Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help 1. Isabel Fox (unmarried) is blind and employed as a Counselor at the main office of Canal Street Crisis Center. Isabel lives in

please help

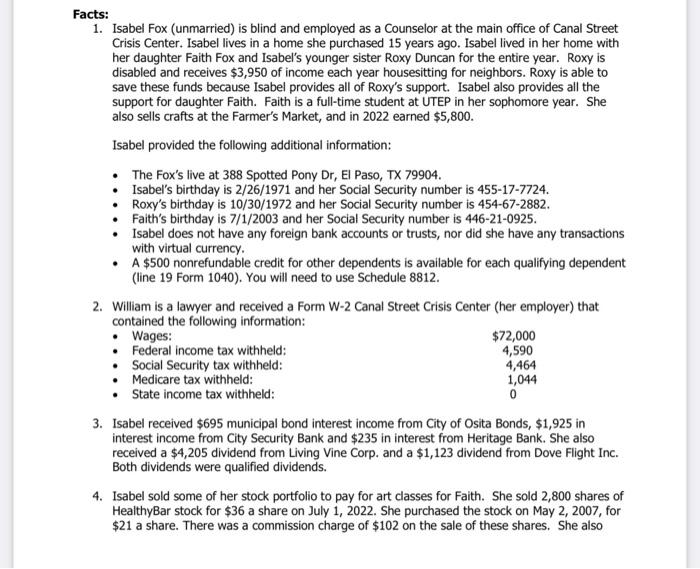

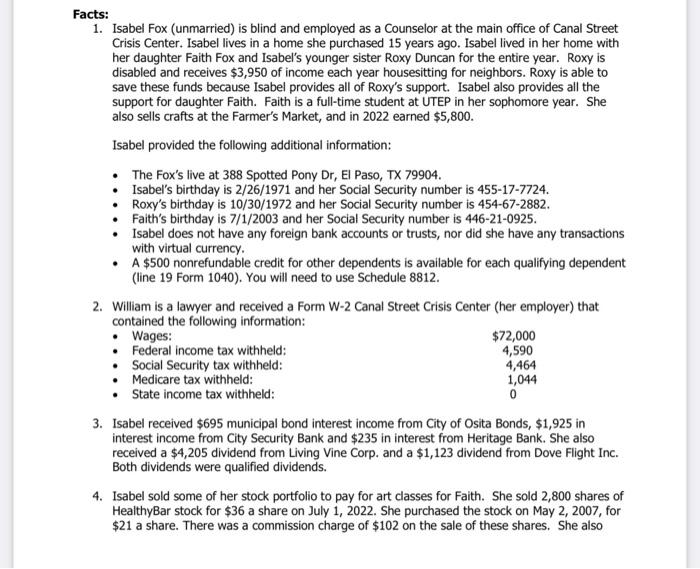

1. Isabel Fox (unmarried) is blind and employed as a Counselor at the main office of Canal Street Crisis Center. Isabel lives in a home she purchased 15 years ago. Isabel lived in her home with her daughter Faith Fox and Isabel's younger sister Roxy Duncan for the entire year. Roxy is disabled and receives $3,950 of income each year housesitting for neighbors. Roxy is able to save these funds because Isabel provides all of Roxy's support. Isabel also provides all the support for daughter Faith. Faith is a full-time student at UTEP in her sophomore year. She also sells crafts at the Farmer's Market, and in 2022 earned $5,800. Isabel provided the following additional information: - The Fox's live at 388 Spotted Pony Dr, El Paso, TX 79904. - Isabel's birthday is 2/26/1971 and her Social Security number is 455-17-7724. - Roxy's birthday is 10/30/1972 and her Social Security number is 454-67-2882. - Faith's birthday is 7/1/2003 and her Social Security number is 446-21-0925. - Isabel does not have any foreign bank accounts or trusts, nor did she have any transactions with virtual currency. - A $500 nonrefundable credit for other dependents is available for each qualifying dependent (line 19 Form 1040). You will need to use Schedule 8812. that 3. Isabel received $695 municipal bond interest income from City of Osita Bonds, $1,925 in interest income from City Security Bank and $235 in interest from Heritage Bank. She also received a $4,205 dividend from Living Vine Corp. and a $1,123 dividend from Dove Flight Inc. Both dividends were qualified dividends. 4. Isabel sold some of her stock portfolio to pay for art classes for Faith. She sold 2,800 shares of HealthyBar stock for $36 a share on July 1, 2022. She purchased the stock on May 2, 2007, for $21 a share. There was a commission charge of $102 on the sale of these shares. She also

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started