Answered step by step

Verified Expert Solution

Question

1 Approved Answer

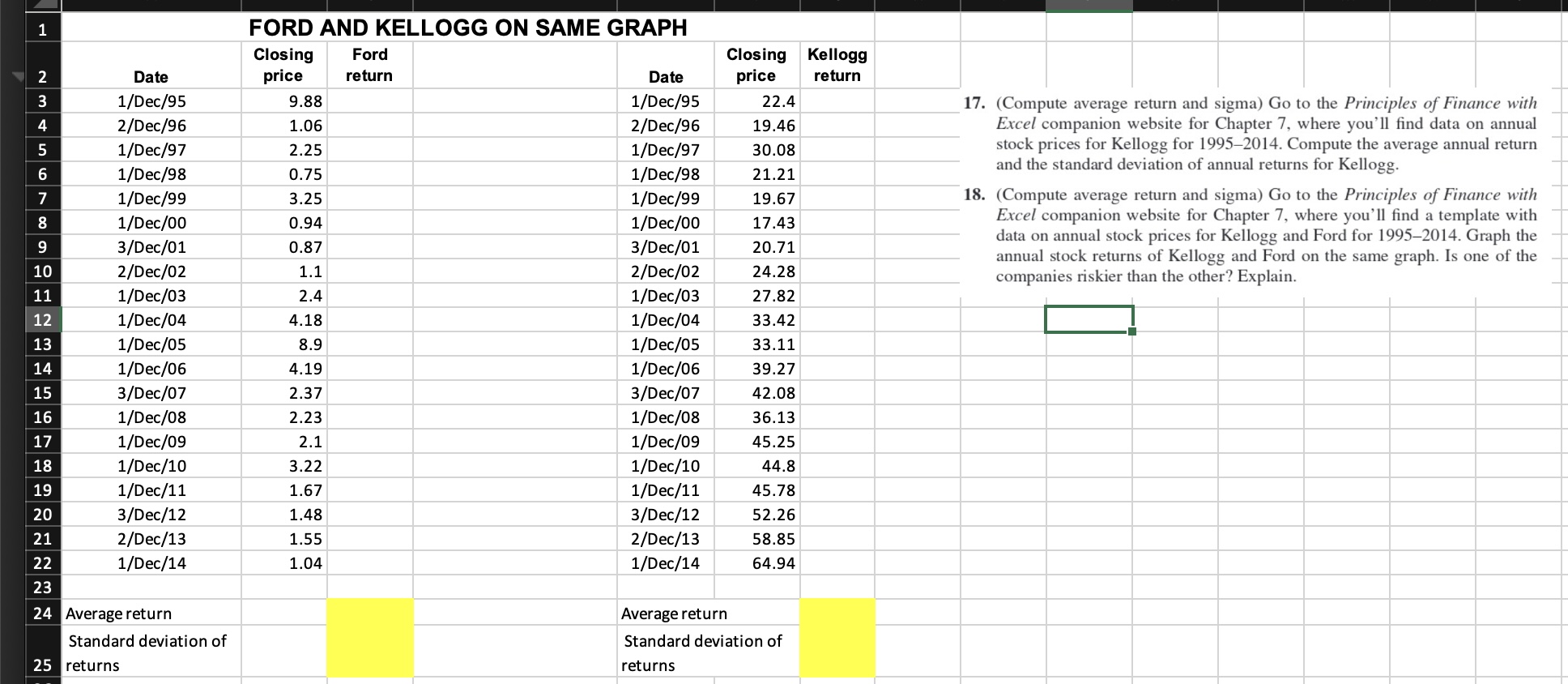

Please help 1 FORD AND KELLOGG ON SAME GRAPH begin{tabular}{|c|c|} hline 2 & Date hline 3 & 1/Dec/95 hline 4 & 2/Dec/96

Please help

1 FORD AND KELLOGG ON SAME GRAPH \begin{tabular}{|c|c|} \hline 2 & Date \\ \hline 3 & 1/Dec/95 \\ \hline 4 & 2/Dec/96 \\ \hline 5 & 1/Dec/97 \\ \hline 6 & 1/Dec/98 \\ \hline 7 & 1/Dec/99 \\ \hline 8 & 1/Dec/00 \\ \hline 9 & 3/Dec/01 \\ \hline 10 & 2/Dec/02 \\ \hline 11 & 1/Dec/03 \\ \hline 12 & 1/Dec/04 \\ \hline 13 & 1/Dec/05 \\ \hline 14 & 1/Dec/06 \\ \hline 15 & 3/Dec/07 \\ \hline 16 & 1/Dec/08 \\ \hline 17 & 1/Dec/09 \\ \hline 18 & 1/Dec/10 \\ \hline 19 & 1/Dec/11 \\ \hline 20 & 3/Dec/12 \\ \hline 21 & 2/Dec/13 \\ \hline 22 & 1/Dec/14 \\ \hline 23 & \\ \hline 24 & Average return \\ \hline 25 & \begin{tabular}{l} Standard deviation of \\ returns \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \begin{tabular}{l} Closing \\ price \end{tabular} & \begin{tabular}{l} Ford \\ return \end{tabular} & Date & \begin{tabular}{l} Closing \\ price \end{tabular} \\ \hline 9.88 & & 1/Dec/95 & 22.4 \\ \hline 1.06 & & 2/Dec/96 & 19.46 \\ \hline 2.25 & & 1/Dec/97 & 30.08 \\ \hline 0.75 & & 1/Dec/98 & 21.21 \\ \hline 3.25 & & 1/Dec/99 & 19.67 \\ \hline 0.94 & & 1/Dec/00 & 17.43 \\ \hline 0.87 & & 3/Dec/01 & 20.71 \\ \hline 1.1 & & 2/Dec/02 & 24.28 \\ \hline 2.4 & & 1/Dec/03 & 27.82 \\ \hline 4.18 & & 1/Dec/04 & 33.42 \\ \hline 8.9 & & 1/Dec/05 & 33.11 \\ \hline 4.19 & & 1/Dec/06 & 39.27 \\ \hline 2.37 & & 3/Dec/07 & 42.08 \\ \hline 2.23 & & 1/Dec/08 & 36.13 \\ \hline 2.1 & & 1/Dec/09 & 45.25 \\ \hline 3.22 & & 1/Dec/10 & 44.8 \\ \hline 1.67 & & 1/Dec/11 & 45.78 \\ \hline 1.48 & & 3/Dec/12 & 52.26 \\ \hline 1.55 & & 2/Dec/13 & 58.85 \\ \hline 1.04 & & 1/Dec/14 & 64.94 \\ \hline & & & \\ \hline & & \multicolumn{2}{|c|}{ Average return } \\ \hline & & \multicolumn{2}{|c|}{\begin{tabular}{l} Standard deviation of \\ returns \end{tabular}} \\ \hline \end{tabular} 17. (Compute average return and sigma) Go to the Principles of Finance with Excel companion website for Chapter 7, where you'll find data on annual stock prices for Kellogg for 1995-2014. Compute the average annual return and the standard deviation of annual returns for Kellogg. 18. (Compute average return and sigma) Go to the Principles of Finance with Excel companion website for Chapter 7, where you'll find a template with data on annual stock prices for Kellogg and Ford for 1995-2014. Graph the annual stock returns of Kellogg and Ford on the same graph. Is one of the companies riskier than the other? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started