Answered step by step

Verified Expert Solution

Question

1 Approved Answer

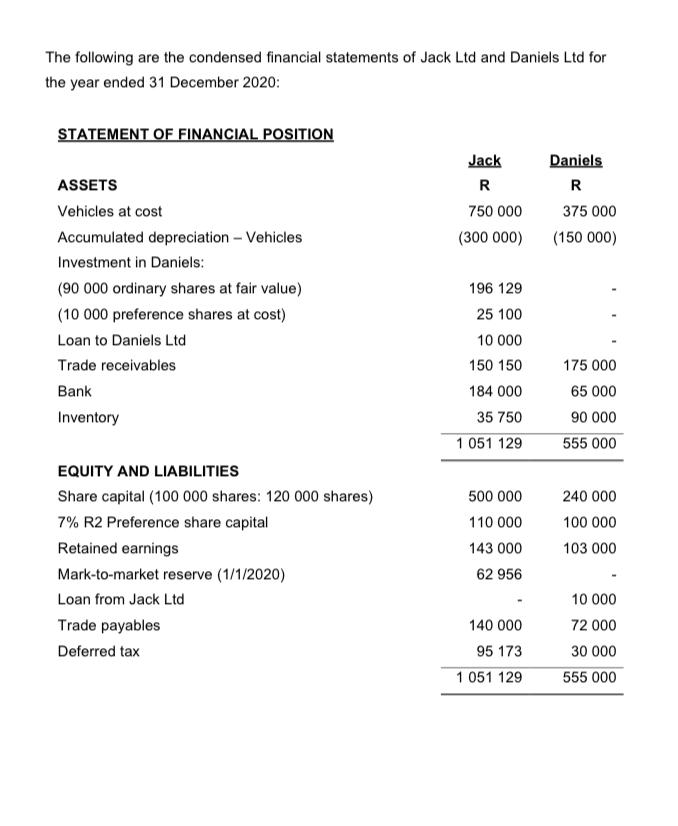

The following are the condensed financial statements of Jack Ltd and Daniels Ltd for the year ended 31 December 2020: STATEMENT OF FINANCIAL POSITION

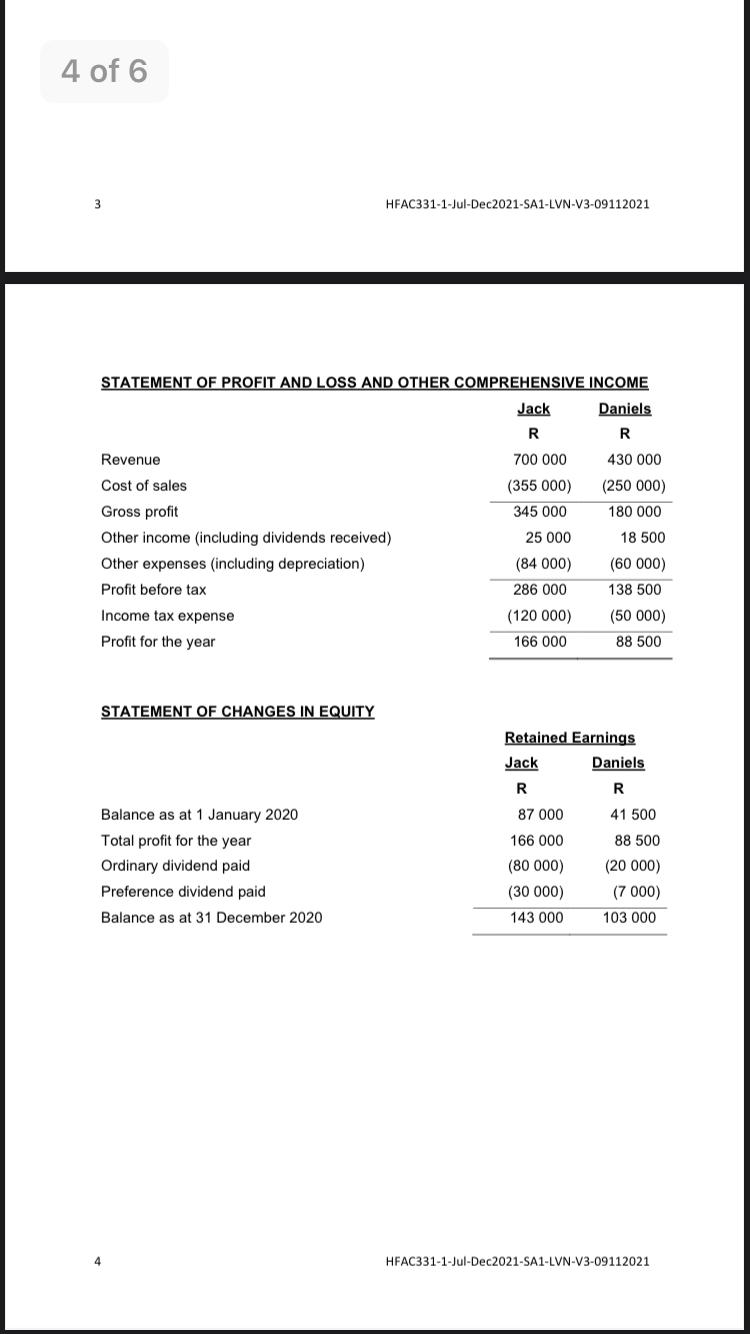

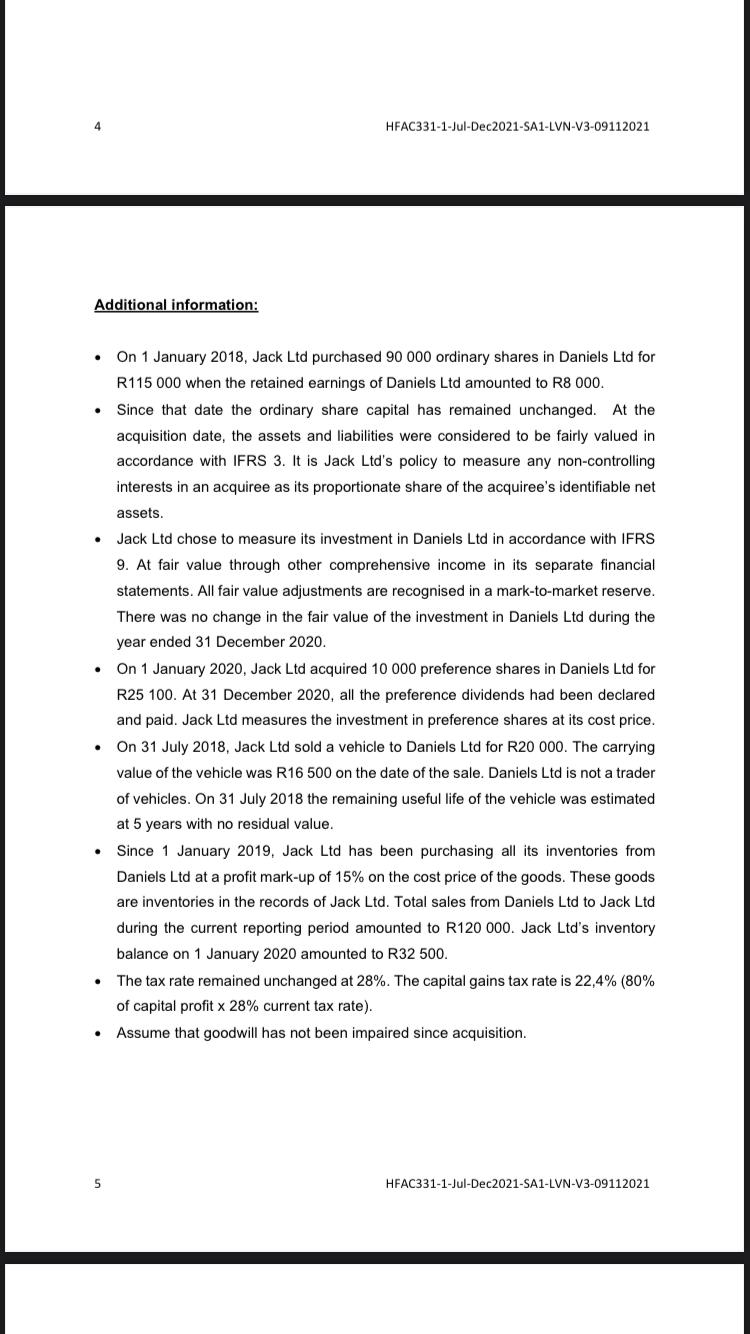

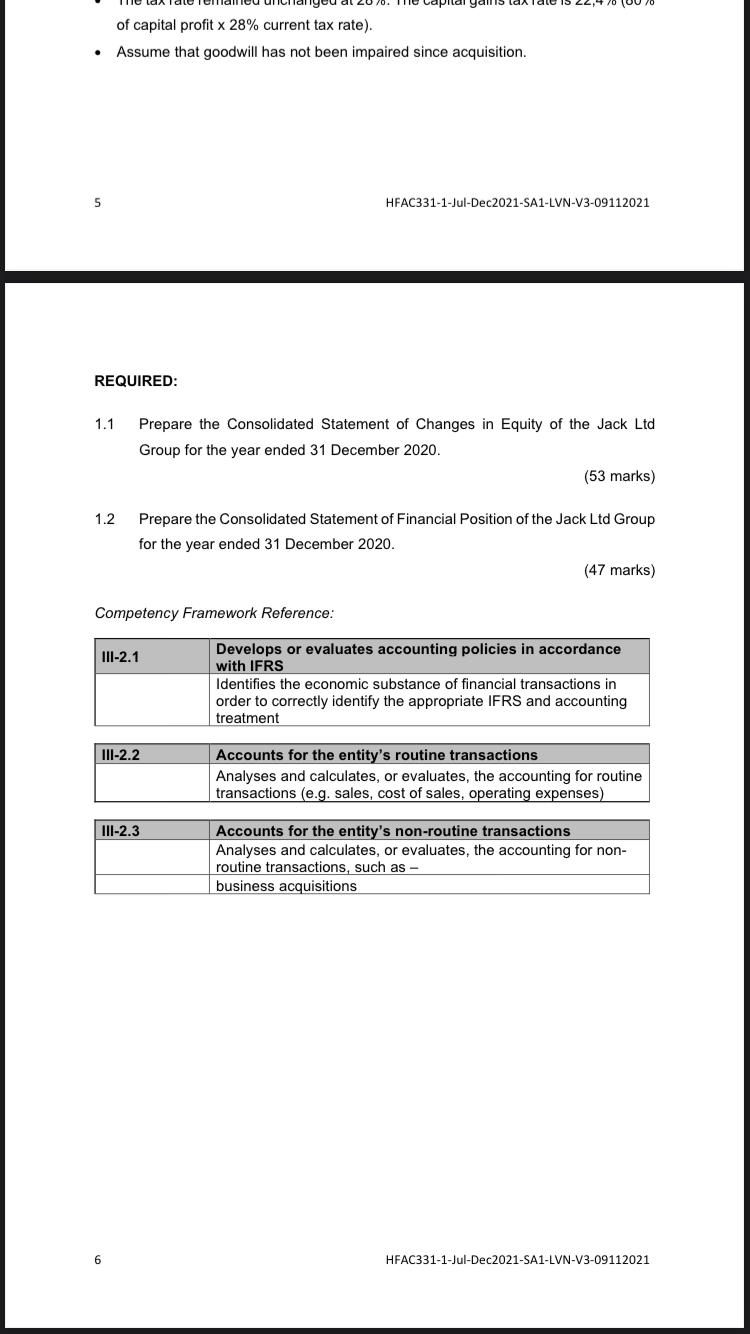

The following are the condensed financial statements of Jack Ltd and Daniels Ltd for the year ended 31 December 2020: STATEMENT OF FINANCIAL POSITION ASSETS Vehicles at cost Accumulated depreciation - Vehicles Investment in Daniels: (90 000 ordinary shares at fair value) (10 000 preference shares at cost) Loan to Daniels Ltd Trade receivables Bank Inventory EQUITY AND LIABILITIES Share capital (100 000 shares: 120 000 shares) 7% R2 Preference share capital Retained earnings Mark-to-market reserve (1/1/2020) Loan from Jack Ltd Trade payables Deferred tax Jack R 750 000 (300 000) 196 129 25 100 10 000 150 150 184 000 35 750 1051 129 500 000 110 000 143 000 62 956 140 000 95 173 1051 129 Daniels R 375 000 (150 000) 175 000 65 000 90 000 555 000 240 000 100 000 103 000 10 000 72 000 30 000 555 000 4 of 6 3 4 STATEMENT OF PROFIT AND LOSS AND OTHER COMPREHENSIVE INCOME Daniels R 430 000 (250 000) 180 000 HFAC331-1-Jul-Dec2021-SA1-LVN-V3-09112021 Revenue Cost of sales Gross profit Other income (including dividends received) Other expenses (including depreciation) Profit before tax Income tax expense Profit for the year STATEMENT OF CHANGES IN EQUITY Balance as at 1 January 2020 Total profit for the year Ordinary dividend paid Preference dividend paid Balance as at 31 December 2020 Jack R 700 000 (355 000) 345 000 25 000 (84 000) 286 000 (120 000) 166 000 18 500 (60 000) 138 500 (50 000) 88 500 Retained Earnings Jack R 87 000 166 000 (80 000) (30 000) 143 000 Daniels R 41 500 88 500 (20 000) (7 000) 103 000 HFAC331-1-Jul-Dec2021-SA1-LVN-V3-09112021 Additional information: . . . . . . . 5 HFAC331-1-Jul-Dec2021-SA1-LVN-V3-09112021 On 1 January 2018, Jack Ltd purchased 90 000 ordinary shares in Daniels Ltd for R115 000 when the retained earnings of Daniels Ltd amounted to R8 000. Since that date the ordinary share capital has remained unchanged. At the acquisition date, the assets and liabilities were considered to be fairly valued in accordance with IFRS 3. It is Jack Ltd's policy to measure any non-controlling interests in an acquiree as its proportionate share of the acquiree's identifiable net assets. Jack Ltd chose to measure its investment in Daniels Ltd in accordance with IFRS 9. At fair value through other comprehensive income in its separate financial statements. All fair value adjustments are recognised in a mark-to-market reserve. There was no change in the fair value of the investment in Daniels Ltd during the year ended 31 December 2020. On 1 January 2020, Jack Ltd acquired 10 000 preference shares in Daniels Ltd for R25 100. At 31 December 2020, all the preference dividends had been declared and paid. Jack Ltd measures the investment in preference shares at its cost price. On 31 July 2018, Jack Ltd sold a vehicle to Daniels Ltd for R20 000. The carrying value of the vehicle was R16 500 on the date of the sale. Daniels Ltd is not a trader of vehicles. On 31 July 2018 the remaining useful life of the vehicle was estimated at 5 years with no residual value. Since 1 January 2019, Jack Ltd has been purchasing all its inventories from Daniels Ltd at a profit mark-up of 15% on the cost price of the goods. These goods are inventories in the records of Jack Ltd. Total sales from Daniels Ltd to Jack Ltd. during the current reporting period amounted to R120 000. Jack Ltd's inventory balance on 1 January 2020 amounted to R32 500. The tax rate remained unchanged at 28%. The capital gains tax rate is 22,4% (80% of capital profit x 28% current tax rate). Assume that goodwill has not been impaired since acquisition. HFAC331-1-Jul-Dec2021-SA1-LVN-V3-09112021 . 5 REQUIRED: of capital profit x 28% current tax rate). Assume that goodwill has not been impaired since acquisition. 1.2 1.1 Prepare the Consolidated Statement of Changes in Equity of the Jack Ltd Group for the year ended 31 December 2020. Competency Framework Reference: 6 The Capital gains ta III-2.1 III-2.2 Prepare the Consolidated Statement of Financial Position of the Jack Ltd Group for the year ended 31 December 2020. HFAC331-1-Jul-Dec2021-SA1-LVN-V3-09112021 III-2.3 (53 marks) (47 marks) Develops or evaluates accounting policies in accordance with IFRS Identifies the economic substance of financial transactions in order to correctly identify the appropriate IFRS and accounting treatment Accounts for the entity's routine transactions Analyses and calculates, or evaluates, the accounting for routine transactions (e.g. sales, cost of sales, operating expenses) Accounts for the entity's non-routine transactions Analyses and calculates, or evaluates, the accounting for non- routine transactions, such as - business acquisitions HFAC331-1-Jul-Dec2021-SA1-LVN-V3-09112021

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Changes in Equity Jack Group Year Ended 31 December 200 Share Capital Retained Earnings Total Equity Balance at 1 January 2000 240000 143...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started