Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give me the part 2 answer Risk Premium Part I Suppose that you own a business worth $100000. With probability 1=0.05, a disaster a

please give me the part 2 answer

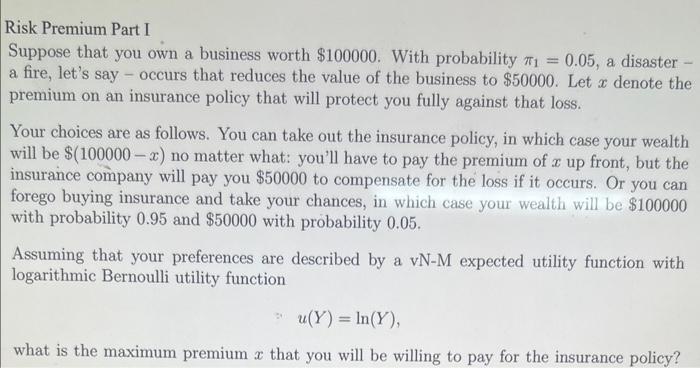

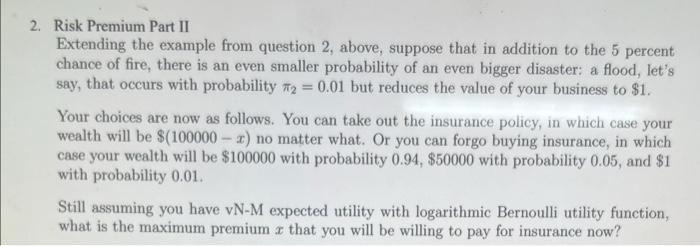

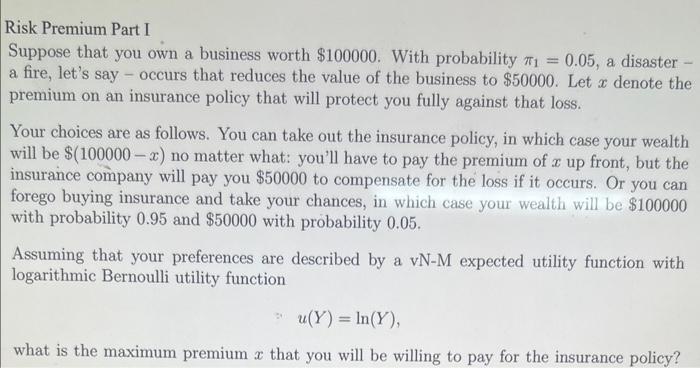

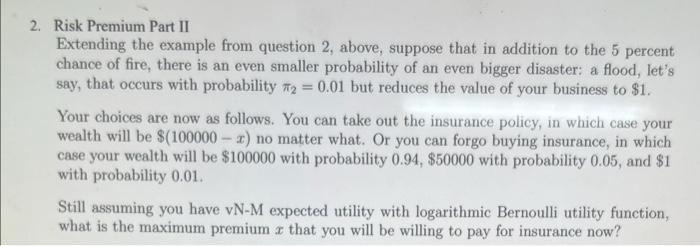

Risk Premium Part I Suppose that you own a business worth $100000. With probability 1=0.05, a disaster a fire, let's say - occurs that reduces the value of the business to $50000. Let x denote the premium on an insurance policy that will protect you fully against that loss. Your choices are as follows. You can take out the insurance policy, in which case your wealth will be $(100000x) no matter what: you'll have to pay the premium of x up front, but the insurance company will pay you $50000 to compensate for the loss if it occurs. Or you can forego buying insurance and take your chances, in which case your wealth will be $100000 with probability 0.95 and $50000 with probability 0.05. Assuming that your preferences are described by a vN-M expected utility function with logarithmic Bernoulli utility function u(Y)=ln(Y) 2. Risk Premium Part II Extending the example from question 2, above, suppose that in addition to the 5 percent chance of fire, there is an even smaller probability of an even bigger disaster: a flood, let's say, that occurs with probability 2=0.01 but reduces the value of your business to $1. Your choices are now as follows. You can take out the insurance policy, in which case your wealth will be $(100000x) no matter what. Or you can forgo buying insurance, in which case your wealth will be $100000 with probability 0.94,$50000 with probability 0.05, and $1 with probability 0.01. Still assuming you have vNM expected utility with logarithmic Bernoulli utility function, what is the maximum premium x that you will be willing to pay for insurance now

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started