Answered step by step

Verified Expert Solution

Question

1 Approved Answer

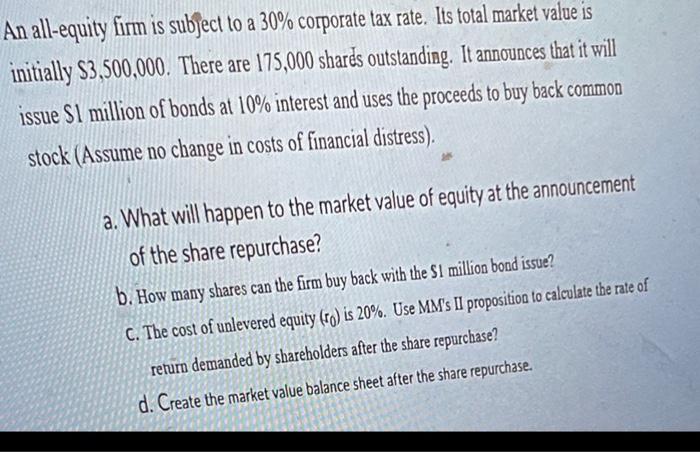

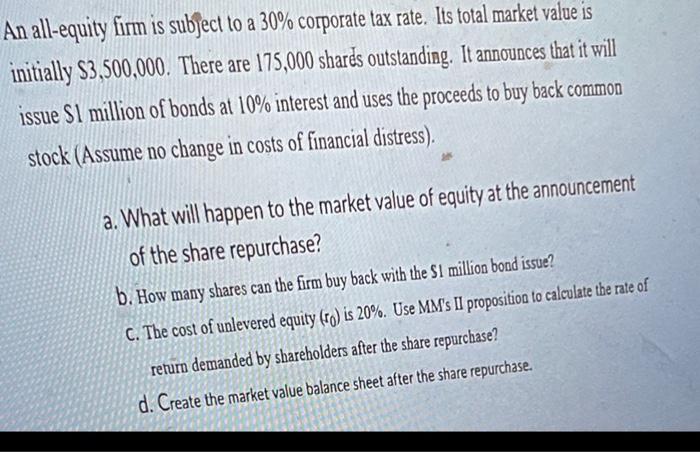

please help!!! An all-equity firm is subject to a 30% corporate tax rate. Its total market value is initially $3,500,000. There are 175,000 shares outstanding.

please help!!!

An all-equity firm is subject to a 30% corporate tax rate. Its total market value is initially $3,500,000. There are 175,000 shares outstanding. It announces that it will issue SI million of bonds at 10% interest and uses the proceeds to buy back common stock (Assume no change in costs of financial distress). a. What will happen to the market value of equity at the announcement of the share repurchase? b. How many shares can the firm buy back with the SI million bond issue? c. The cost of unlevered equity (ro0) is 20%. Use MMs II proposition to calcelate the ntee of return demanded by shareholders after the share repurchase? d. Create the market value balance sheet atter the share repurch hse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started