please help

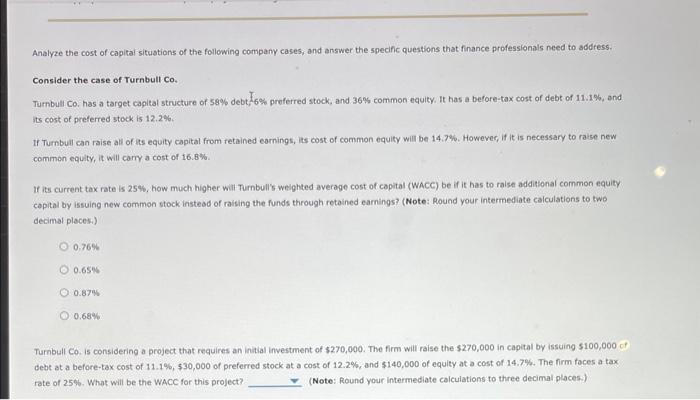

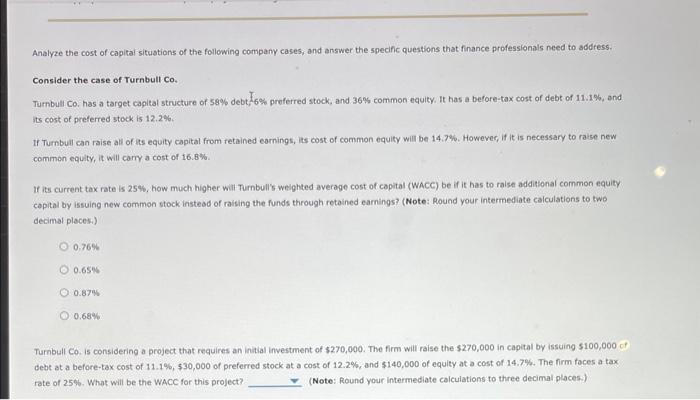

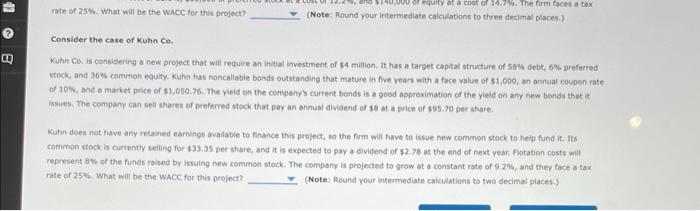

Analyze the cost of capital situstions of the following company cases; and answer the specific questions that finance professionals need to address. Consider the case of Turnbull Co. Tumbull co, has a target capital structure of 59% debt, I6% preferred stock, and 36% common equity, It has a before-tax cost of debt of 11.1%, and ts cost of preferred stock is 12.2%. If Tumbuil can raise all of its equity capital from retained eamings, its cost of common equity will be 14.7%. However, if it is necessary to raise new common equity, it will carry a cost of 16.8%. If its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WAcc) be if it has to ralse additional common equity. copital by issuing new common stock instead of raising the funds through retained earnings? (Note: Round your intermediate calculations to two decimal pleces.) 0,76% 0.65% 0.87% 0.68% Tumbull Co. is considering a project that requires an initial investment of $270,000. The firm will raise the $270,000 in capital by isscing 5100,000 cf debt at a before-tax cost of 11.1%,530,000 of preferred stock at a cost of 12.2%, and $140,000 of equity at a cost of 14.7%. The firm faces a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to three decimal places.) rate of 2556 . What will be the WAMC for this project? (Note: Round your intermediate calculations to three decimal places.) Consider the case of Kuhn Co. Kuhn Co. is considering a new project that will require an intial investment of $4 mililon. It has a target capizal structure of 5 s.w debt, thepreferred stock, and 36% common equity. Kuhn has noncallable bonds outstanding that mature in five vears with a face value of 51,000 , an annual coupon rate of 10%, and o market price of $1,050.76. The yield on the companyy current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell thares of preferred tock that pay an ennual dividend of 18 at a price of s05.70 per share. Kuhn does not have any retained eamings available to finance this project, so the firm will have to iscue new common stock to neip fund if. Its common stock is curtently selling. for $33.35 per share, and it is evpected to pay a dividend of $2.78 at the end of next year. Fotation costs will represent b\% of the funos reised by issuing new common stock. The company is projected to grow at a constant rate of 9.2%, and they face a tax rate of 25%. What will be the WACC for this project? (Note: Rhound your intermediate calculations to two decimal places.)