Answered step by step

Verified Expert Solution

Question

1 Approved Answer

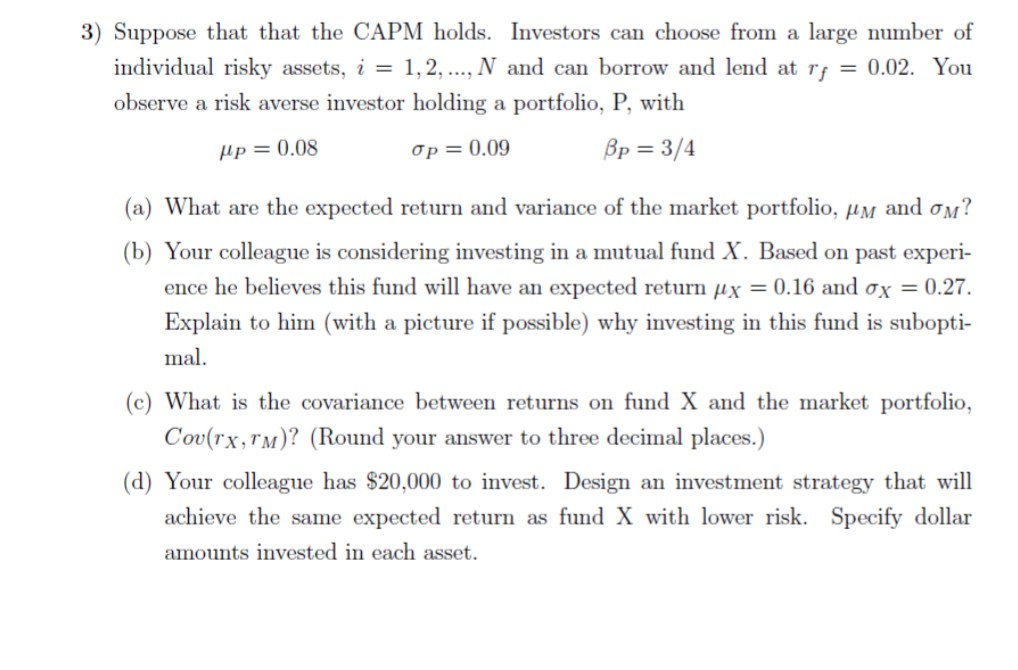

Please help 3) Suppose that that the CAPM holds. Investors can choose from a large number of individual risky assets, i = 1, 2, ,N

Please help

3) Suppose that that the CAPM holds. Investors can choose from a large number of individual risky assets, i = 1, 2, ,N and can borrow and lend at rf = 0.02. You observe a risk averse investor holding a portfolio, P, with = 0.08 = 0.09 (a) What are the expected return and variance of the market portfolio. and (b) Your colleague is considering investing in a mutual fund X. Based on past experi- ence he believes this fund will have an expected return 0.16 and 0.27. Explain to him (with a picture if possible) why investing in this fund is subopti- ma (c) What is the covariance between returns on fund X and the market portfolio Cov(rx, TM)? (Round your answer to three decimal places.) (d) Your colleague has S20,000 to invest. Design an investment strategy that will achieve the same expected return as fund X with lower risk. Specify dollar amounts invested in each assetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started