Answered step by step

Verified Expert Solution

Question

1 Approved Answer

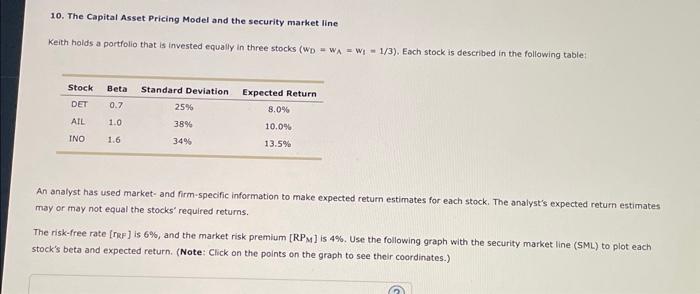

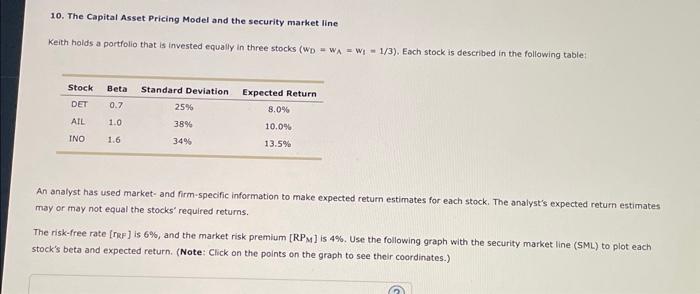

Please help! 10. The Capital Asset Pricing Model and the security market line Keith holds a portfolio that is invested equally in three stocks (wD=wA=w1=1/3),

Please help!

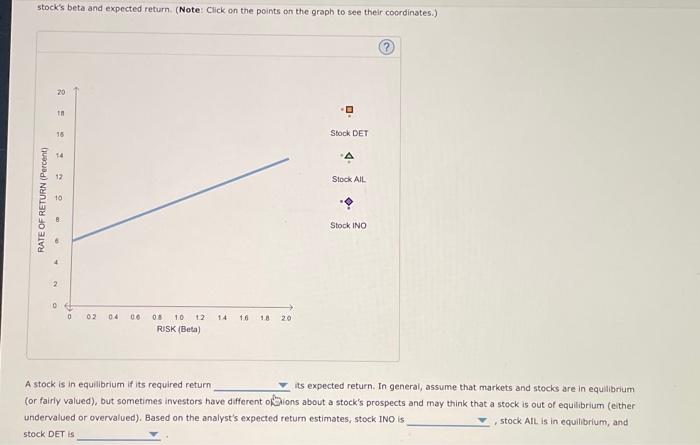

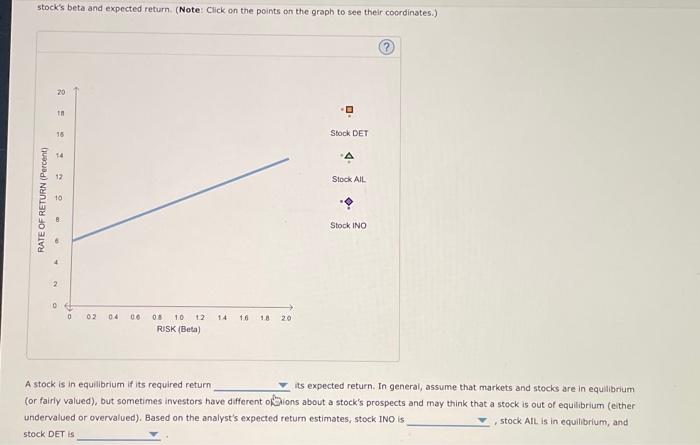

10. The Capital Asset Pricing Model and the security market line Keith holds a portfolio that is invested equally in three stocks (wD=wA=w1=1/3), Each stock is described in the following table: An analyst has used market- and firm-specific information to make expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. The risk-free rate [rRF] is 6\%, and the market risk premium [RPM] is 4%. Use the following graph with the security market line (SML) to plot each tock's beta and expected return. (Note: Click on the points on the graph to see their coordinates.) stock's beta and expected return. (Note: Click on the points on the graph to see their coordinates.) A stock is in equilibrium if its required return its expected return. In general; assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different oflilons about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, stock INO is stock DET is , stock All is in equilibrium, and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started