please give me the answers for all the three questions together. thank you for your time and effort.

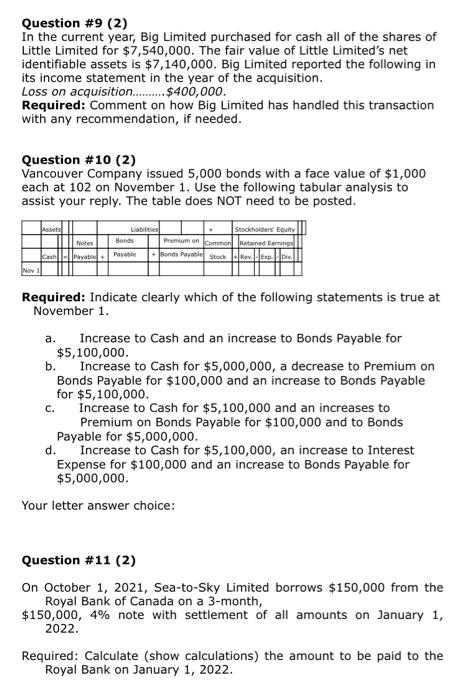

Question #9 (2) In the current year, Big Limited purchased for cash all of the shares of Little Limited for $7,540,000. The fair value of Little Limited's net identifiable assets is $7,140,000. Big Limited reported the following in its income statement in the year of the acquisition. Loss on acquisition..........$400,000. Required: Comment on how Big Limited has handled this transaction with any recommendation, if needed. Question #10 (2) Vancouver Company issued 5,000 bonds with a face value of $1,000 each at 102 on November 1. Use the following tabular analysis to assist your reply. The table does NOT need to be posted. Assets Notes Payable Liabilities Bonds Payable Stockholders' Eaulty Premium on Common Retained Earnings onds Patie Stade Rev Nov Required: Indicate clearly which of the following statements is true at November 1. a. Increase to cash and an increase to Bonds Payable for $5,100,000 b. Increase to Cash for $5,000,000, a decrease to Premium on Bonds Payable for $100,000 and an increase to Bonds Payable for $5,100,000. Increase to Cash for $5,100,000 and an increases to Premium on Bonds Payable for $100,000 and to Bonds Payable for $5,000,000. d. Increase to Cash for $5,100,000, an increase to Interest Expense for $100,000 and an increase to Bonds Payable for $5,000,000 Your letter answer choice: Question #11 (2) On October 1, 2021, Sea-to-Sky Limited borrows $150,000 from the Royal Bank of Canada on a 3-month, $150,000, 4% note with settlement of all amounts on January 1, 2022. Required: Calculate (show calculations) the amount to be paid to the Royal Bank on January 1, 2022. Question #9 (2) In the current year, Big Limited purchased for cash all of the shares of Little Limited for $7,540,000. The fair value of Little Limited's net identifiable assets is $7,140,000. Big Limited reported the following in its income statement in the year of the acquisition. Loss on acquisition..........$400,000. Required: Comment on how Big Limited has handled this transaction with any recommendation, if needed. Question #10 (2) Vancouver Company issued 5,000 bonds with a face value of $1,000 each at 102 on November 1. Use the following tabular analysis to assist your reply. The table does NOT need to be posted. Assets Notes Payable Liabilities Bonds Payable Stockholders' Eaulty Premium on Common Retained Earnings onds Patie Stade Rev Nov Required: Indicate clearly which of the following statements is true at November 1. a. Increase to cash and an increase to Bonds Payable for $5,100,000 b. Increase to Cash for $5,000,000, a decrease to Premium on Bonds Payable for $100,000 and an increase to Bonds Payable for $5,100,000. Increase to Cash for $5,100,000 and an increases to Premium on Bonds Payable for $100,000 and to Bonds Payable for $5,000,000. d. Increase to Cash for $5,100,000, an increase to Interest Expense for $100,000 and an increase to Bonds Payable for $5,000,000 Your letter answer choice: Question #11 (2) On October 1, 2021, Sea-to-Sky Limited borrows $150,000 from the Royal Bank of Canada on a 3-month, $150,000, 4% note with settlement of all amounts on January 1, 2022. Required: Calculate (show calculations) the amount to be paid to the Royal Bank on January 1, 2022