Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please helo me solve - We have a new project to launch a new product in our company, in next slides you have the estimated

please helo me solve

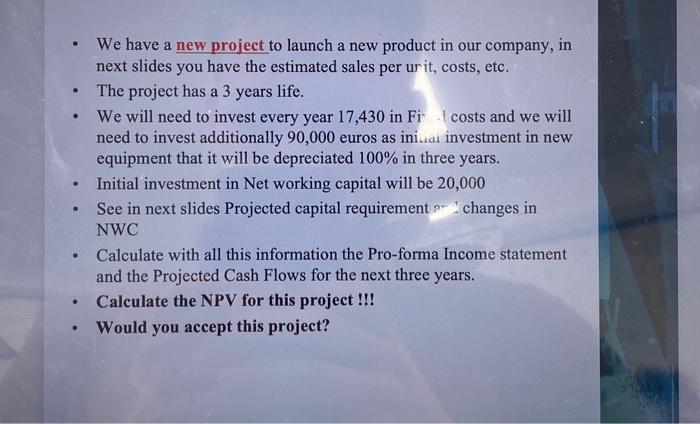

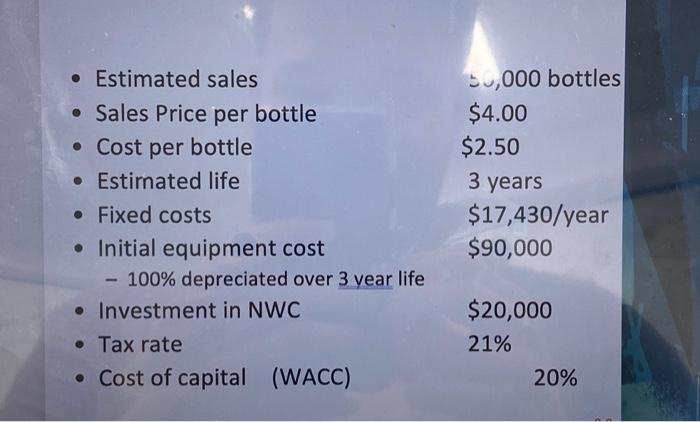

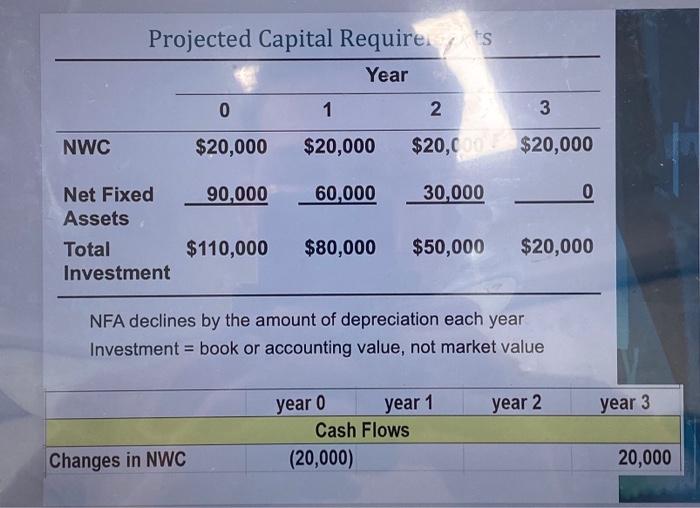

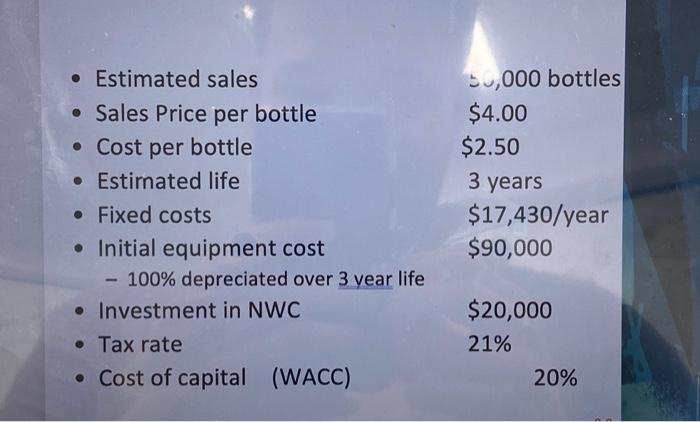

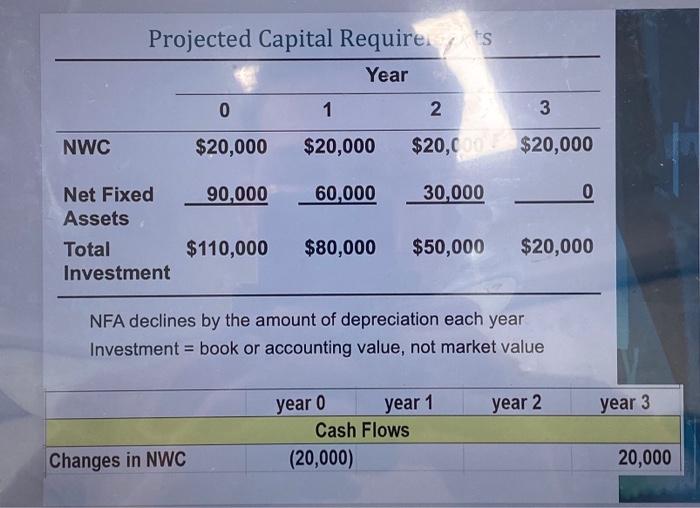

- We have a new project to launch a new product in our company, in next slides you have the estimated sales per urit, costs, etc. - The project has a 3 years life. - We will need to invest every year 17,430 in Fi . 1 costs and we will need to invest additionally 90,000 euros as ini iat investment in new equipment that it will be depreciated 100% in three years. - Initial investment in Net working capital will be 20,000 - See in next slides Projected capital requirement ohanges in NWC - Calculate with all this information the Pro-forma Income statement and the Projected Cash Flows for the next three years. - Calculate the NPV for this project !!! - Would you accept this project? - Estimated sales su,000 bottles - Sales Price per bottle $4.00 - Cost per bottle $2.50 - Estirnated life 3 years - Fixed costs - Initial equipment cost $90,000 - 100\% depreciated over 3 vear life - Investment in NWC $20,000 - Tax rate 21% - Cost of capital (WACC) 20% NFA declines by the amount of depreciation each year Investment = book or accounting value, not market value - We have a new project to launch a new product in our company, in next slides you have the estimated sales per urit, costs, etc. - The project has a 3 years life. - We will need to invest every year 17,430 in Fi . 1 costs and we will need to invest additionally 90,000 euros as ini iat investment in new equipment that it will be depreciated 100% in three years. - Initial investment in Net working capital will be 20,000 - See in next slides Projected capital requirement ohanges in NWC - Calculate with all this information the Pro-forma Income statement and the Projected Cash Flows for the next three years. - Calculate the NPV for this project !!! - Would you accept this project? - Estimated sales su,000 bottles - Sales Price per bottle $4.00 - Cost per bottle $2.50 - Estirnated life 3 years - Fixed costs - Initial equipment cost $90,000 - 100\% depreciated over 3 vear life - Investment in NWC $20,000 - Tax rate 21% - Cost of capital (WACC) 20% NFA declines by the amount of depreciation each year Investment = book or accounting value, not market value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started