please help all :)

please help all :)

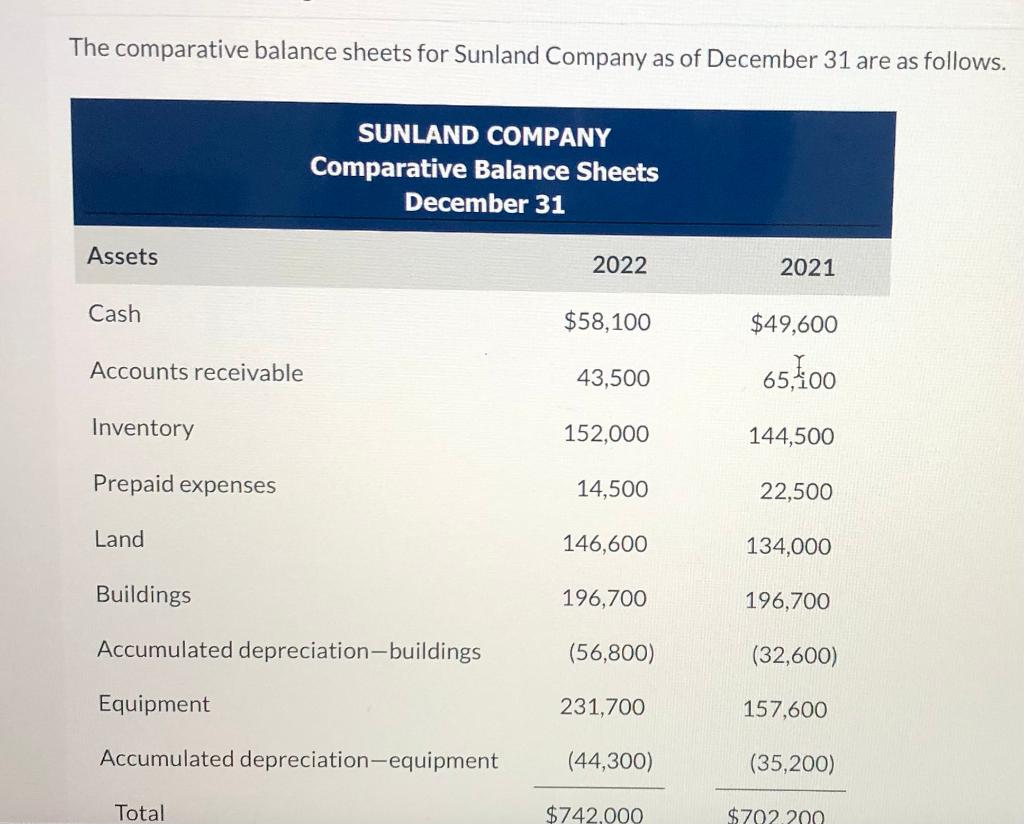

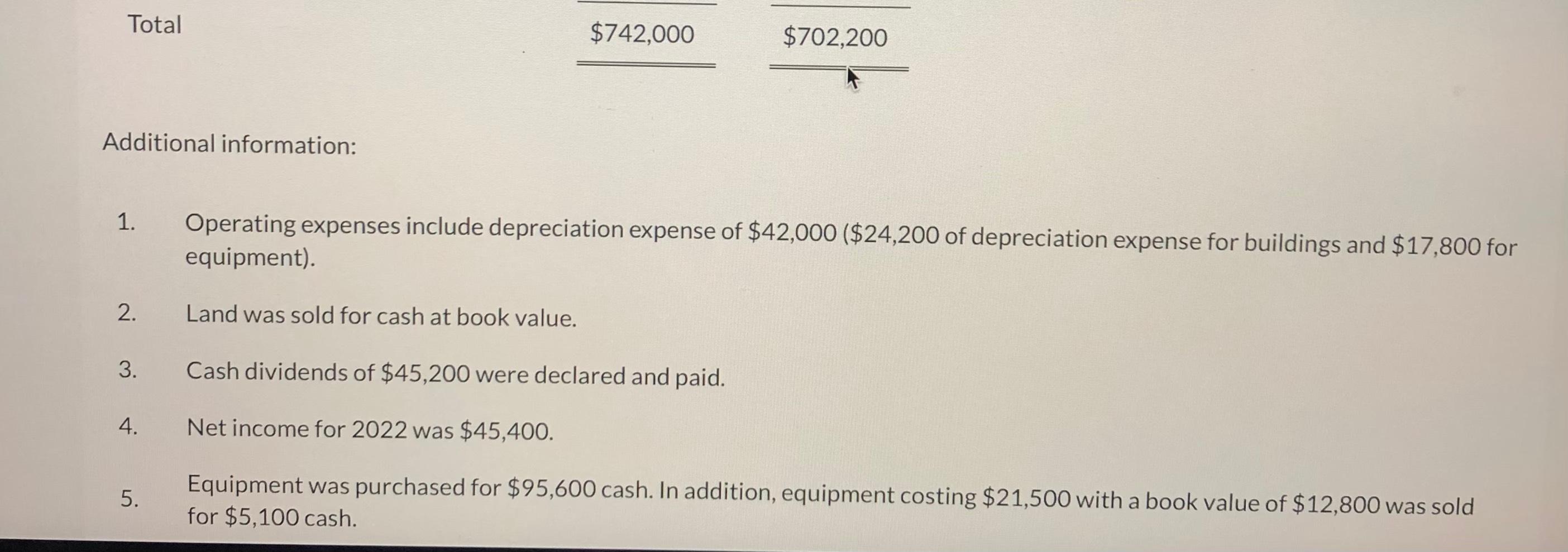

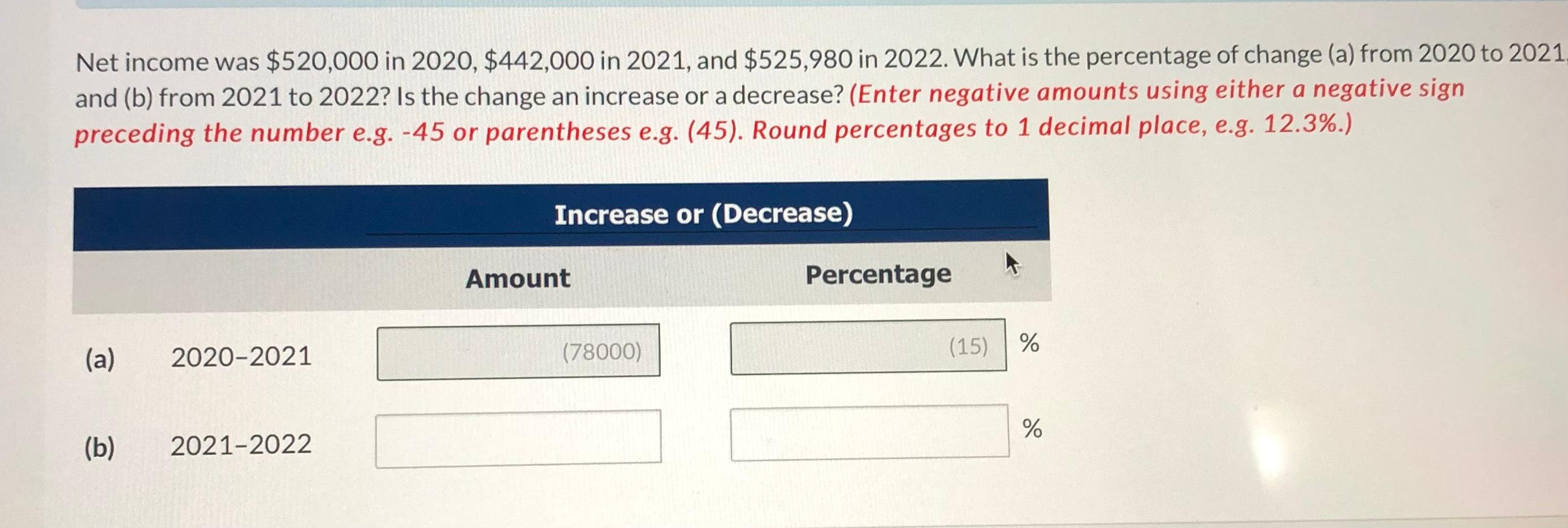

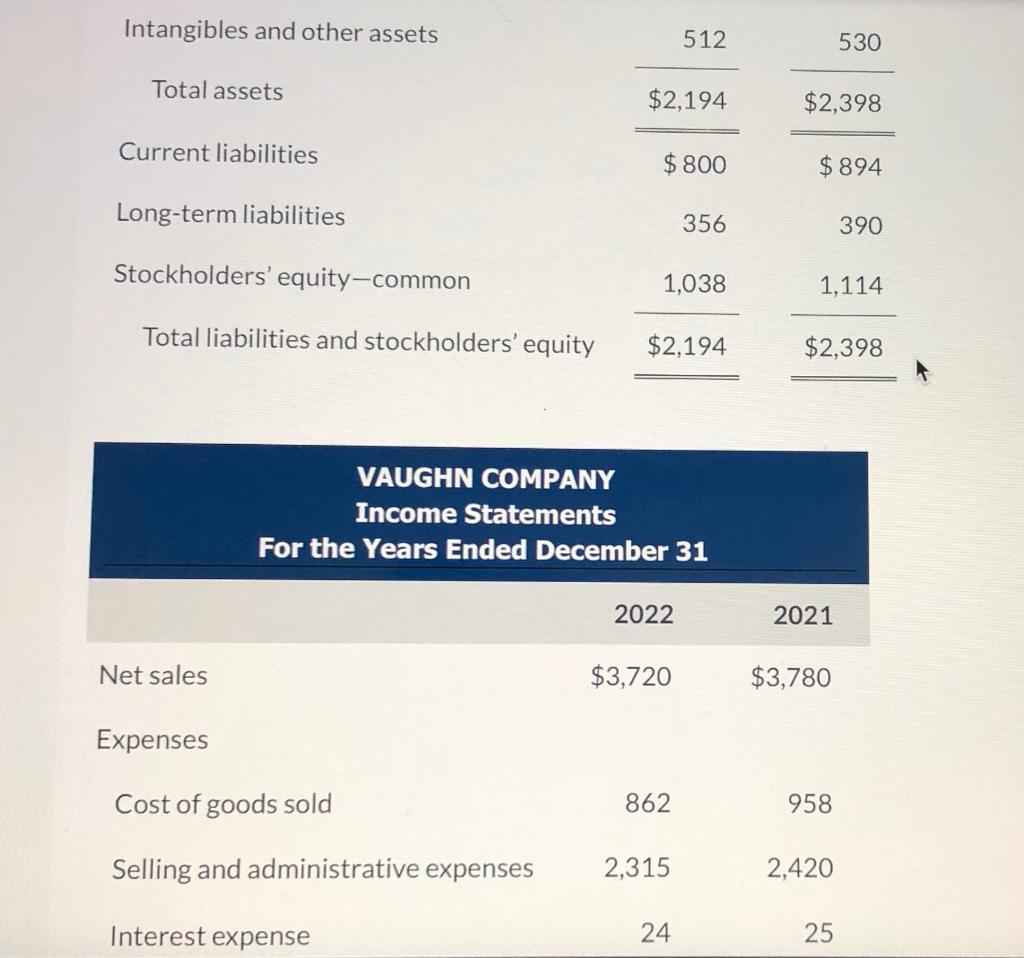

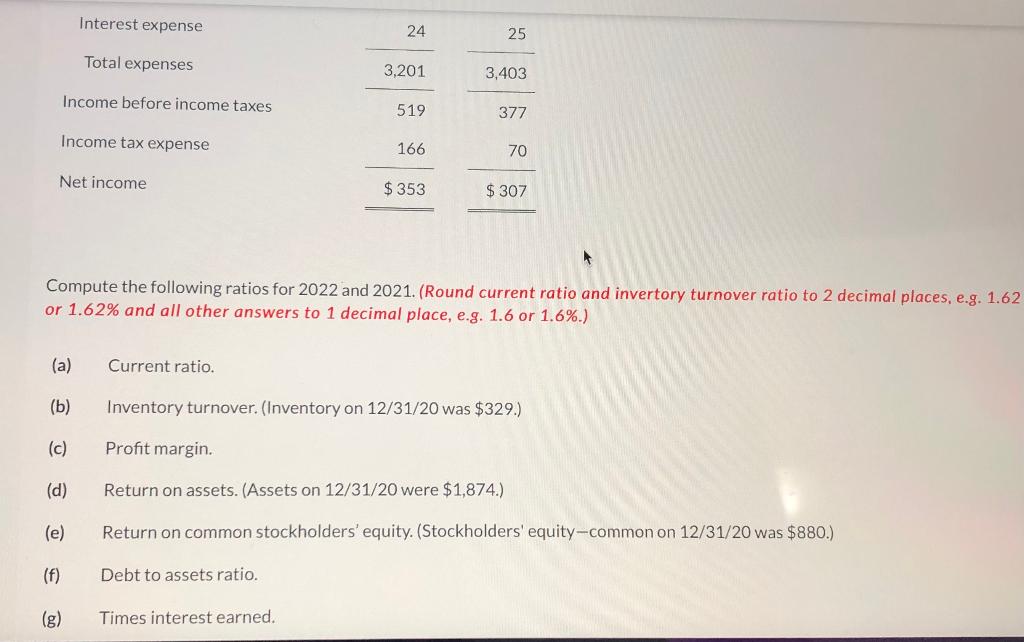

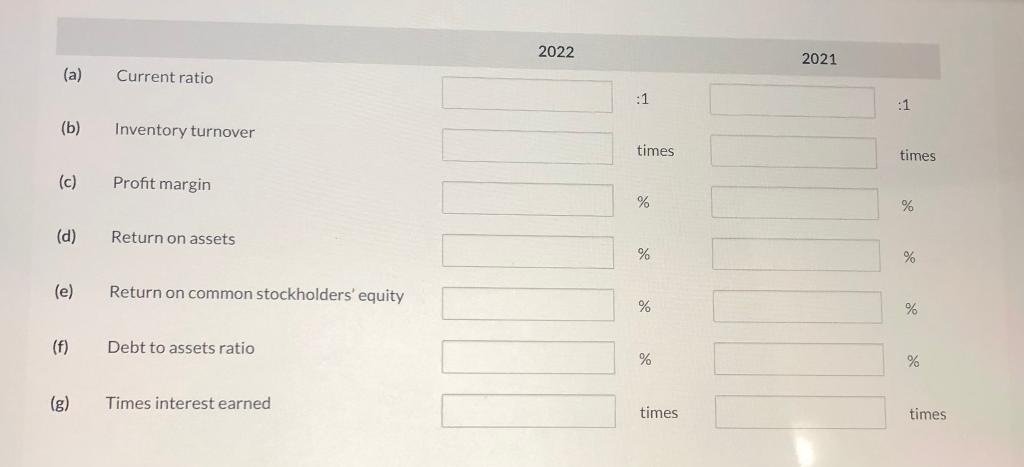

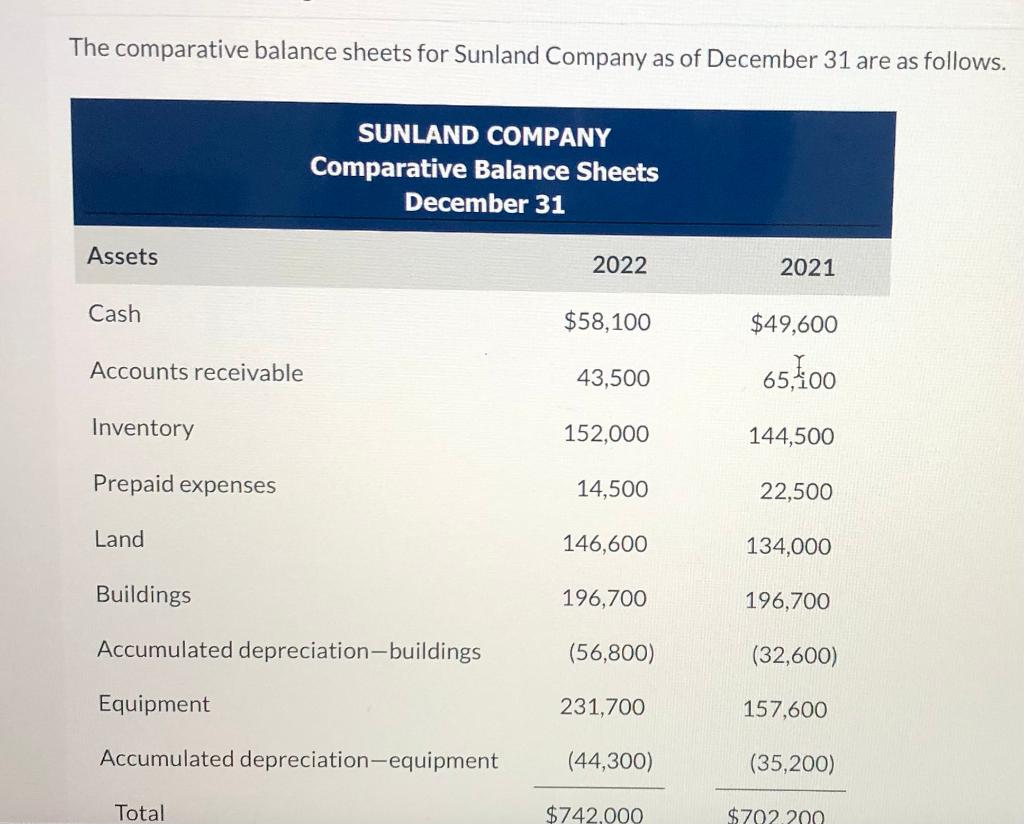

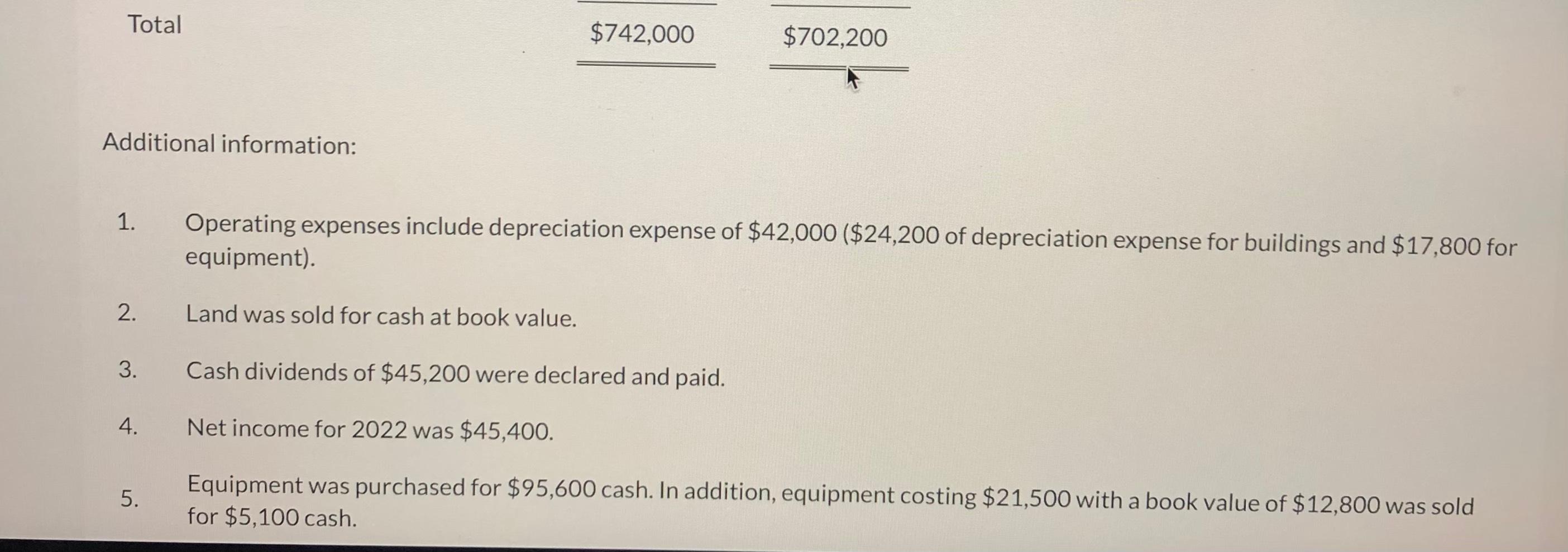

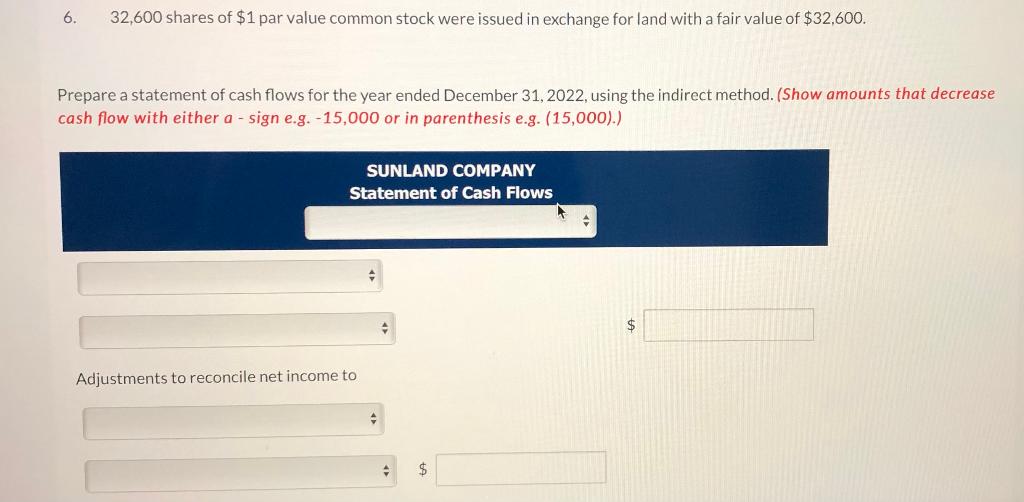

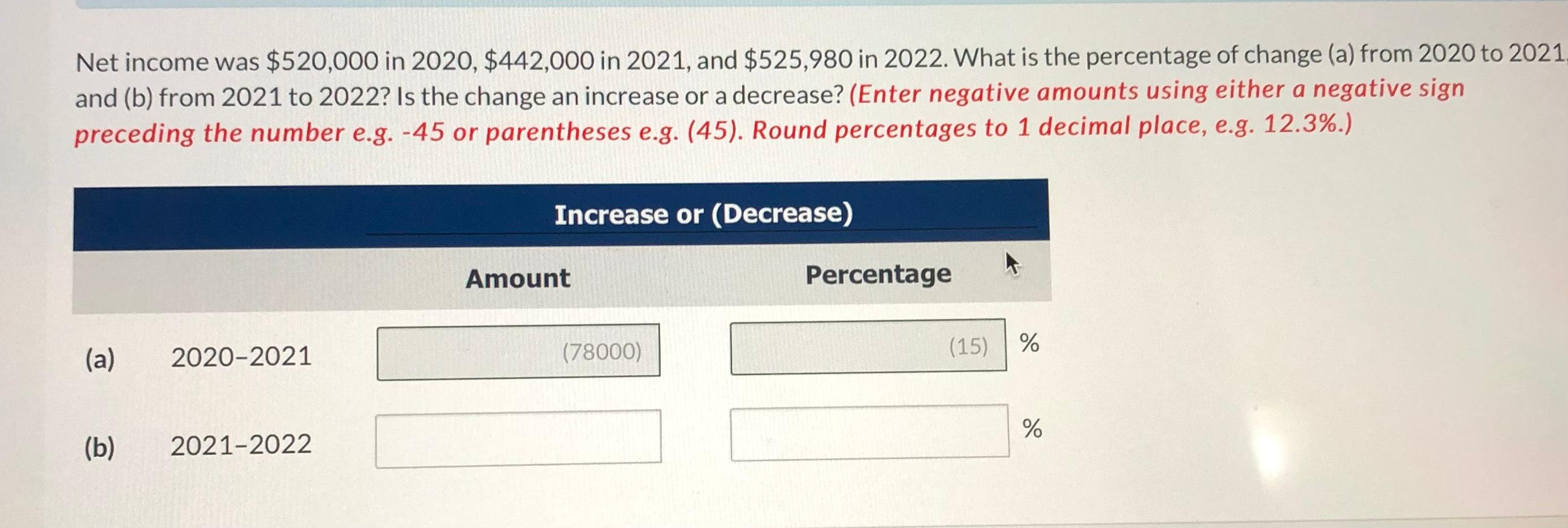

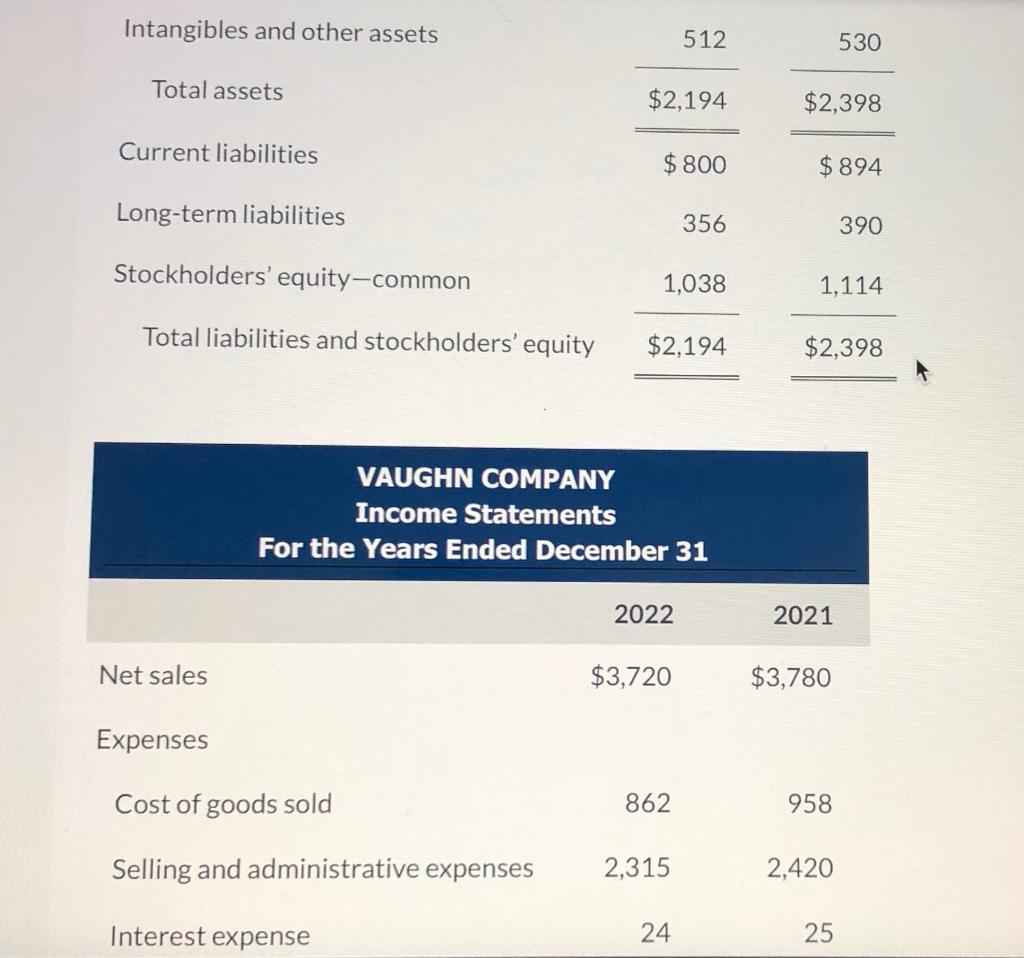

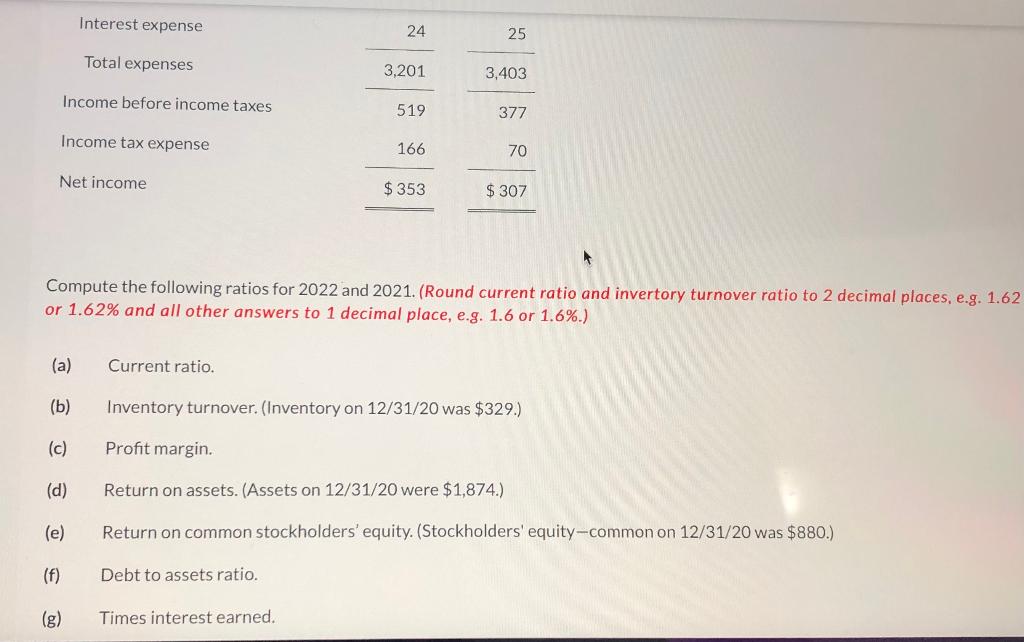

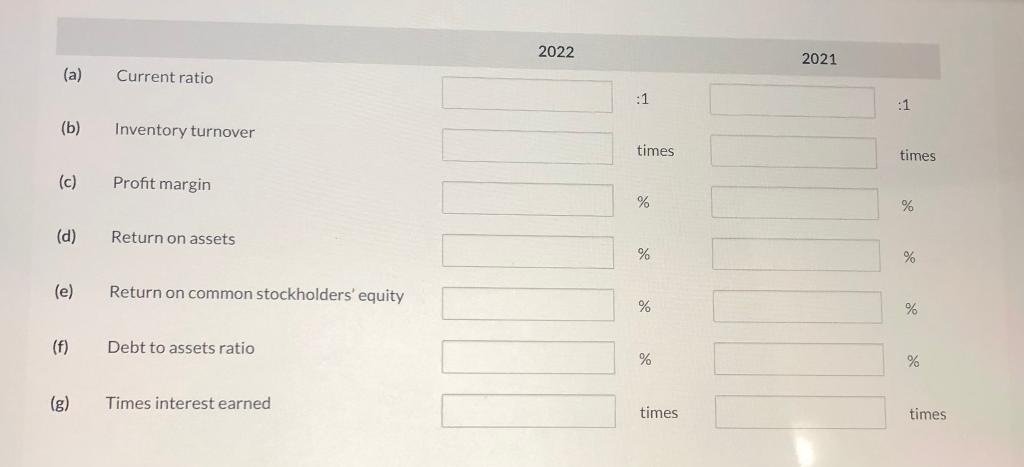

The comparative balance sheets for Sunland Company as of December 31 are as follows. Assets Cash Accounts receivable Inventory Prepaid expenses Land SUNLAND COMPANY Comparative Balance Sheets December 31 Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Total 2022 $58,100 43,500 152,000 14,500 146,600 196,700 (56,800) 231,700 (44,300) $742,000 2021 $49,600 65.100 144,500 22,500 134,000 196,700 (32,600) 157,600 (35,200) $702.200 Total Additional information: 1. 2. 3. 4. 5. $742,000 Land was sold for cash at book value. $702,200 Operating expenses include depreciation expense of $42,000 ($24,200 of depreciation expense for buildings and $17,800 for equipment). Cash dividends of $45,200 were declared and paid. Net income for 2022 was $45,400. Equipment was purchased for $95,600 cash. In addition, equipment costing $21,500 with a book value of $12,800 was sold for $5,100 cash. 6. 32,600 shares of $1 par value common stock were issued in exchange for land with a fair value of $32,600. Prepare a statement of cash flows for the year ended December 31, 2022, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) SUNLAND COMPANY Statement of Cash Flows Adjustments to reconcile net income to + $ + $ I + + + + # # # # + O $ Net income was $520,000 in 2020, $442,000 in 2021, and $525,980 in 2022. What is the percentage of change (a) from 2020 to 2021, and (b) from 2021 to 2022? Is the change an increase or a decrease? (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round percentages to 1 decimal place, e.g. 12.3%.) (a) 2020-2021 (b) 2021-2022 Increase or (Decrease) Amount (78000) Percentage (15) % % The condensed financial statements of Vaughn Company for the years 2021 and 2022 are presented as follows. (Amounts in thousands.) Current assets Cash and cash equivalents Accounts receivable (net) Inventory Prepaid expenses Total current assets VAUGHN COMPANY Balance Sheets December 31 Investments Property, plant, and equipment (net) Intangibles and other assets 2022 $342 378 384 168 1,272 10 400 512 2021 * $365 484 466 150 1,465 13 390 530 Intangibles and other assets Total assets Current liabilities Net sales Long-term liabilities Stockholders' equity-common Total liabilities and stockholders' equity $2,194 Expenses Cost of goods sold Selling and administrative expenses $2,194 Interest expense $800 VAUGHN COMPANY Income Statements For the Years Ended December 31 512 1,038 2022 $3,720 862 2,315 356 24 $2,398 $894 390 1,114 $2,398 2021 530 $3,780 958 2,420 25 Interest expense Total expenses Income before income taxes Income tax expense Net income (a) (b) (c) (d) (e) (f) (g) Current ratio. 24 Debt to assets ratio. 3,201 Times interest earned. 519 166 $353 25 3,403 Compute the following ratios for 2022 and 2021. (Round current ratio and invertory turnover ratio to 2 decimal places, e.g. 1.62 or 1.62% and all other answers to 1 decimal place, e.g. 1.6 or 1.6%.) 377 70 $307 Inventory turnover. (Inventory on 12/31/20 was $329.) Profit margin. Return on assets. (Assets on 12/31/20 were $1,874.) Return on common stockholders' equity. (Stockholders' equity-common on 12/31/20 was $880.) (a) (b) (c) (d) (e) (f) (g) Current ratio Inventory turnover Profit margin Return on assets Return on common stockholders' equity Debt to assets ratio Times interest earned 2022 :1 times % % % % times 2021 times % % % % times

please help all :)

please help all :)