Please give your detailed answer for questions P1-6 and P1-7, the Exhibit 1-3 that the questions require is posted at the end, thank you!

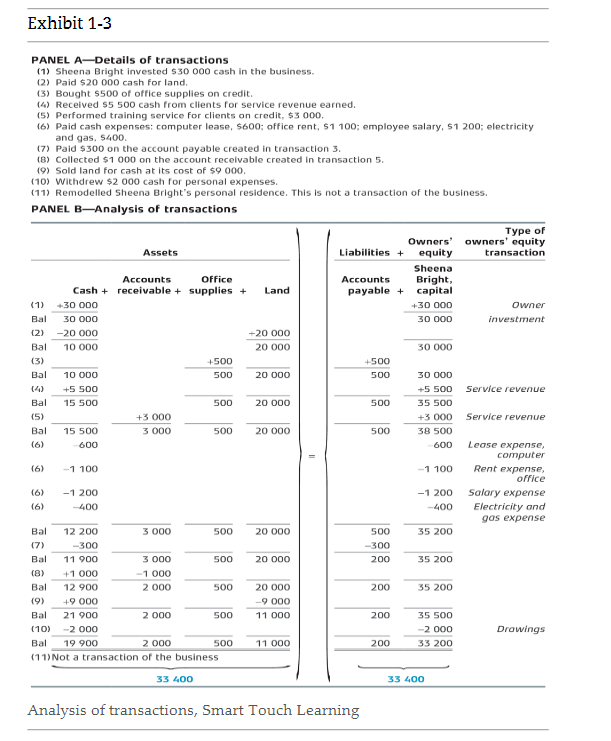

Here is Exhibit 1-3

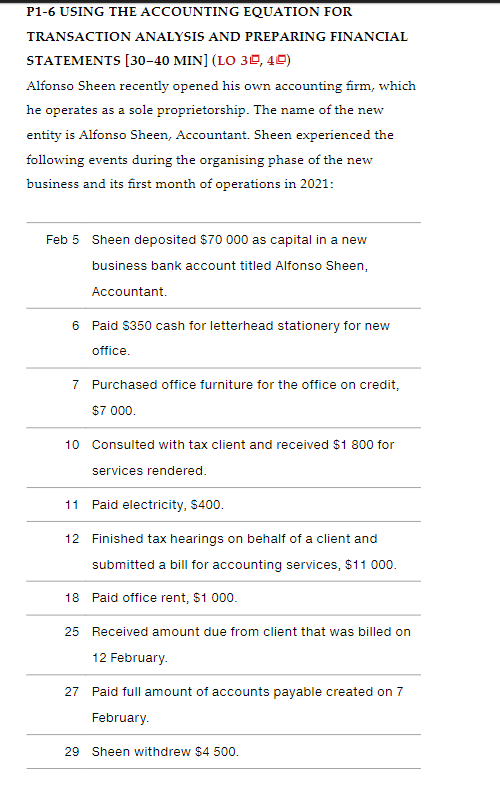

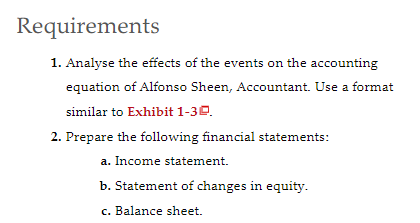

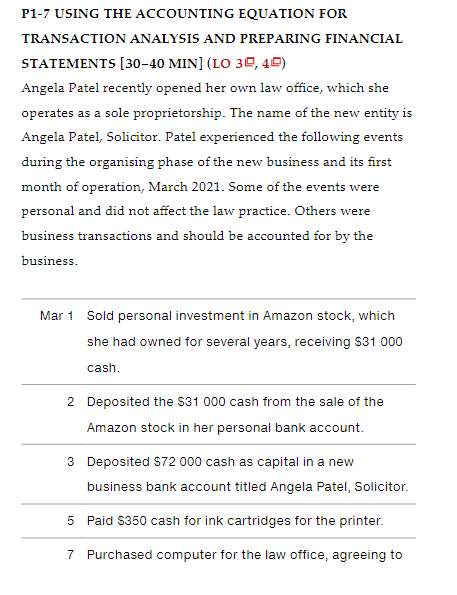

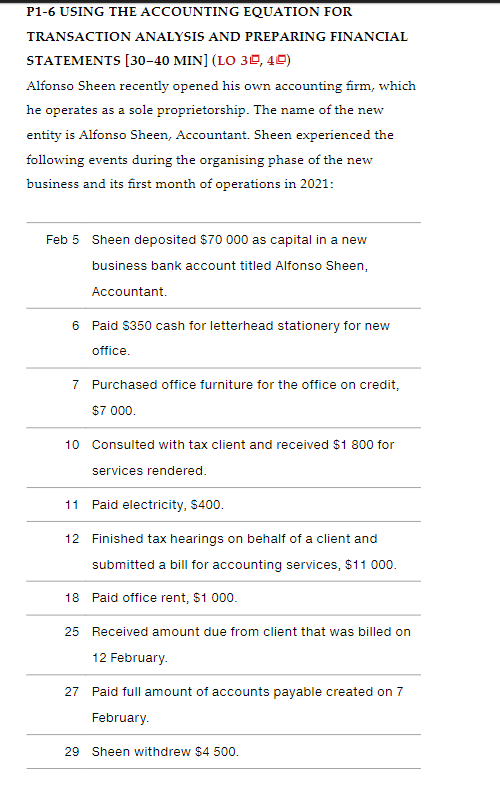

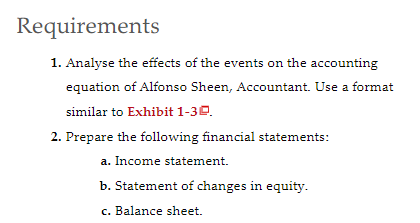

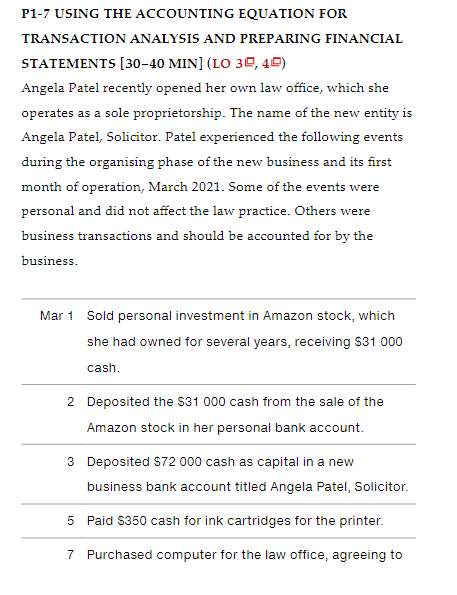

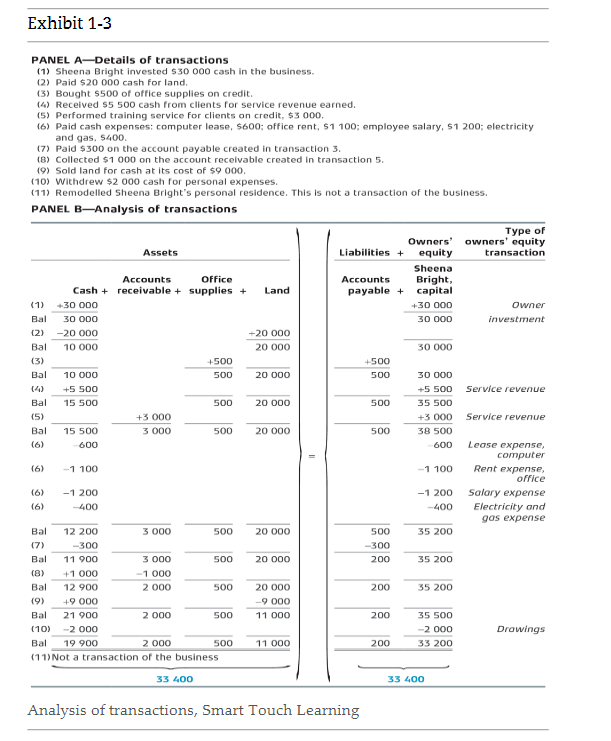

P1-6 USING THE ACCOUNTING EQUATION FOR TRANSACTION ANALYSIS AND PREPARING FINANCIAL STATEMENTS [30-40 MIN] (LO 3 , 4) Alfonso Sheen recently opened his own accounting firm, which he operates as a sole proprietorship. The name of the new entity is Alfonso Sheen, Accountant. Sheen experienced the following events during the organising phase of the new business and its first month of operations in 2021: Feb 5 Sheen deposited $70000 as capital in a new business bank account titled Alfonso Sheen, Accountant. 6 Paid $350 cash for letterhead stationery for new office. 7 Purchased office furniture for the office on credit, $7000. 10 Consulted with tax client and received $1800 for services rendered. 11 Paid electricity, $400. 12 Finished tax hearings on behalf of a client and submitted a bill for accounting services, $11000. 18 Paid office rent, $1000. 25 Received amount due from client that was billed on 12 February. 27 Paid full amount of accounts payable created on 7 February. 29 Sheen withdrew $4500. 1. Analyse the effects of the events on the accounting equation of Alfonso Sheen, Accountant. Use a format similar to Exhibit 1-3. 2. Prepare the following financial statements: a. Income statement. b. Statement of changes in equity. c. Balance sheet. P1-7 USING THE ACCOUNTING EQUATION FOR TRANSACTION ANALYSIS AND PREPARING FINANCIAL STATEMENTS [30-40 MIN] (LO 3 , 4 ) Angela Patel recently opened her own law office, which she operates as a sole proprietorship. The name of the new entity is Angela Patel, Solicitor. Patel experienced the following events during the organising phase of the new business and its first month of operation, March 2021. Some of the events were personal and did not affect the law practice. Others were business transactions and should be accounted for by the business. 1. Analyse the effects of the preceding events on the accounting equation of Angela Patel, Solicitor. Use a format similar to Exhibit 1-3 2. Prepare the following financial statements: a. Income statement. b. Statement of changes in equity. c. Balance sheet. PANEL A-Details of transactions (1) Sheena Bright invested 530000 cash in the business. (2) Paid 520000 cash for land. (3) Bought 5500 of office supplies on credit. (4) Received 55500 cash from clients for service revenue earned. (5) Performed training service for clients on credit, 53000 . (6) Paid cash expenses: computer lease, 5600 ; office rent, 51 100; employee salary, 51 200; electricity and gas, 5400 . (7) Paid $300 on the account payable created in transaction 3. (B) Collected $1 ooo on the account recelvable created in transaction 5. (9) Sold land for cash at its cost of $9000. (10) Withdrew $2000 cash for personal expenses. (11) Remodelled sheena Bright's personal residence. This is not a transaction of the business. PANEL B-Analysis of transactions Analysis of transactions, Smart Touch Learning P1-6 USING THE ACCOUNTING EQUATION FOR TRANSACTION ANALYSIS AND PREPARING FINANCIAL STATEMENTS [30-40 MIN] (LO 3 , 4) Alfonso Sheen recently opened his own accounting firm, which he operates as a sole proprietorship. The name of the new entity is Alfonso Sheen, Accountant. Sheen experienced the following events during the organising phase of the new business and its first month of operations in 2021: Feb 5 Sheen deposited $70000 as capital in a new business bank account titled Alfonso Sheen, Accountant. 6 Paid $350 cash for letterhead stationery for new office. 7 Purchased office furniture for the office on credit, $7000. 10 Consulted with tax client and received $1800 for services rendered. 11 Paid electricity, $400. 12 Finished tax hearings on behalf of a client and submitted a bill for accounting services, $11000. 18 Paid office rent, $1000. 25 Received amount due from client that was billed on 12 February. 27 Paid full amount of accounts payable created on 7 February. 29 Sheen withdrew $4500. 1. Analyse the effects of the events on the accounting equation of Alfonso Sheen, Accountant. Use a format similar to Exhibit 1-3. 2. Prepare the following financial statements: a. Income statement. b. Statement of changes in equity. c. Balance sheet. P1-7 USING THE ACCOUNTING EQUATION FOR TRANSACTION ANALYSIS AND PREPARING FINANCIAL STATEMENTS [30-40 MIN] (LO 3 , 4 ) Angela Patel recently opened her own law office, which she operates as a sole proprietorship. The name of the new entity is Angela Patel, Solicitor. Patel experienced the following events during the organising phase of the new business and its first month of operation, March 2021. Some of the events were personal and did not affect the law practice. Others were business transactions and should be accounted for by the business. 1. Analyse the effects of the preceding events on the accounting equation of Angela Patel, Solicitor. Use a format similar to Exhibit 1-3 2. Prepare the following financial statements: a. Income statement. b. Statement of changes in equity. c. Balance sheet. PANEL A-Details of transactions (1) Sheena Bright invested 530000 cash in the business. (2) Paid 520000 cash for land. (3) Bought 5500 of office supplies on credit. (4) Received 55500 cash from clients for service revenue earned. (5) Performed training service for clients on credit, 53000 . (6) Paid cash expenses: computer lease, 5600 ; office rent, 51 100; employee salary, 51 200; electricity and gas, 5400 . (7) Paid $300 on the account payable created in transaction 3. (B) Collected $1 ooo on the account recelvable created in transaction 5. (9) Sold land for cash at its cost of $9000. (10) Withdrew $2000 cash for personal expenses. (11) Remodelled sheena Bright's personal residence. This is not a transaction of the business. PANEL B-Analysis of transactions Analysis of transactions, Smart Touch Learning