Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help 27. You want to quit your job and return to school for an MBA degree 3 years from now, and you plan to

please help

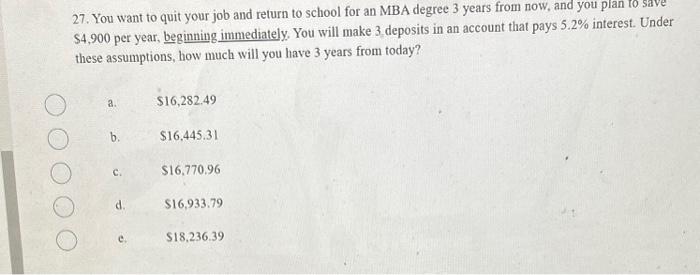

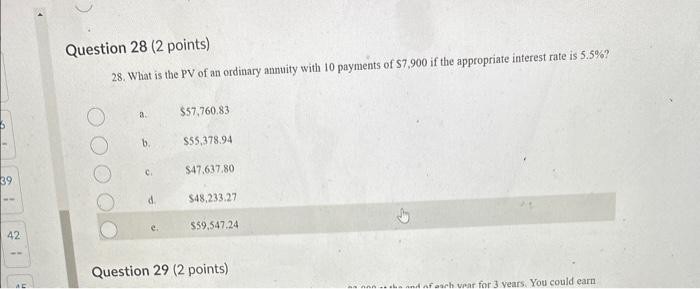

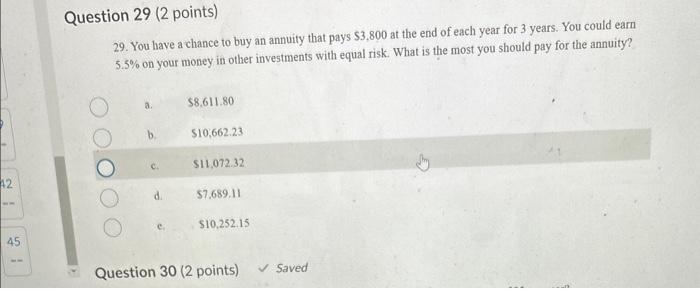

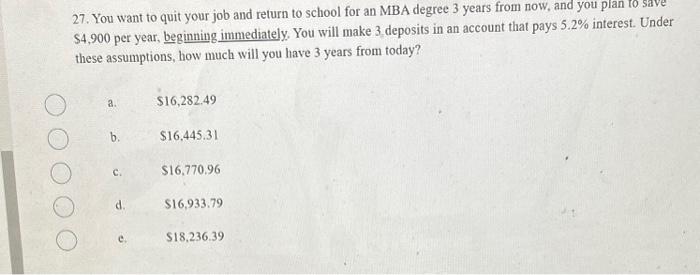

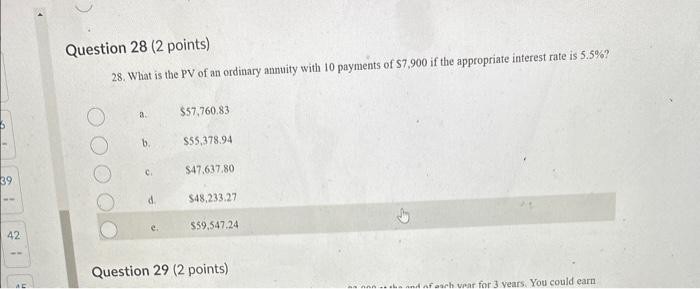

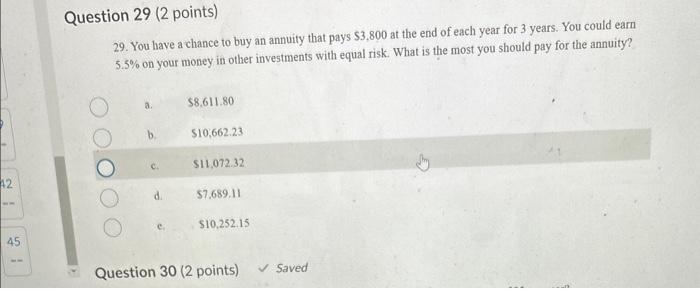

27. You want to quit your job and return to school for an MBA degree 3 years from now, and you plan to save $4,900 per year, beginning immediately. You will make 3 deposits in an account that pays 5.2% interest. Under these assumptions, how much will you have 3 years from today? a. $16,282,49 b. $16.445.31 c. $16.770.96 d. $16,933.79 e. $18.236.39 28. What is the PV of an ordinary annuity with 10 payments of $7,900 if the appropriate interest rate is 5.5% ? a. $57,760.83 b. $55,378.94 c. $47,637,80 d. $48,233,27 e. $59,547,24 Question 29 ( 2 points) 29. You have a chance to buy an annuity that pays $3,800 at the end of each year for 3 years. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? a. 58.611.80 b. $10,662.23 c. $11,072.32 d. $7.689.11 c. $10,252,15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started