Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give me solutions for 7.24 to 7.26 Supplementary Problems 7.24 Goods are sold at $9,000 with terms of 4/10, 1/30. If goods costing $2,000

please give me solutions for 7.24 to 7.26

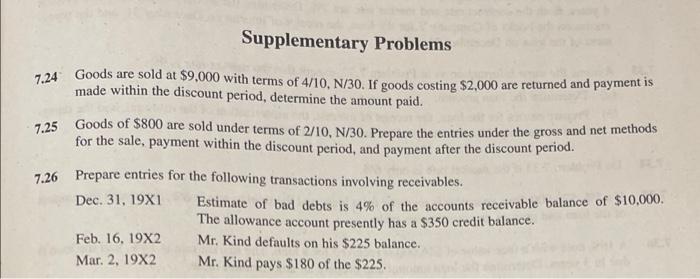

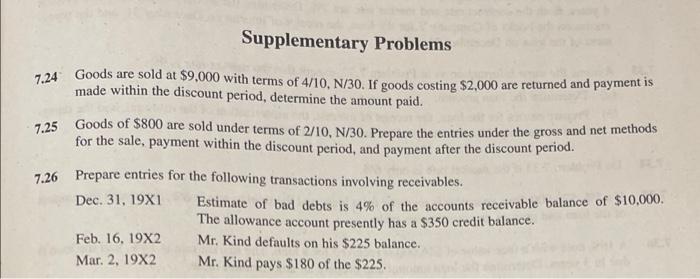

Supplementary Problems 7.24 Goods are sold at $9,000 with terms of 4/10, 1/30. If goods costing $2,000 are returned and payment is made within the discount period, determine the amount paid. 7.25 Goods of $800 are sold under terms of 2/10, N/30. Prepare the entries under the gross and net methods for the sale, payment within the discount period, and payment after the discount period. 7.26 Prepare entries for the following transactions involving receivables. Dec. 31, 19X1 Estimate of bad debts is 4% of the accounts receivable balance of $10,000. The allowance account presently has a $350 credit balance. Feb. 16. 19X2 Mr. Kind defaults on his $225 balance. Mar. 2, 19X2 Mr. Kind pays $180 of the $225. a Supplementary Problems 7.24 Goods are sold at $9,000 with terms of 4/10, 1/30. If goods costing $2,000 are returned and payment is made within the discount period, determine the amount paid. 7.25 Goods of $800 are sold under terms of 2/10, N/30. Prepare the entries under the gross and net methods for the sale, payment within the discount period, and payment after the discount period. 7.26 Prepare entries for the following transactions involving receivables. Dec. 31, 19X1 Estimate of bad debts is 4% of the accounts receivable balance of $10,000. The allowance account presently has a $350 credit balance. Feb. 16. 19X2 Mr. Kind defaults on his $225 balance. Mar. 2, 19X2 Mr. Kind pays $180 of the $225. a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started