please help

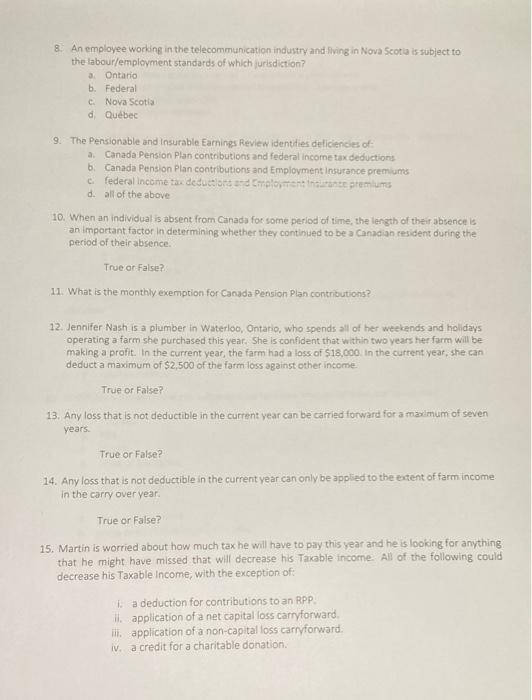

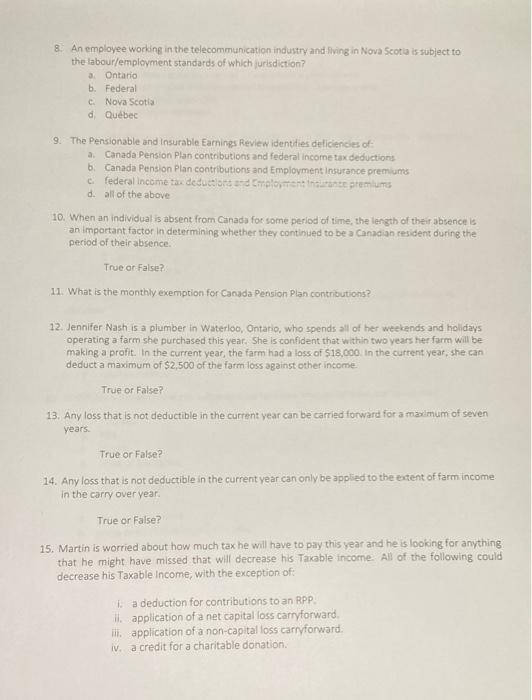

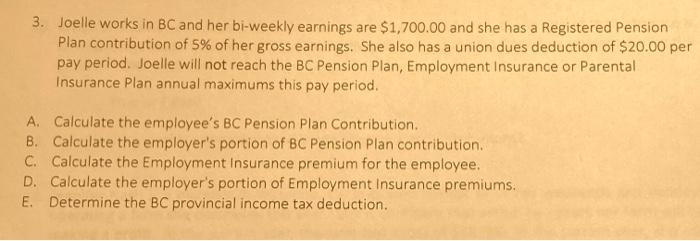

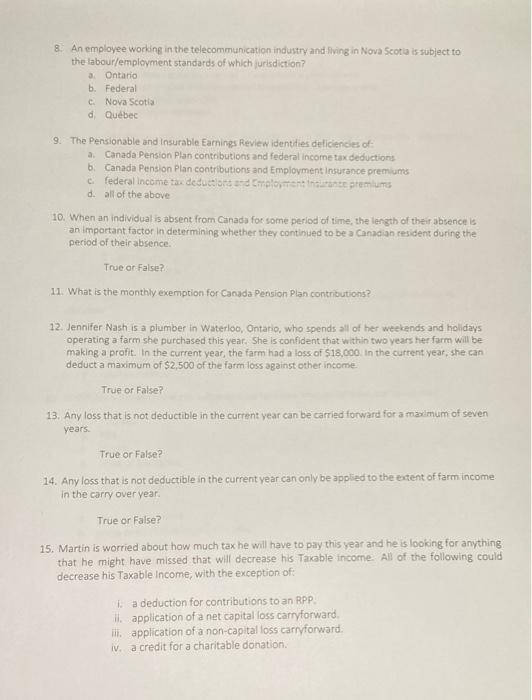

8. An employee working in the telecommunication industry and living in Nova Scotia is subject to the labour/employment standards of which jurisdiction? Ontario b. Federal Nova Scotia d. Qubec 9. The Pensionable and insurable Earnings Review identities deficiencies of a Canada Pension Plan contributions and federal income tax deductions b. Canada Pension Plan contributions and Employment insurance premium c federal income tax deductions and meloenenance premiums d. all of the above 10. When an individual is absent from Canada for some period of time, the length of their absence is an important factor in determining whether they continued to be a Canadian resident during the period of their absence True or False? 11. What is the monthly exemption for Canada Pension Plan contributions? 12. Jennifer Nash is a plumber in Waterloo, Ontario, who spends all of her weekends and holidays operating a farm she purchased this year. She is confident that within two years hier farm will be making a profit. In the current year, the farm had a loss of $18,000. In the current year, she can deduct a maximum of $2,500 of the farm loss against other income True or False? 13. Any loss that is not deductible in the current year can be carried forward for a madmum of seven years True or False? 14. Any loss that is not deductible in the current year can only be applied to the extent of farm income in the carry over year True or False? 15. Martin is worried about how much tax he will have to pay this year and he is looking for anything that he might have missed that will decrease his Taxable income. All of the following could decrease his Taxable income, with the exception of: Ta deduction for contributions to an RPP il application of a net capital loss carryforward. ill. application of a non-capital loss carryforward. iva credit for a charitable donation 3. Joelle works in BC and her bi-weekly earnings are $1,700.00 and she has a Registered Pension Plan contribution of 5% of her gross earnings. She also has a union dues deduction of $20.00 per pay period. Joelle will not reach the BC Pension Plan, Employment Insurance or Parental Insurance Plan annual maximums this pay period. A. Calculate the employee's BC Pension Plan Contribution B. Calculate the employer's portion of BC Pension Plan contribution C. Calculate the Employment Insurance premium for the employee. D. Calculate the employer's portion of Employment Insurance premiums. E. Determine the BC provincial income tax deduction