Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please helo me answer with the numbers in the problem. Required information The Foundational 15 (Algo) (L06-1, LO6-3, L06-4, LO 6-5, LO6-6, LO6-7, LO6-8) {The

please helo me answer with the numbers in the problem.

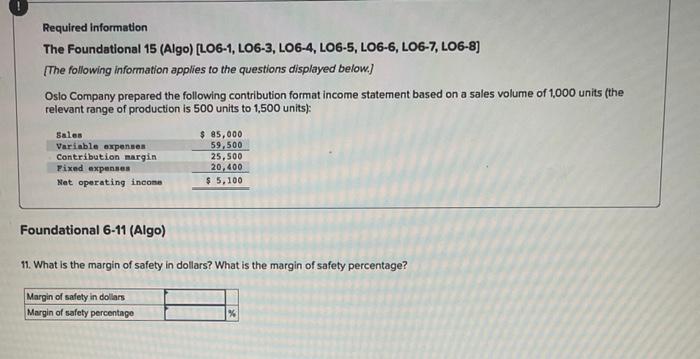

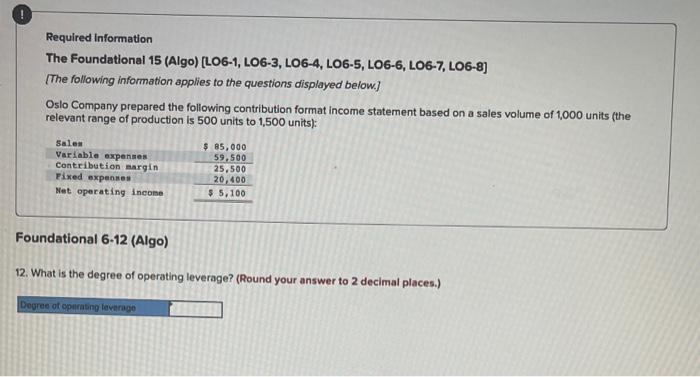

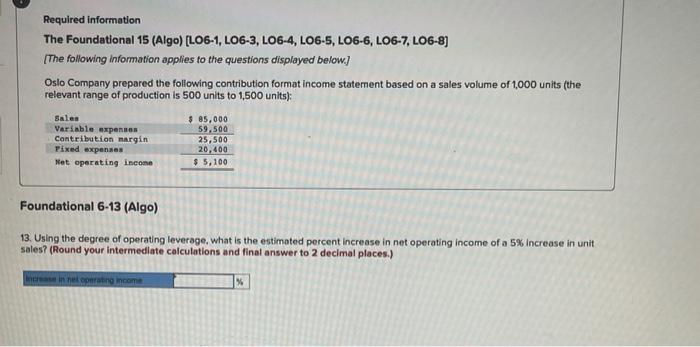

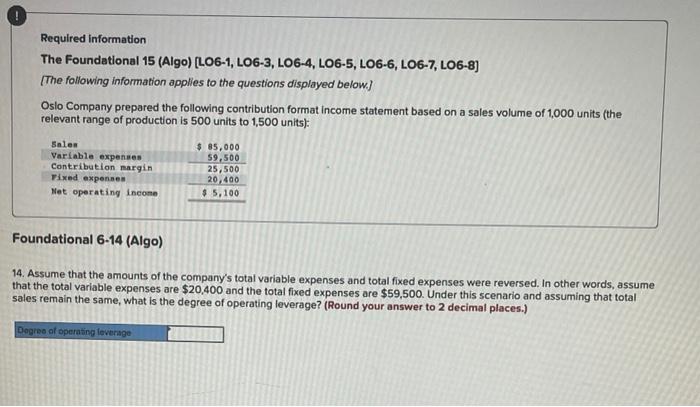

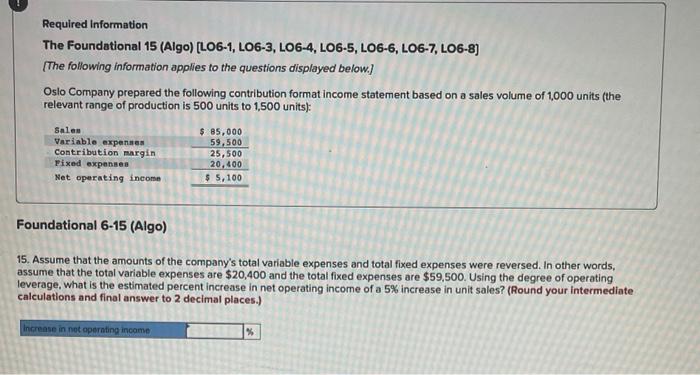

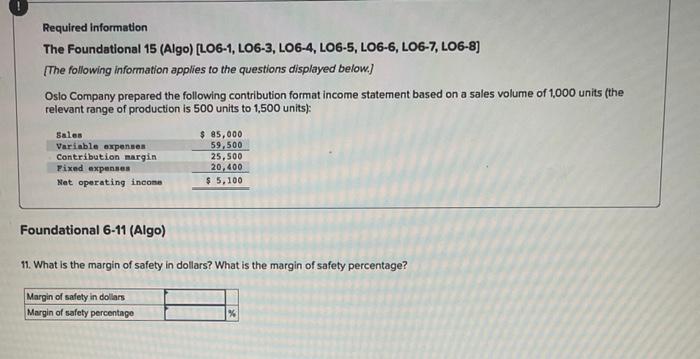

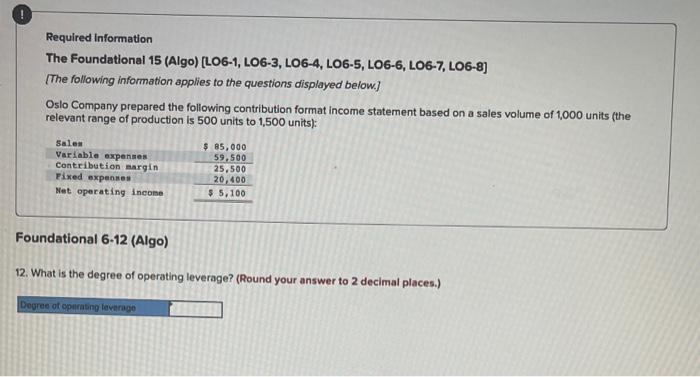

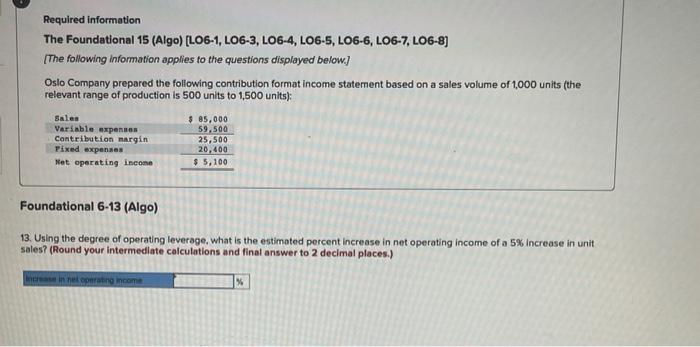

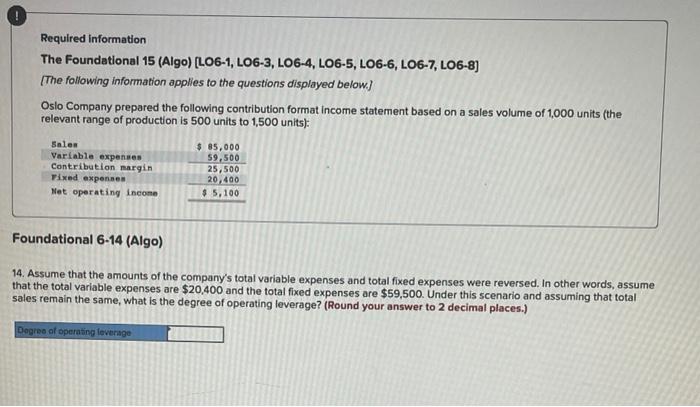

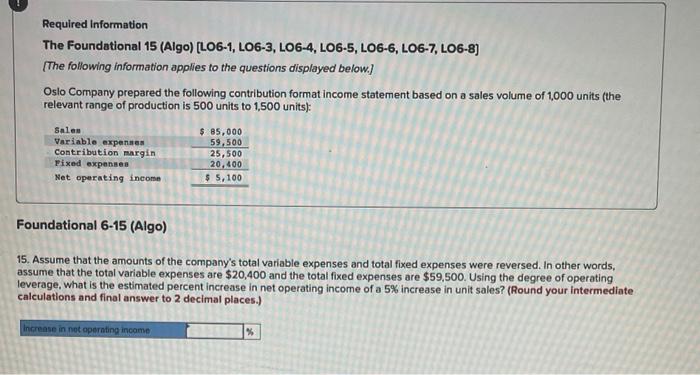

Required information The Foundational 15 (Algo) (L06-1, LO6-3, L06-4, LO 6-5, LO6-6, LO6-7, LO6-8) {The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 85,000 59,500 25,500 20,400 $ 5,100 Foundational 6-11 (Algo) 11. What is the margin of safety in dollars? What is the margin of safety percentage? Margin of safety in dollars Margin of safety percentage % ! Required Information The Foundational 15 (Algo) (LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8) (The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 85,000 59.500 25,500 20,400 $ 5,100 Foundational 6-12 (Algo) 12. What is the degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leverage Required information The Foundational 15 (Algo) (L06-1, LO6-3, L06-4, LO6-5, LO6-6, LO 6-7, LO6-8) (The following information applies to the questions displayed below) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 85,000 59.500 25,500 20,400 $ 5,100 Foundational 6-13 (Algo) 13. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% Increase in unit sales? (Round your intermediate calculations and final answer to 2 decimal places.) in neoprating income Required information The Foundational 15 (Algo) (L06-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8) The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 85,000 59,500 25,500 20,400 $ 5,100 Foundational 6-14 (Algo) 14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $20,400 and the total fixed expenses are $59,500. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leverage Required Information The Foundational 15 (Algo) (L06-1, LO6-3, L06-4, L06-5, LO6-6, LO6-7, LO6-8) (The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 85,000 59,500 25,500 20,400 $ 5,100 Foundational 6-15 (Algo) 15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $20,400 and the total fixed expenses are $59,500. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% increase in unit sales? (Round your intermediate calculations and final answer to 2 decimal places.) Increase in net operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started