Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give me the answer of this question please do not solve on excel please solve completely with formulas I have an exam tomorrow please

please give me the answer of this question please do not solve on excel please solve completely with formulas I have an exam tomorrow please help me

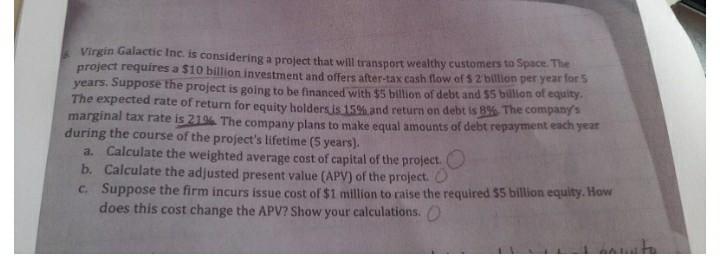

Virgin Galactic Inc. is considering a project that will transport wealthy customers to Space . The project requires a $10 billion investment and offers after-tax cash flow of 2 billion per year for years. Suppose the project is going to be financed with $5 billion of debt and $5 billion of equity. The expected rate of return for equity holders is 15% and return on debt is 8% The company's marginal tax rate is 21%. The company plans to make equal amounts of debt repayment each year during the course of the project's lifetime (5 years). a. Calculate the weighted average cost of capital of the project b. Calculate the adjusted present value (APV) of the project. C. Suppose the firm incurs issue cost of $1 million to raise the required 55 billion equity. How does this cost change the APV? Show your calculations()Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started