Please guide me on this question

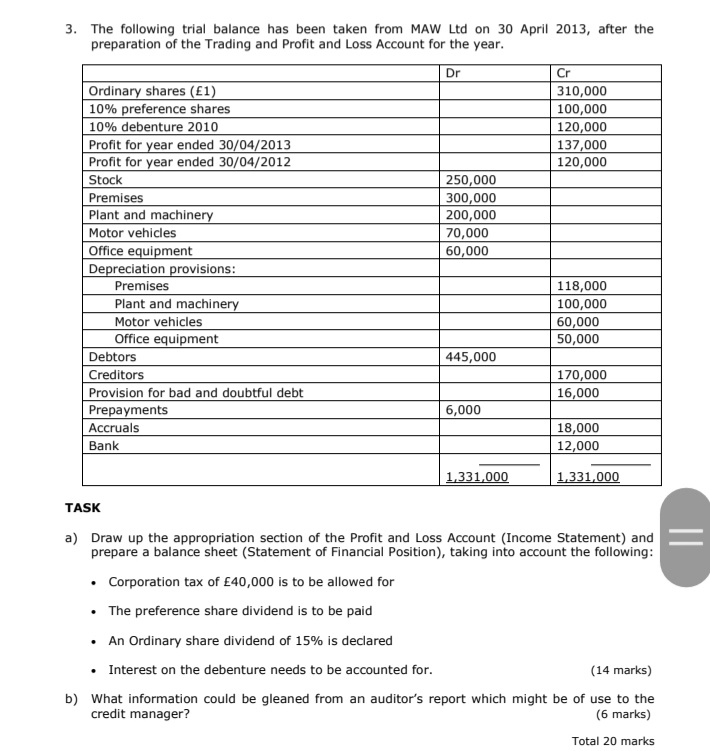

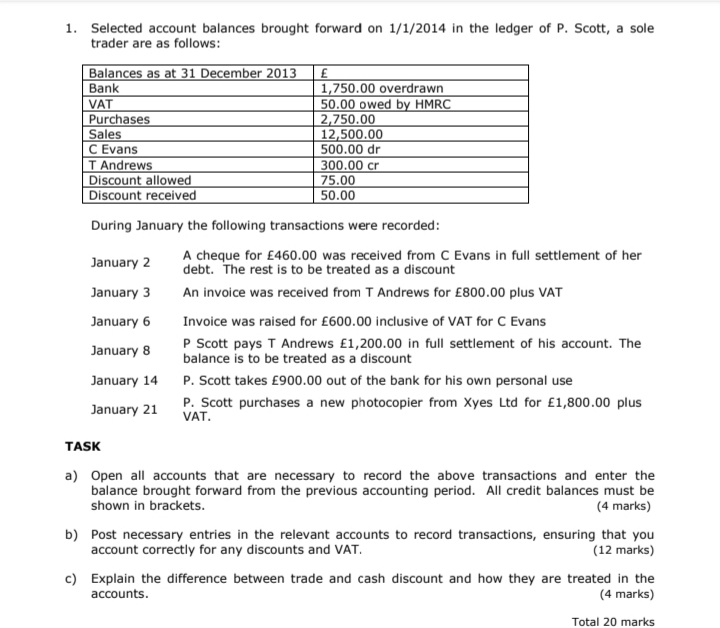

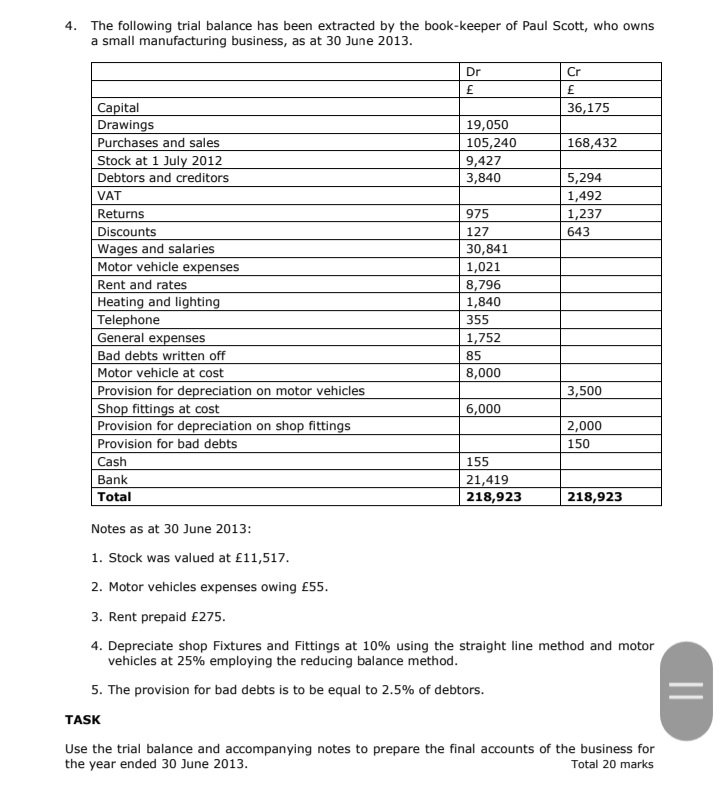

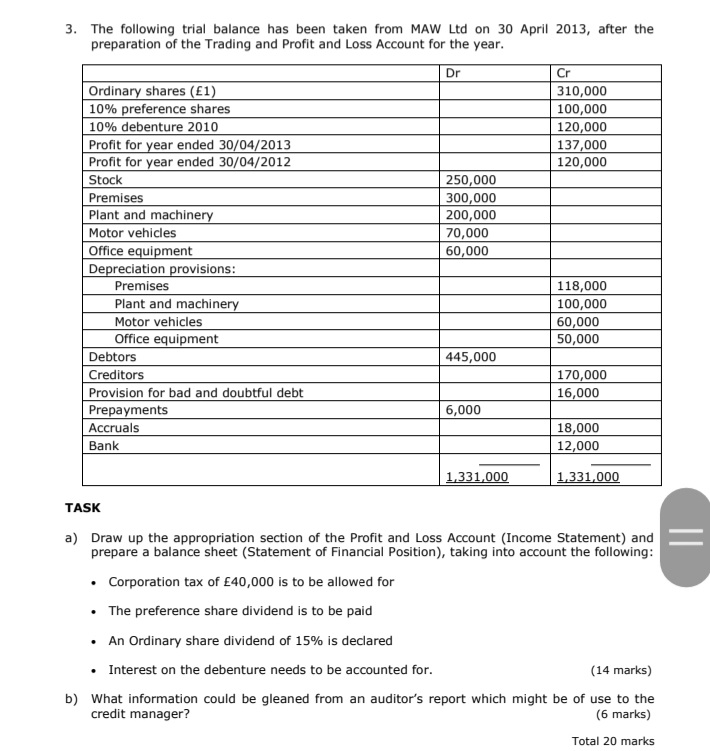

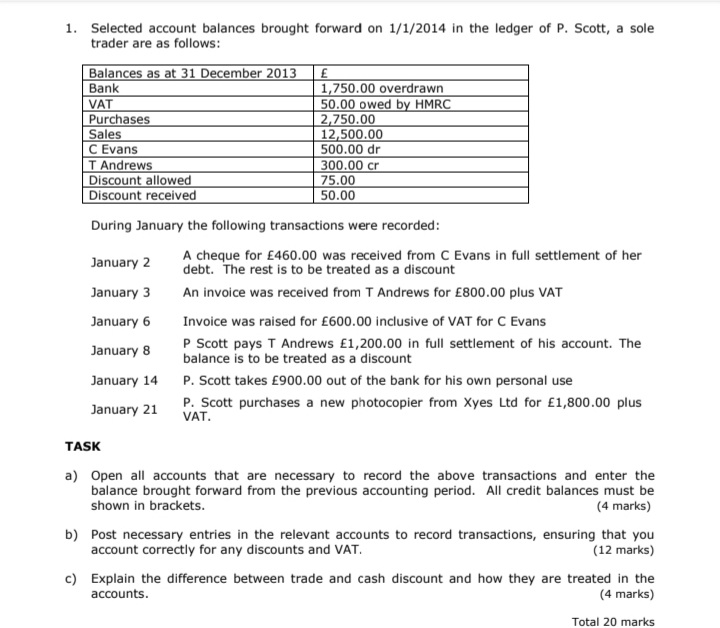

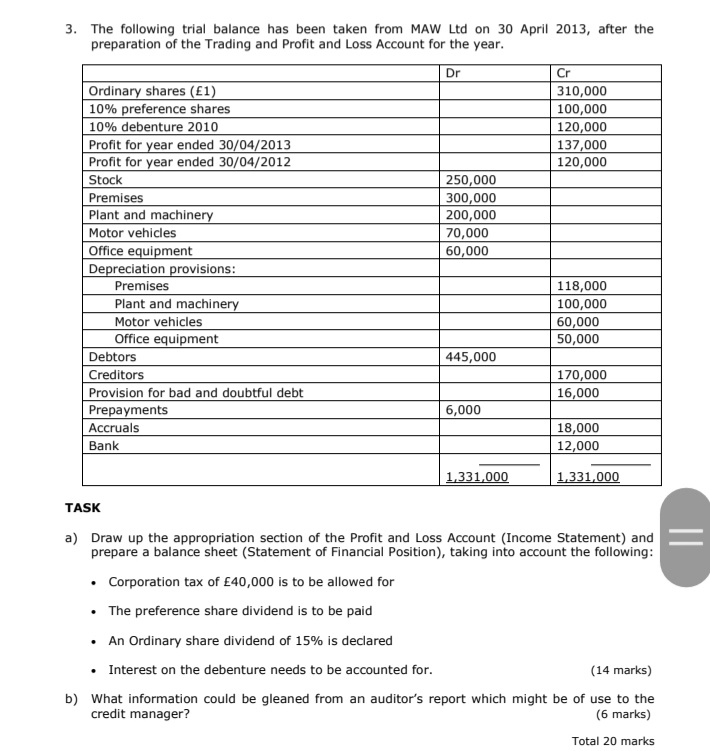

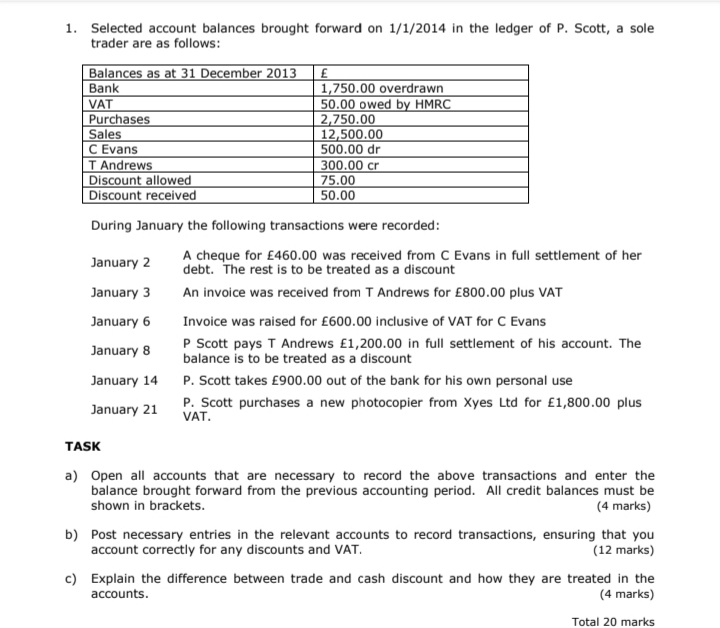

4. The following trial balance has been extracted by the book-keeper of Paul Scott, who owns a small manufacturing business, as at 30 June 2013. Dr Cr F E Capital 36,175 Drawings 19,050 Purchases and sales 105,240 168,432 Stock at 1 July 2012 9,427 Debtors and creditors 3,840 5,294 VAT 1,492 Returns 975 1,237 Discounts 127 643 Wages and salaries 30,841 Motor vehicle expenses 1,021 Rent and rates 8,796 Heating and lighting 1,840 Telephone 355 General expenses 1,752 Bad debts written off 85 Motor vehicle at cost 8,000 Provision for depreciation on motor vehicles 3,500 Shop fittings at cost 6,000 Provision for depreciation on shop fittings 2,000 Provision for bad debts 150 Cash 155 Bank 21,419 Total 218,923 218,923 Notes as at 30 June 2013: 1. Stock was valued at E11,517. 2. Motor vehicles expenses owing E55. 3. Rent prepaid E275. 4. Depreciate shop Fixtures and Fittings at 10% using the straight line method and motor vehicles at 25% employing the reducing balance method. 5. The provision for bad debts is to be equal to 2.5% of debtors. TASK Use the trial balance and accompanying notes to prepare the final accounts of the business for the year ended 30 June 2013. Total 20 marks3. The following trial balance has been taken from MAW Ltd on 30 April 2013, after the preparation of the Trading and Profit and Loss Account for the year. Dr Cr Ordinary shares (E1) 310,000 10% preference shares 100,000 10% debenture 2010 120,000 Profit for year ended 30/04/2013 137,000 Profit for year ended 30/04/2012 120,000 Stock 250,000 Premises 300,000 Plant and machinery 200,000 Motor vehicles 70,000 Office equipment 60,000 Depreciation provisions: Premises 118,000 Plant and machinery 100,000 Motor vehicles 60,000 Office equipment 50,000 Debtors 445,000 Creditors 170,000 Provision for bad and doubtful debt 16,000 Prepayments 6,000 Accruals 18,000 Bank 12,000 1,331,000 1,331,000 TASK a) Draw up the appropriation section of the Profit and Loss Account (Income Statement) and prepare a balance sheet (Statement of Financial Position), taking into account the following: . Corporation tax of E40,000 is to be allowed for The preference share dividend is to be paid An Ordinary share dividend of 15% is declared Interest on the debenture needs to be accounted for. (14 marks) b) What information could be gleaned from an auditor's report which might be of use to the credit manager? (6 marks) Total 20 marks1. Selected account balances brought forward on 1/1/2014 in the ledger of P. Scott, a sole trader are as follows: Balances as at 31 December 2013 E Bank 1,750.00 overdrawn VAT 50.00 owed by HMRC Purchases 2,750.00 Sales 12,500.00 C Evans 500.00 dr T Andrews 300.00 cr Discount allowed 75.00 Discount received 50.00 During January the following transactions were recorded: January 2 A cheque for E460.00 was received from C Evans in full settlement of her debt. The rest is to be treated as a discount January 3 An invoice was received from T Andrews for E800.00 plus VAT January 6 Invoice was raised for E600.00 inclusive of VAT for C Evans January 8 P Scott pays T Andrews E1,200.00 in full settlement of his account. The balance is to be treated as a discount January 14 P. Scott takes E900.00 out of the bank for his own personal use January 21 P. Scott purchases a new photocopier from Xyes Ltd for E1,800.00 plus VAT. TASK a) Open all accounts that are necessary to record the above transactions and enter the balance brought forward from the previous accounting period. All credit balances must be shown in brackets. (4 marks) b) Post necessary entries in the relevant accounts to record transactions, ensuring that you account correctly for any discounts and VAT. (12 marks) c) Explain the difference between trade and cash discount and how they are treated in the accounts. (4 marks) Total 20 marks