Question: Please Help!! A. Abstract of the case to include overview of the problem or issue.. B. Contribution of case to strategic management C. Recommendations for

Please Help!!

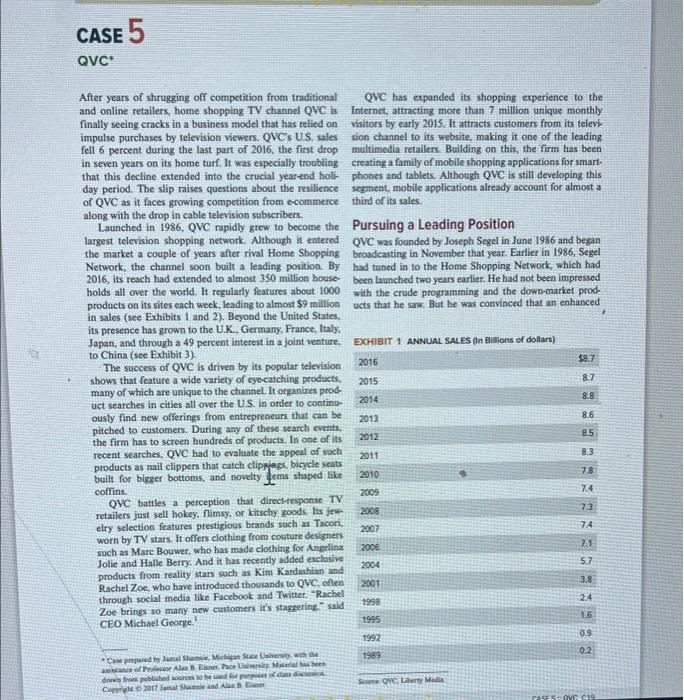

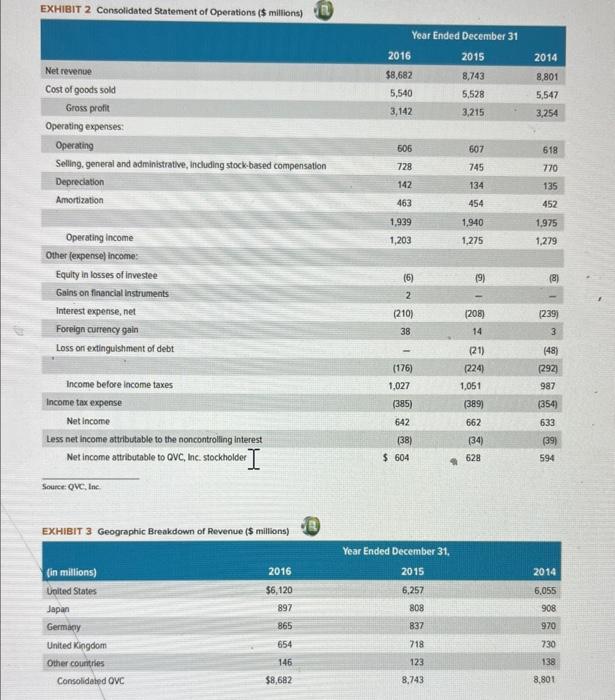

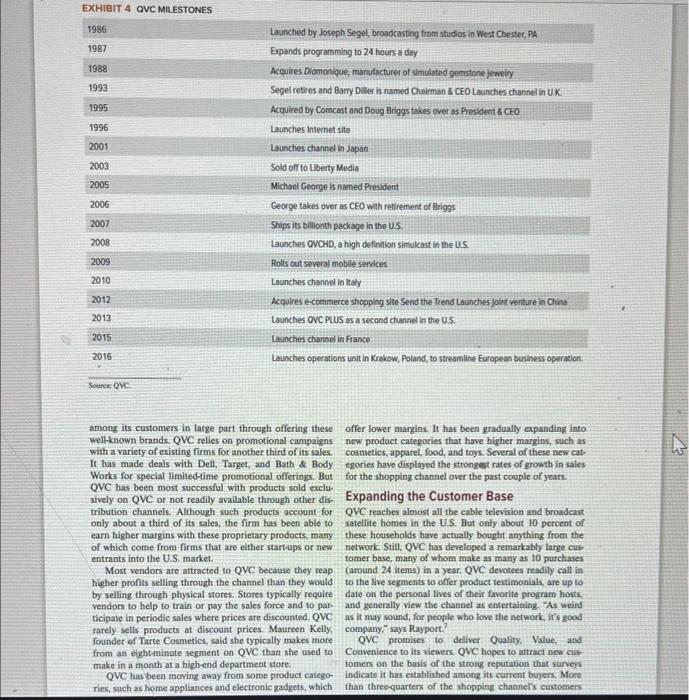

A. Abstract of the case to include overview of the problem or issue.. B. Contribution of case to strategic management C. Recommendations for solving the problem or issue. Further Instructions: - One page three paragraphis for each critique is the requirement including any references. - Each paper should be in 12 font New Times Roman single spaced. After years of shrugging off competition from traditional QVC has expanded its shopping experience to the and online retailers, home shopping TV channel QVC is Internet, attracting mote than 7 million unique monthly finally secing cracks in a business model that has relied on visitors by early 2015 . It attracts customers from its televi: impulse purchases by television viewers. QVC's U.S. sales sion channel to its website, making it one of the leading fell 6 percent during the last part of 2016 , the first drop multimedia retailers. Building on this, the firm has been in seven years on its home turf. It was especially troubling creating a family of mobile shopping applications for smartthat this decline extended into the crucial yearend holi- phones and tablets. Although QVC is still developing this day period. The slip raises questions about the resilience segment, mobile applications already account for almost a of QVC as it faces growing competition from commerce thind of its sales. along with the drop in cable television subscribers. Launched in 1986, QVC rapidly grew to become the Pursuing a Leading Position largest television shopping network. Although it entered QVC was founded by Joseph Segel in June 1986 and began the market a couple of years after rival Home Shopping broadcasting in November that year. Earlier in 1986, Segel Network, the channel soon built a leading position. By had tuned in to the Home Shopping Network, which had 2016, its reach had extended to almost 350 million house- been launched two years earlier. He had not been impressed hoids all over the world. It regularly features about 1000 with the crude programming and the down-market prodproducts on its sites each week, leading to almost $9 million ucts that he saw. But he was convinced that an enhanced its presence has grown to the U.K., Germany, France, Italy. Japan, and through a 49 percent interest in a joint venture. ExHIRIT 1 ANNUAL SALES An Bisions of dollars). to China (see Exhibit 3). The success of QVC is driven by its popular television shows that feature a wide varicty of eyecatching products, many of which are unique to the channel. It organizes product searches in cities all over the U.S. in order to continuously find new offerings from entrepreneurs that can be pitched to customers. During any of these search events, the firm has to screen hundreds of produets. In one of its recent searches, QVC had to evaluate the appeal of soch products as nail clippers that catch clippiags, bicycie seats coffins. QVC battles a perception that direct-response TV retailers just sell hokey, flimsy, or kitschy goods. Its jewelry selection features prestigious brands such as Tacori, worn by TV stars, it offers clothing from couture designers such as Marc Bouwer, who has made clothing for Angelina Jolie and Halle Betry. And it has recently added evelusive products from reality stars such as Kim Kardashian and Rachel Zoe, who have introduced thousands to QvC, onten Zoe brines so many new customers it's staggering" said CEO Michael George. Sonte QNC LIery Moan EXHIBIT 2 Consolidated Statement of Ooerations is milihinti EXHIBIT 3 Geographic Breakdown of Revenue (\$ millions) TV shopping network would have the potential to attract them to succeed, celebrities are given training on bow to best a large client base and produce significant profits. He enrin pitch their offerings On some oceasions, customers are able sioned superior resources he could bring to his network, to call in and have onair converations with program hosts while the operating expenses for a shopping network could : and visiting celebrities Celebrities are schooled in QVC"s still be kept relatively low. "backyaudfence" style, which means conversing with viewers Over the next few months, Segel raised $30 million in the way they would chat with a friendly neighbor. Theyrestart-up capital, hired several seasoned television execu- just so downbome, 50 it's like they're right in your living tives, and launched QVC. Operating out of headquarters in room demonatrating." said a long time QVC customer.? West Chester, Pennsylvania, QVC offered 24hour, seven- In spite of the folksy presentation, the sales are minutely day television home shopping to viewers. By the end of its managed. Behind the scenes, a producer scans nine televifirst year of operation, QVC reached 13 million homes by sion and computer screens to track sales of featured items. satellite and cable systems: 700,000 viewers had become. "We track new orders per minute in increments of six seccustomers, resulting in shipping 3 million orders. Sales had onds we can look backward in time and see what it was already topped $100 million and the firm was able to show that drove that spilic, said Doug Rose, who oversees proa small profit. potential offered by television shopping. "Television's com- sales. A beauty designer was asked to rub an eyeliner onto bination of sight, sound and motion is the best way to sell her hand, which immediately led to a surge of new onders. a product. It is more effective than presenting a product in QVC transmits its prognmming five from its central print or just putting the product on a store shelf," he stated. production facilities in Pennsylvania through uplinks to. "The costefficiency comes from the cable distribution a satellite. The representatives who staff Qver four call advertising, or traditional retail store distributionail, print centers. which handle iso million or more calls a year, advertising, or traditional retail store distribution.-2 are well trained to take orders. More than 90 percent of ties. proprietary technology. and trademark rights of the tribution centers. The distribution centers have a combined Diamonique Corporation, which produced a wide range floor space equivalent to the size of over loo football fields. of simulated gemstones and jewelry that could be sold on An effort is made to see that every item works as it should QVC shows. Over the next couple of years, Segel expanded before it is shipped and that its packaging will protect it QVC by acquiring competiors such as the Cable Value daring the shipping process. "Nothing ships unless it is By 1993. QVC had overtaken Home Shopping Network for QVC. "Since our prodoct is going busineesto-consumer, to become the leading TV shopping channel in sales and there's no way to fix or change a productrelated problem. profits. Its reach extended to over 80 percent of all cable All aew products must pass through stringent tests that homes and to 3 milison satellite dishes. Segel retired the are carried out by QVES inhouse Quality Assurance Lab. Since then, QVC's sales have continued to grow substan- quality inspection on first try and as many as a third are tially, widening the zap between it and Home Shopping never offered to the poblic because they fail athogether. Network, its closest competitor. StrivingforRetailingExcellenceMorethan100experienced,informedbuyerscombtheSearchingforProfitableProducts QVC has established itself as the world's preeminent virtual world on a regular basis to search for new products to shopping mall that never closes Its customen around the launch on QVC. The shopping channel concentrates on world can, and do. shop at any hour at the rate of more unique products that can be demonstrated on live televh than five customets per second. It selis a wide variety of sion. Jeffres. Rayport, author of a book on customer set. stration by live program hosts. QVC is extremely selective encoph-or interesting enough-that the host can talk about in choosing its hosts, screening as many as 3,000 applicants it on air. - Furthermoce, the price of these peoducts must annually in order to pick three. New hosts are trained for at be high enough for viewen to justify the additiotal shipleast six months before they are allowed on air. Regularly ping and hending charge. Over the course of a typical year. scheduled shows are each focused on a particular type of QVC earries mote than 60.000 products As many as 1,000 product and a welldefined market. Shows typically lasts items are typically offeted in any given week, of which about for one hour and are based on a theme such as Now Youke 20 perceat ate new prococes foe the nectwork oves sup Conking or Cleaning Solutions. OVC frequently entices celebrities such as clothing small entreperneurial eaterprises. Qve frequently entices celebrities such as ciocting smalif eatrepseneurial caterprises deegments to sell their own products. In order to prepare (able aational beands. The firm has been able to bulld trust among its customers in large patt through offering these offer lower margins. It has been gradually expanding into well-known brands. QVC relies on promotional campaigns new product categaries that have higher margins, such as with a variety of existing firms for another third of its sales. cosmetics, apparel, food, and toys. Several of these new catIt has made deals with. Dell. Target, and Bath \& Body egories have displayed the strongent rates of growth in sales Works for special limited-time promotional offerings. But for the shopping channel over the past couple of years: QVC has been most successful with groducts sold exclusively on QVC or not readily available through other dis- Expanding the Customer Base tribution channels. Although such products account for QVC reaches almost all the cable television and broadcast only about a third of its sales, the firm has been able to satetlite homes in the U.S. But only about 10 percent of earn higher margins with these proprietary prodocts, many these households have actually bought anything from the of which come from firms that are either start-ups or new network. Still. QVC has developed a remarkably large cas entrants into the U.S. market. tomer base, many of whom make as many as to purchases Most vendors are attracted to QVC because they reap (around 24 items) in a year. QVC devotees readily call in higher profits selling through the channel than they would to the live segments to offer product testimonials, are up to by selling through physical stores. Stores typically require date on the personal tives of their fivorite program hosts: vendors to help to train or pay the sales force and to par- and generally view the channel as entertaining. "As wein ticipate in periodie sales where prices are discounted. QVC as it may sound, for people who love the network, it's good rarely sells products at discount prices. Maureen Kelly, company," says Rayport.? founder of Tarte Cosmetics, said she typically makes more QVC promises to delivet Quality. Value, and from an eightminute segment on QVC than she used to Convenience to its viewers. QVC hopes to attract new cus \begin{tabular}{ll} make in a month at a high-end department store. & tomers on the basis of the strong reputation that survers \\ \hline QVC has been moving away from some product catego- & indicate it has entablished among its current buyers. More \end{tabular} QVC has been moving away from some product catego- indicate it has established among its current buyers. Mort ries, such as home appliances and electronic gadgets, which than threc-quarters of the shopping channer's customers have given it a score of 7 out of 7 for trustworthiness. Once revenue. CEO Michael George recently stated that 60 perviewers start buying from QVC, they tend to be loyal to the cent of QVC's new customers in the United States buy firm. This has led most of its customers to recommend it to on the Internet or on mobile devices. "The online busi-: their friends. ness is becoming such a crucial part of the business for QVC has benefited from the growing percentage of QVC," remarked Douglas Anmuth, an analyst at Barclay's women entering the workforce, resulting in a significant Capital Furthermore. QVC.com is now more profitable increase in dualincome families. Although the firm's cur- than QVC's television operation. It needs fewer call-center rent customer base spans several socioeconomic groups, it workers, and while QVC must share profits with cable corris led by young professional families who have above aver- panies on TV orders, it does not have to pay them on online age disposable income, and enjoy various forms of "thrill- orders for products which have not been featured on the air seeking" activities, including ranking shopping relatively for 24 hours. high as a leisure activity when compared to the typical The falloff in cable television subseribers may affect consumer. QVC. QVC is not immune from shifts in technology usage The firm is exploring an interactive service which and people's entertainment choices and information gathwould allow viewers to purchase offerings with the single ering habits. But for many of QVC's loyal consumers, elick of a remote. QVC also provides a credit program to nothing will ever replace shopping via television. Michael allow customers to pay for goods over a period of several George insists that QVC shoppers are less likely to drop months. Everything it sells is backed by a 30-day uncondi- cable services because they tend to be slightly older and tional money-back guarantee. Furthermore, QVC does not more affluent. These customers tune in at different times impose any hidden charges, such as a "restocking fee," for of the diry or night and are drawn to the offerings. "We're, any returned merchandise. These policies help the home going to try and find 120 to 140 items every day where we they can view but are not able to either touch or feel. In 2012. QVC built on its existing customer base by The website does not offer the hybrid of talk show and acquiring Send the Trend, Inc, an ecommerce destina. sales pitch that attracts audiences to the QVC shopping tion known for trendy fashion and beauty products. It uses television channel. Online shoppers also miss out on the proprietary technology to deliver monthly personalized interaction between hosts and shoppers and the continuous recommendations that can casily be shared by customers urgent feedback about the time that they may have to place: over their social networks for an assortment of prestigious an order before an ifem is sold out. "You know, on Sundays brands in jewelry, beiauty and fashion accessories. "The I might find a program on Lifetime Movie Network, but teams at QVC and Send the Trend share a passion for whatever T'm watching, if it's not QVC, when the commes bringing the customer what she wants, in the way she wants cial comes on I'll flip it back to QVC." said one loyal QVC it." said Claire Watts, the U.S.-based CEO of QVC. fan. - I'm just stuck on themp."11 Positioning for Future Growth ENDNOTES A. Abstract of the case to include overview of the problem or issue.. B. Contribution of case to strategic management C. Recommendations for solving the problem or issue. Further Instructions: - One page three paragraphis for each critique is the requirement including any references. - Each paper should be in 12 font New Times Roman single spaced. After years of shrugging off competition from traditional QVC has expanded its shopping experience to the and online retailers, home shopping TV channel QVC is Internet, attracting mote than 7 million unique monthly finally secing cracks in a business model that has relied on visitors by early 2015 . It attracts customers from its televi: impulse purchases by television viewers. QVC's U.S. sales sion channel to its website, making it one of the leading fell 6 percent during the last part of 2016 , the first drop multimedia retailers. Building on this, the firm has been in seven years on its home turf. It was especially troubling creating a family of mobile shopping applications for smartthat this decline extended into the crucial yearend holi- phones and tablets. Although QVC is still developing this day period. The slip raises questions about the resilience segment, mobile applications already account for almost a of QVC as it faces growing competition from commerce thind of its sales. along with the drop in cable television subscribers. Launched in 1986, QVC rapidly grew to become the Pursuing a Leading Position largest television shopping network. Although it entered QVC was founded by Joseph Segel in June 1986 and began the market a couple of years after rival Home Shopping broadcasting in November that year. Earlier in 1986, Segel Network, the channel soon built a leading position. By had tuned in to the Home Shopping Network, which had 2016, its reach had extended to almost 350 million house- been launched two years earlier. He had not been impressed hoids all over the world. It regularly features about 1000 with the crude programming and the down-market prodproducts on its sites each week, leading to almost $9 million ucts that he saw. But he was convinced that an enhanced its presence has grown to the U.K., Germany, France, Italy. Japan, and through a 49 percent interest in a joint venture. ExHIRIT 1 ANNUAL SALES An Bisions of dollars). to China (see Exhibit 3). The success of QVC is driven by its popular television shows that feature a wide varicty of eyecatching products, many of which are unique to the channel. It organizes product searches in cities all over the U.S. in order to continuously find new offerings from entrepreneurs that can be pitched to customers. During any of these search events, the firm has to screen hundreds of produets. In one of its recent searches, QVC had to evaluate the appeal of soch products as nail clippers that catch clippiags, bicycie seats coffins. QVC battles a perception that direct-response TV retailers just sell hokey, flimsy, or kitschy goods. Its jewelry selection features prestigious brands such as Tacori, worn by TV stars, it offers clothing from couture designers such as Marc Bouwer, who has made clothing for Angelina Jolie and Halle Betry. And it has recently added evelusive products from reality stars such as Kim Kardashian and Rachel Zoe, who have introduced thousands to QvC, onten Zoe brines so many new customers it's staggering" said CEO Michael George. Sonte QNC LIery Moan EXHIBIT 2 Consolidated Statement of Ooerations is milihinti EXHIBIT 3 Geographic Breakdown of Revenue (\$ millions) TV shopping network would have the potential to attract them to succeed, celebrities are given training on bow to best a large client base and produce significant profits. He enrin pitch their offerings On some oceasions, customers are able sioned superior resources he could bring to his network, to call in and have onair converations with program hosts while the operating expenses for a shopping network could : and visiting celebrities Celebrities are schooled in QVC"s still be kept relatively low. "backyaudfence" style, which means conversing with viewers Over the next few months, Segel raised $30 million in the way they would chat with a friendly neighbor. Theyrestart-up capital, hired several seasoned television execu- just so downbome, 50 it's like they're right in your living tives, and launched QVC. Operating out of headquarters in room demonatrating." said a long time QVC customer.? West Chester, Pennsylvania, QVC offered 24hour, seven- In spite of the folksy presentation, the sales are minutely day television home shopping to viewers. By the end of its managed. Behind the scenes, a producer scans nine televifirst year of operation, QVC reached 13 million homes by sion and computer screens to track sales of featured items. satellite and cable systems: 700,000 viewers had become. "We track new orders per minute in increments of six seccustomers, resulting in shipping 3 million orders. Sales had onds we can look backward in time and see what it was already topped $100 million and the firm was able to show that drove that spilic, said Doug Rose, who oversees proa small profit. potential offered by television shopping. "Television's com- sales. A beauty designer was asked to rub an eyeliner onto bination of sight, sound and motion is the best way to sell her hand, which immediately led to a surge of new onders. a product. It is more effective than presenting a product in QVC transmits its prognmming five from its central print or just putting the product on a store shelf," he stated. production facilities in Pennsylvania through uplinks to. "The costefficiency comes from the cable distribution a satellite. The representatives who staff Qver four call advertising, or traditional retail store distributionail, print centers. which handle iso million or more calls a year, advertising, or traditional retail store distribution.-2 are well trained to take orders. More than 90 percent of ties. proprietary technology. and trademark rights of the tribution centers. The distribution centers have a combined Diamonique Corporation, which produced a wide range floor space equivalent to the size of over loo football fields. of simulated gemstones and jewelry that could be sold on An effort is made to see that every item works as it should QVC shows. Over the next couple of years, Segel expanded before it is shipped and that its packaging will protect it QVC by acquiring competiors such as the Cable Value daring the shipping process. "Nothing ships unless it is By 1993. QVC had overtaken Home Shopping Network for QVC. "Since our prodoct is going busineesto-consumer, to become the leading TV shopping channel in sales and there's no way to fix or change a productrelated problem. profits. Its reach extended to over 80 percent of all cable All aew products must pass through stringent tests that homes and to 3 milison satellite dishes. Segel retired the are carried out by QVES inhouse Quality Assurance Lab. Since then, QVC's sales have continued to grow substan- quality inspection on first try and as many as a third are tially, widening the zap between it and Home Shopping never offered to the poblic because they fail athogether. Network, its closest competitor. StrivingforRetailingExcellenceMorethan100experienced,informedbuyerscombtheSearchingforProfitableProducts QVC has established itself as the world's preeminent virtual world on a regular basis to search for new products to shopping mall that never closes Its customen around the launch on QVC. The shopping channel concentrates on world can, and do. shop at any hour at the rate of more unique products that can be demonstrated on live televh than five customets per second. It selis a wide variety of sion. Jeffres. Rayport, author of a book on customer set. stration by live program hosts. QVC is extremely selective encoph-or interesting enough-that the host can talk about in choosing its hosts, screening as many as 3,000 applicants it on air. - Furthermoce, the price of these peoducts must annually in order to pick three. New hosts are trained for at be high enough for viewen to justify the additiotal shipleast six months before they are allowed on air. Regularly ping and hending charge. Over the course of a typical year. scheduled shows are each focused on a particular type of QVC earries mote than 60.000 products As many as 1,000 product and a welldefined market. Shows typically lasts items are typically offeted in any given week, of which about for one hour and are based on a theme such as Now Youke 20 perceat ate new prococes foe the nectwork oves sup Conking or Cleaning Solutions. OVC frequently entices celebrities such as clothing small entreperneurial eaterprises. Qve frequently entices celebrities such as ciocting smalif eatrepseneurial caterprises deegments to sell their own products. In order to prepare (able aational beands. The firm has been able to bulld trust among its customers in large patt through offering these offer lower margins. It has been gradually expanding into well-known brands. QVC relies on promotional campaigns new product categaries that have higher margins, such as with a variety of existing firms for another third of its sales. cosmetics, apparel, food, and toys. Several of these new catIt has made deals with. Dell. Target, and Bath \& Body egories have displayed the strongent rates of growth in sales Works for special limited-time promotional offerings. But for the shopping channel over the past couple of years: QVC has been most successful with groducts sold exclusively on QVC or not readily available through other dis- Expanding the Customer Base tribution channels. Although such products account for QVC reaches almost all the cable television and broadcast only about a third of its sales, the firm has been able to satetlite homes in the U.S. But only about 10 percent of earn higher margins with these proprietary prodocts, many these households have actually bought anything from the of which come from firms that are either start-ups or new network. Still. QVC has developed a remarkably large cas entrants into the U.S. market. tomer base, many of whom make as many as to purchases Most vendors are attracted to QVC because they reap (around 24 items) in a year. QVC devotees readily call in higher profits selling through the channel than they would to the live segments to offer product testimonials, are up to by selling through physical stores. Stores typically require date on the personal tives of their fivorite program hosts: vendors to help to train or pay the sales force and to par- and generally view the channel as entertaining. "As wein ticipate in periodie sales where prices are discounted. QVC as it may sound, for people who love the network, it's good rarely sells products at discount prices. Maureen Kelly, company," says Rayport.? founder of Tarte Cosmetics, said she typically makes more QVC promises to delivet Quality. Value, and from an eightminute segment on QVC than she used to Convenience to its viewers. QVC hopes to attract new cus \begin{tabular}{ll} make in a month at a high-end department store. & tomers on the basis of the strong reputation that survers \\ \hline QVC has been moving away from some product catego- & indicate it has entablished among its current buyers. More \end{tabular} QVC has been moving away from some product catego- indicate it has established among its current buyers. Mort ries, such as home appliances and electronic gadgets, which than threc-quarters of the shopping channer's customers have given it a score of 7 out of 7 for trustworthiness. Once revenue. CEO Michael George recently stated that 60 perviewers start buying from QVC, they tend to be loyal to the cent of QVC's new customers in the United States buy firm. This has led most of its customers to recommend it to on the Internet or on mobile devices. "The online busi-: their friends. ness is becoming such a crucial part of the business for QVC has benefited from the growing percentage of QVC," remarked Douglas Anmuth, an analyst at Barclay's women entering the workforce, resulting in a significant Capital Furthermore. QVC.com is now more profitable increase in dualincome families. Although the firm's cur- than QVC's television operation. It needs fewer call-center rent customer base spans several socioeconomic groups, it workers, and while QVC must share profits with cable corris led by young professional families who have above aver- panies on TV orders, it does not have to pay them on online age disposable income, and enjoy various forms of "thrill- orders for products which have not been featured on the air seeking" activities, including ranking shopping relatively for 24 hours. high as a leisure activity when compared to the typical The falloff in cable television subseribers may affect consumer. QVC. QVC is not immune from shifts in technology usage The firm is exploring an interactive service which and people's entertainment choices and information gathwould allow viewers to purchase offerings with the single ering habits. But for many of QVC's loyal consumers, elick of a remote. QVC also provides a credit program to nothing will ever replace shopping via television. Michael allow customers to pay for goods over a period of several George insists that QVC shoppers are less likely to drop months. Everything it sells is backed by a 30-day uncondi- cable services because they tend to be slightly older and tional money-back guarantee. Furthermore, QVC does not more affluent. These customers tune in at different times impose any hidden charges, such as a "restocking fee," for of the diry or night and are drawn to the offerings. "We're, any returned merchandise. These policies help the home going to try and find 120 to 140 items every day where we they can view but are not able to either touch or feel. In 2012. QVC built on its existing customer base by The website does not offer the hybrid of talk show and acquiring Send the Trend, Inc, an ecommerce destina. sales pitch that attracts audiences to the QVC shopping tion known for trendy fashion and beauty products. It uses television channel. Online shoppers also miss out on the proprietary technology to deliver monthly personalized interaction between hosts and shoppers and the continuous recommendations that can casily be shared by customers urgent feedback about the time that they may have to place: over their social networks for an assortment of prestigious an order before an ifem is sold out. "You know, on Sundays brands in jewelry, beiauty and fashion accessories. "The I might find a program on Lifetime Movie Network, but teams at QVC and Send the Trend share a passion for whatever T'm watching, if it's not QVC, when the commes bringing the customer what she wants, in the way she wants cial comes on I'll flip it back to QVC." said one loyal QVC it." said Claire Watts, the U.S.-based CEO of QVC. fan. - I'm just stuck on themp."11 Positioning for Future Growth ENDNOTES