Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give the detaied calculation! thank you! a. Riley acquired a non-current asset on 1 October 20X1 at a cost of $150,000 which had a

please give the detaied calculation! thank you!

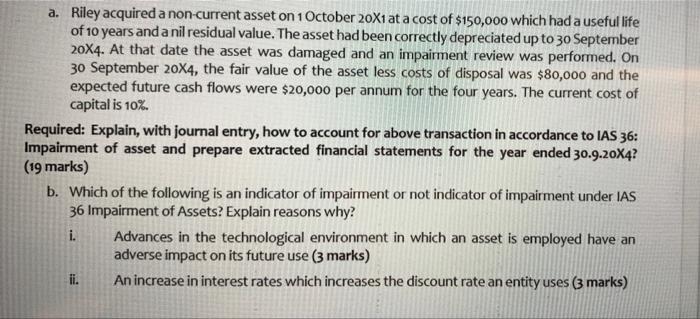

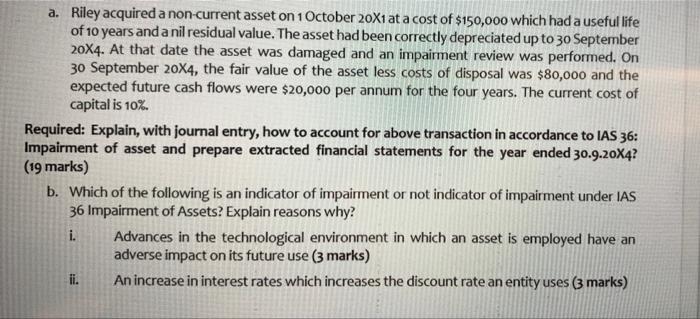

a. Riley acquired a non-current asset on 1 October 20X1 at a cost of $150,000 which had a useful life of 10 years and a nil residual value. The asset had been correctly depreciated up to 30 September 20X4. At that date the asset was damaged and an impairment review was performed. On 30 September 20X4, the fair value of the asset less costs of disposal was $80,000 and the expected future cash flows were $20,000 per annum for the four years. The current cost of capital is 10%. Required: Explain, with journal entry, how to account for above transaction in accordance to IAS 36: Impairment of asset and prepare extracted financial statements for the year ended 30.9.20X4? (19 marks) b. Which of the following is an indicator of impairment or not indicator of impairment under IAS 36 Impairment of Assets? Explain reasons why? i. Advances in the technological environment in which an asset is employed have an adverse impact on its future use (3 marks) ii. An increase in interest rates which increases the discount rate an entity uses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started