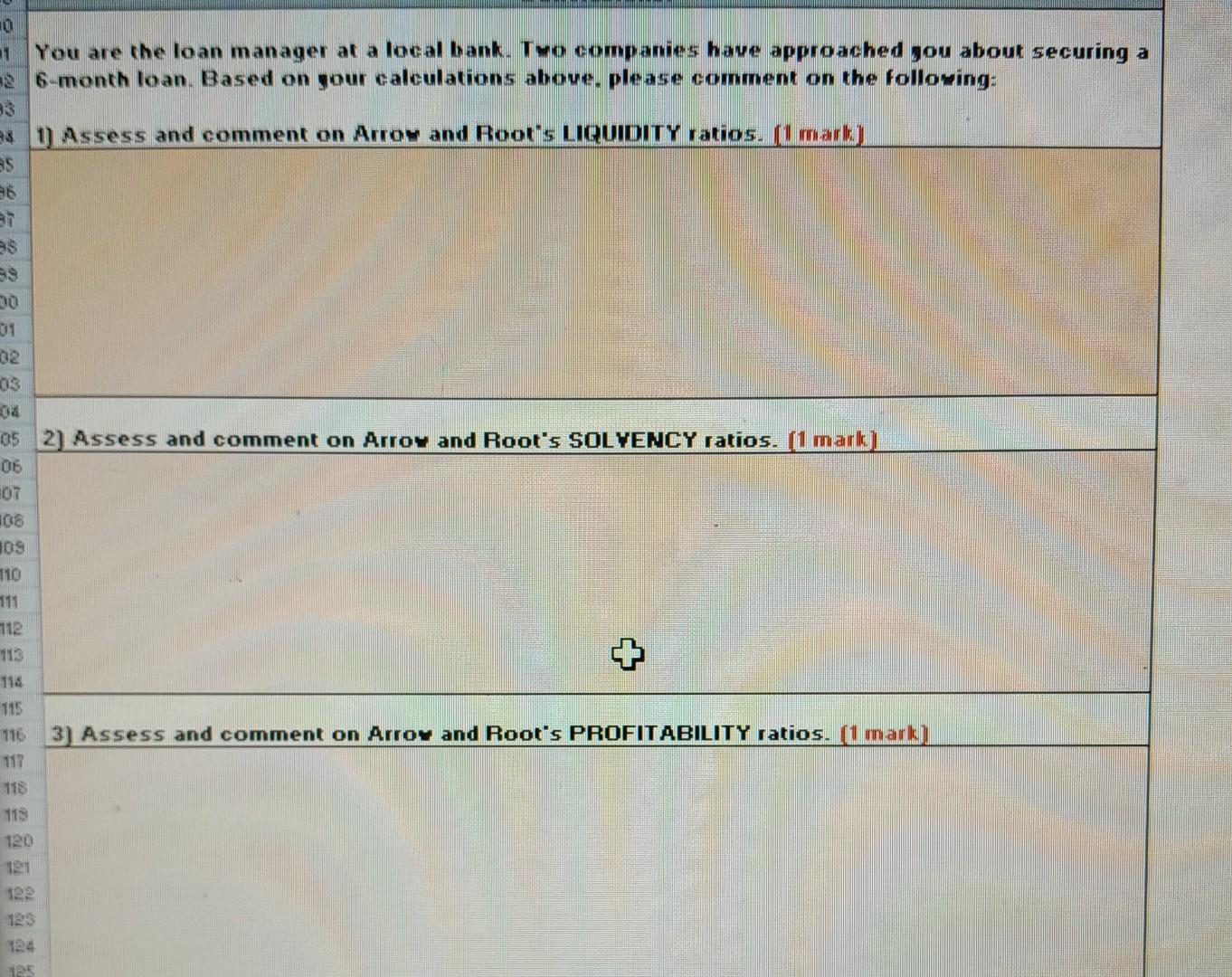

please give me answer fast ...its accounts ratio question 1 Interest Revenue Other Revenues = Total revenues 3 = - . = . D 1

![ROOT LTU. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2022 CAWADIAN DOLLAPS [millions of dollars] Revenue begin{tabular](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/03/6412aad1df10f_1678944964057.jpg)

please give me answer fast ...its accounts ratio question

![4) Which compan would cou prefer to qive the loan to between Arroy and Root? Ezplain wht. [1 mark] 5) In 2-3 sentences, descr](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/03/6412aad29f3c4_1678944966011.jpg)

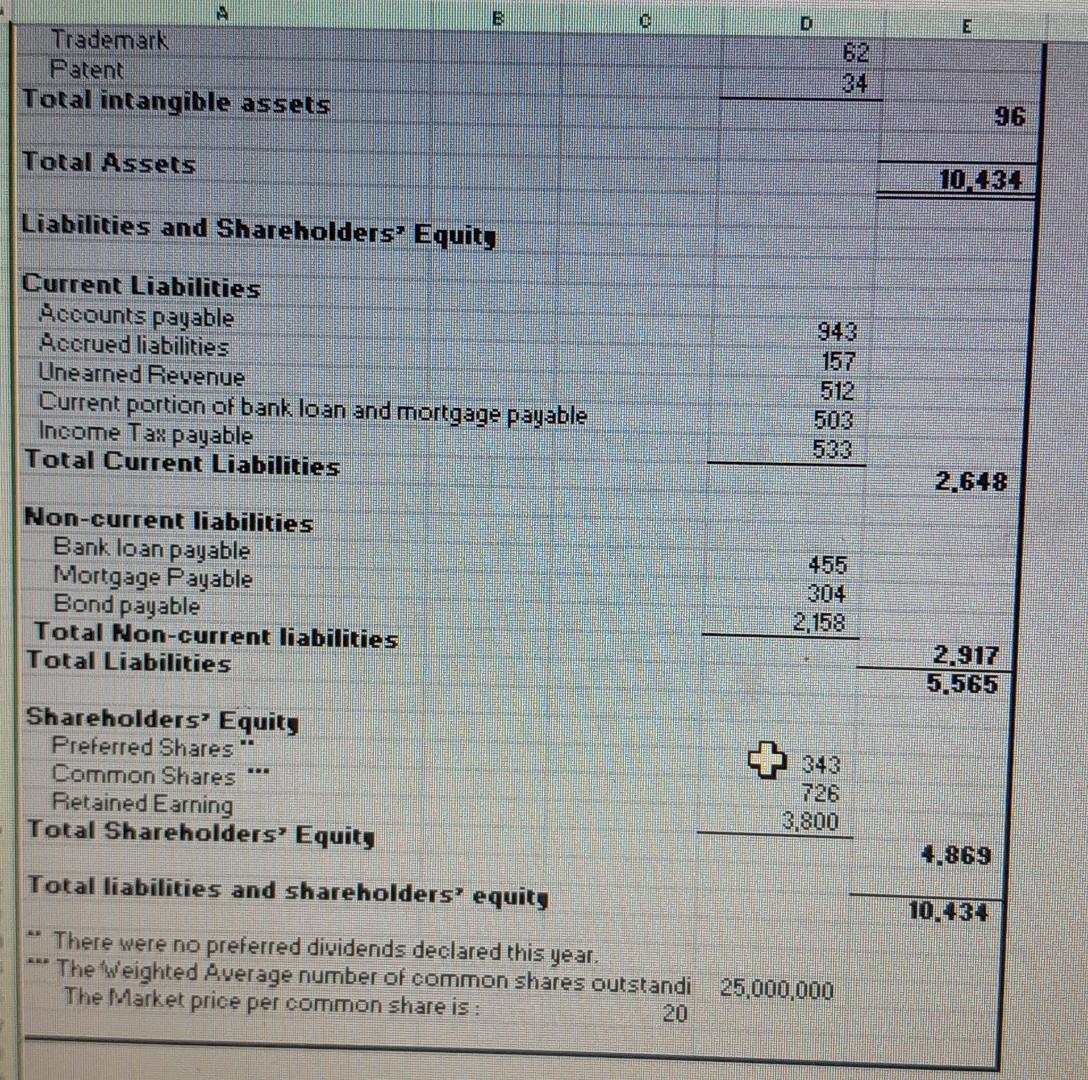

1 Interest Revenue Other Revenues = Total revenues 3 = - . = . D 1 2 B 4 S 6 7 $ 0 1 R 5 Revenue T ## Sales Revenue M Rent Revenue Operating expenses Cost of Goods cold Wages expense Salary expense FOR THE YEAR ENDED DECEMBER 31, 2022 CANADIAN DOLLARS (illions of dollars) Benefit expense Research and development expense ARROW ITO. INCOME STATEMENT Repairs and maintenance expense Sales and distribution costs expense Depreciation expense - equipment Depreciation expense - vehicles Depreciation expense - furniture Depreciation expense - office building Insurance expense Property taxes expense Food and beverage expense Supplies expense Interest expense Information technology expense Advertising expense Total operating expenses Profit before income tax Income Tax expense Profit *Denotes all of these sales were made on credit 1 1,405 507 367 234 25 151 15 15 9 14 6 43 91 46 58 11 107 247 4 2.573 1,585 988

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started