Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give the specific process We want to compare the prices and dynamic hedging strategy components of an American put option and European put option

Please give the specific process

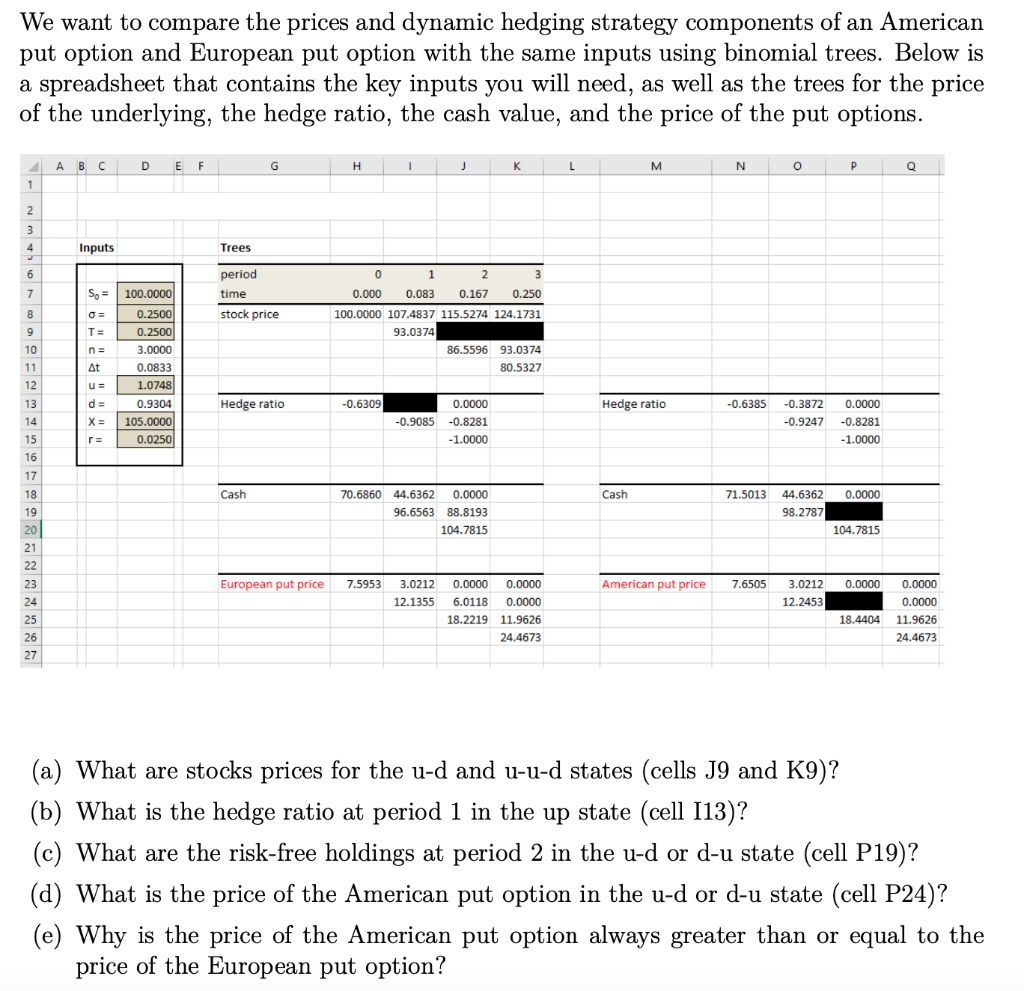

We want to compare the prices and dynamic hedging strategy components of an American put option and European put option with the same inputs using binomial trees. Below is a spreadsheet that contains the key inputs you will need, as well as the trees for the price of the underlying, the hedge ratio, the cash value, and the price of the put options. DEF G H J L M N o P ABC 1 Q Q 2 3 4 Inputs Trees 6 period 7 7 So = time 8 O stock price 0 1 2 3 0.000 0.083 0.167 0.250 100.0000 107.4837 115.5274 124.1731 93.0374 86.5596 93.0374 80.5327 T= 9 10 11 12 100.0000 0.2500 0.2500 3.0000 0.0833 1.0748 0.9304 105.0000 0.0250 n = At U= d= Hedge ratio -0.6309 Hedge ratio -0.6385 13 14 0.0000 -0.9085 -0.8281 -1.0000 -0.3872 -0.9247 X= 0.0000 -0.8281 -1.0000 15 ra 16 17 Cash Cash 0.0000 18 19 70.6860 44.6362 0.0000 96.6563 88.8193 104.7815 71.5013 44.6362 98.2787 104.7815 20 21 22 European put price 7.5953 American put price 7.6505 3.0212 12.2453 23 24 25 26 27 3.0212 0.0000 0.0000 12.1355 6.0118 0.0000 18.2219 11.9626 24.4673 0.0000 0.0000 0.0000 18.4404 11.9626 24.4673 (a) What are stocks prices for the u-d and u-u-d states (cells J9 and K9)? (b) What is the hedge ratio at period 1 in the up state (cell 113)? (c) What are the risk-free holdings at period 2 in the u-d or d-u state (cell P19)? (d) What is the price of the American put option in the u-d or d-u state (cell P24)? (e) Why is the price of the American put option always greater than or equal to the price of the European put option? We want to compare the prices and dynamic hedging strategy components of an American put option and European put option with the same inputs using binomial trees. Below is a spreadsheet that contains the key inputs you will need, as well as the trees for the price of the underlying, the hedge ratio, the cash value, and the price of the put options. DEF G H J L M N o P ABC 1 Q Q 2 3 4 Inputs Trees 6 period 7 7 So = time 8 O stock price 0 1 2 3 0.000 0.083 0.167 0.250 100.0000 107.4837 115.5274 124.1731 93.0374 86.5596 93.0374 80.5327 T= 9 10 11 12 100.0000 0.2500 0.2500 3.0000 0.0833 1.0748 0.9304 105.0000 0.0250 n = At U= d= Hedge ratio -0.6309 Hedge ratio -0.6385 13 14 0.0000 -0.9085 -0.8281 -1.0000 -0.3872 -0.9247 X= 0.0000 -0.8281 -1.0000 15 ra 16 17 Cash Cash 0.0000 18 19 70.6860 44.6362 0.0000 96.6563 88.8193 104.7815 71.5013 44.6362 98.2787 104.7815 20 21 22 European put price 7.5953 American put price 7.6505 3.0212 12.2453 23 24 25 26 27 3.0212 0.0000 0.0000 12.1355 6.0118 0.0000 18.2219 11.9626 24.4673 0.0000 0.0000 0.0000 18.4404 11.9626 24.4673 (a) What are stocks prices for the u-d and u-u-d states (cells J9 and K9)? (b) What is the hedge ratio at period 1 in the up state (cell 113)? (c) What are the risk-free holdings at period 2 in the u-d or d-u state (cell P19)? (d) What is the price of the American put option in the u-d or d-u state (cell P24)? (e) Why is the price of the American put option always greater than or equal to the price of the European put optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started