Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Alignment k! Number el Clipboard Font SECURITY WARNING Macros have been disabled. Enable Content A1 X fx Question 09 B D E F

please help

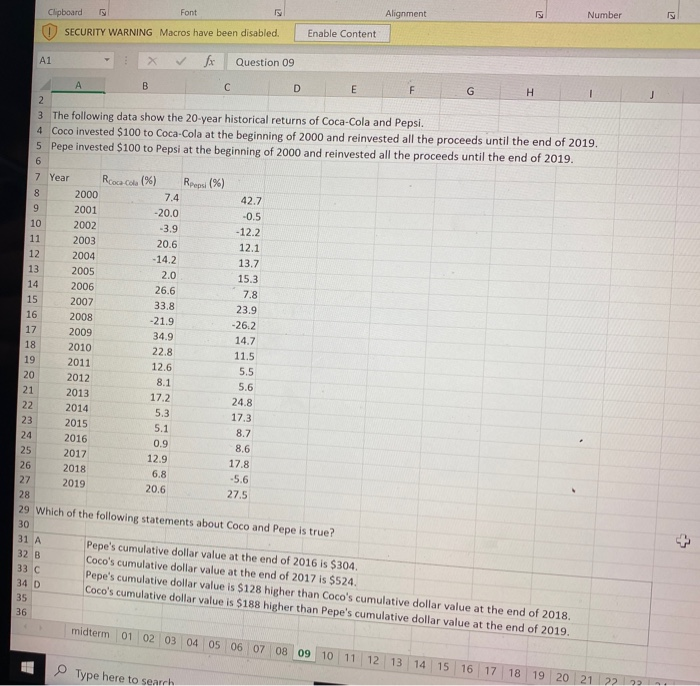

Alignment k! Number el Clipboard Font SECURITY WARNING Macros have been disabled. Enable Content A1 X fx Question 09 B D E F G H 2 3 The following data show the 20-year historical returns of Coca-Cola and Pepsi. 4 Coco invested $100 to Coca-Cola at the beginning of 2000 and reinvested all the proceeds until the end of 2019. 5 Pepe invested $100 to Pepsi at the beginning of 2000 and reinvested all the proceeds until the end of 2019. 6 7 Year Rcoca Co. (%) Repsi (%) 8 2000 7.4 42.7 9 2001 -20.0 -0.5 10 2002 -3.9 - 12.2 11 2003 20.6 12.1 12 2004 - 14.2 13.7 13 2005 2.0 15.3 14 2006 26.6 7.8 15 2007 23.9 16 2008 -21.9 -26.2 17 2009 34.9 14.7 18 2010 22.8 11.5 19 2011 12.6 5.5 20 8.1 5.6 21 2013 17.2 24.8 22 2014 5,3 17.3 23 2015 5.1 8.7 24 2016 0.9 8.6 25 2017 12.9 17.8 26 2018 6.8 -5.6 27 2019 20.6 27.5 28 33.8 2012 29 Which of the following statements about Coco and Pepe is true? 30 31 A Pepe's cumulative dollar value at the end of 2016 is $304 32 B Coco's cumulative dollar value at the end of 2017 is $524. 33 C Pepe's cumulative dollar value is $128 higher than Coco's cumulative dollar value at the end of 2018. 34 D Coco's cumulative dollar value is $188 higher than Pepe's cumulative dollar value at the end of 2019. 35 36 midterm 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Type here to search Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started