Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give me the answer about requiring two. The following additional information is given: On 1 April 2021 the fair value of Ceres' assets was

Please give me the answer about requiring two.

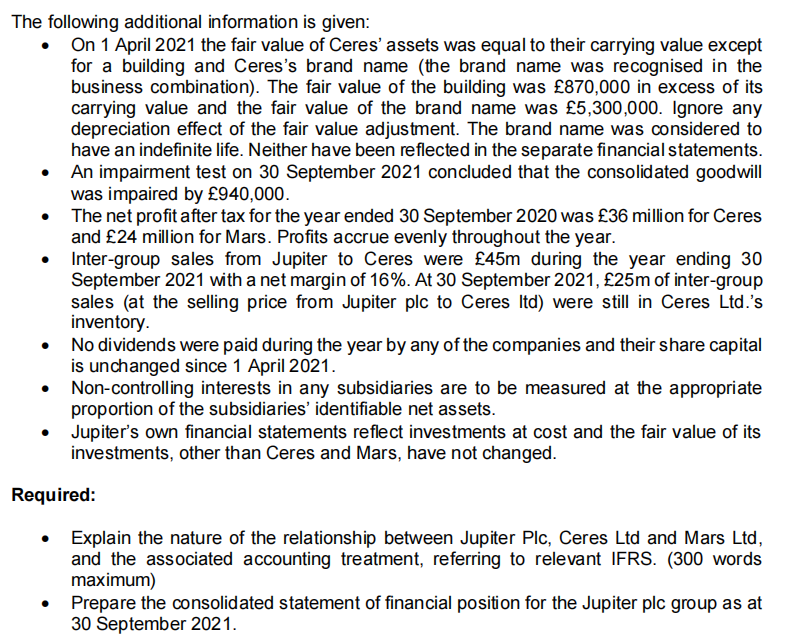

The following additional information is given: On 1 April 2021 the fair value of Ceres' assets was equal to their carrying value except for a building and Ceres's brand name (the brand name was recognised in the business combination). The fair value of the building was 870,000 in excess of its carrying value and the fair value of the brand name was 5,300,000. Ignore any depreciation effect of the fair value adjustment. The brand name was considered to have an indefinite life. Neither have been reflected in the separate financial statements. An impairment test on 30 September 2021 concluded that the consolidated goodwill was impaired by 940,000. The net profit after tax for the year ended 30 September 2020 was 36 million for Ceres and 24 million for Mars. Profits accrue evenly throughout the year. Inter-group sales from Jupiter to Ceres were 45m during the year ending 30 September 2021 with a net margin of 16%. At 30 September 2021, 25m of inter-group sales (at the selling price from Jupiter plc to Ceres Itd) were still in Ceres Ltd.'s inventory. No dividends were paid during the year by any of the companies and their share capital is unchanged since 1 April 2021. Non-controlling interests in any subsidiaries are to be measured at the appropriate proportion of the subsidiaries' identifiable net assets. Jupiter's own financial statements reflect investments at cost and the fair value of its investments, other than Ceres and Mars, have not changed. Required: Explain the nature of the relationship between Jupiter Plc, Ceres Ltd and Mars Ltd, and the associated accounting treatment, referring to relevant IFRS. (300 words maximum) Prepare the consolidated statement of financial position for the Jupiter plc group as at 30 September 2021. The following additional information is given: On 1 April 2021 the fair value of Ceres' assets was equal to their carrying value except for a building and Ceres's brand name (the brand name was recognised in the business combination). The fair value of the building was 870,000 in excess of its carrying value and the fair value of the brand name was 5,300,000. Ignore any depreciation effect of the fair value adjustment. The brand name was considered to have an indefinite life. Neither have been reflected in the separate financial statements. An impairment test on 30 September 2021 concluded that the consolidated goodwill was impaired by 940,000. The net profit after tax for the year ended 30 September 2020 was 36 million for Ceres and 24 million for Mars. Profits accrue evenly throughout the year. Inter-group sales from Jupiter to Ceres were 45m during the year ending 30 September 2021 with a net margin of 16%. At 30 September 2021, 25m of inter-group sales (at the selling price from Jupiter plc to Ceres Itd) were still in Ceres Ltd.'s inventory. No dividends were paid during the year by any of the companies and their share capital is unchanged since 1 April 2021. Non-controlling interests in any subsidiaries are to be measured at the appropriate proportion of the subsidiaries' identifiable net assets. Jupiter's own financial statements reflect investments at cost and the fair value of its investments, other than Ceres and Mars, have not changed. Required: Explain the nature of the relationship between Jupiter Plc, Ceres Ltd and Mars Ltd, and the associated accounting treatment, referring to relevant IFRS. (300 words maximum) Prepare the consolidated statement of financial position for the Jupiter plc group as at 30 September 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started