Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give more details of the solution and step by step Part 1: Calculation Exercise (with sugsested answers at the end of this part) Question

please give more details of the solution and step by step

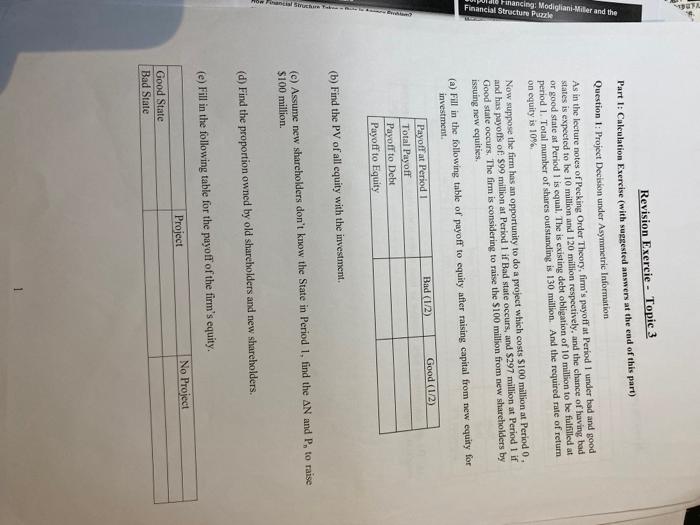

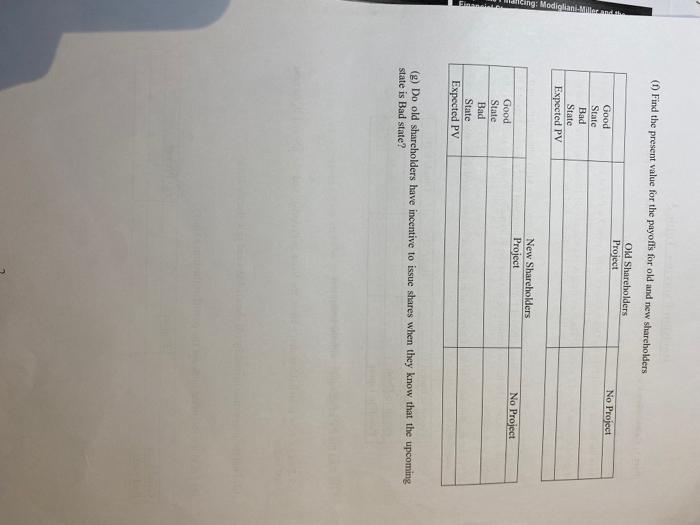

Part 1: Calculation Exercise (with sugsested answers at the end of this part) Question 1: Project Decisson under Asymmetric Information As in the lecture notes of Pecking Order Theory, firm's payofl at Period 1 under bad and good Atates is expected to be 10 million and 120 million respectively, and the chance of having bad or good state at Period 1 is egual. The is existing debt obligation of 10 million to be fulfiled at period 1. Total number of shares outstanding is 130 million. And the required rate of retum on equity is 10%. Now suppose the firm has an opportunity to do a project which costs $100 million at Period 0 , and has payolls of: $99 million at Period 1 if Bad state occurs, and $297 million at Period 1 if Good state occurs. The firm is considering to raise the $100 million from new shareholders by issuing new equities. (a) Fil in the Following table of payoff to equity after raising capital from new equaity for investment. (b) Find the PV of all equity with the investment. (c) Assume new shareholders don't know the State in Period 1 , find the N and Pn to raise $100 million. (d) Find the proportion owned by old shareholders and new shareholders. (e) Fill in the following table for the payoff of the firm's equity. (f) Find the present value for the payoffs for old and new shareholders (g) Do old shareholders have incentive to issue shares when they know that the upcoming state is Bad state

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started