please help, and explain. thank you!

please help and explain, also compute the cost to produce one audio system (round two decimal places)

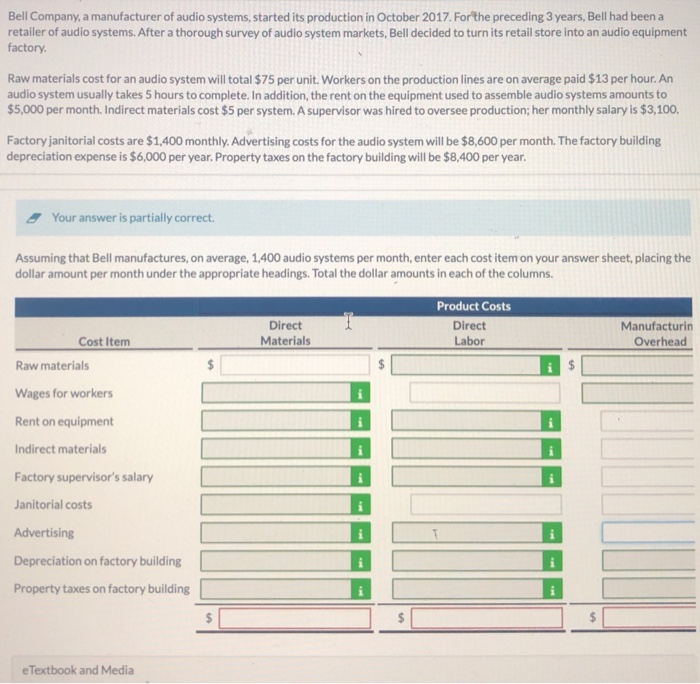

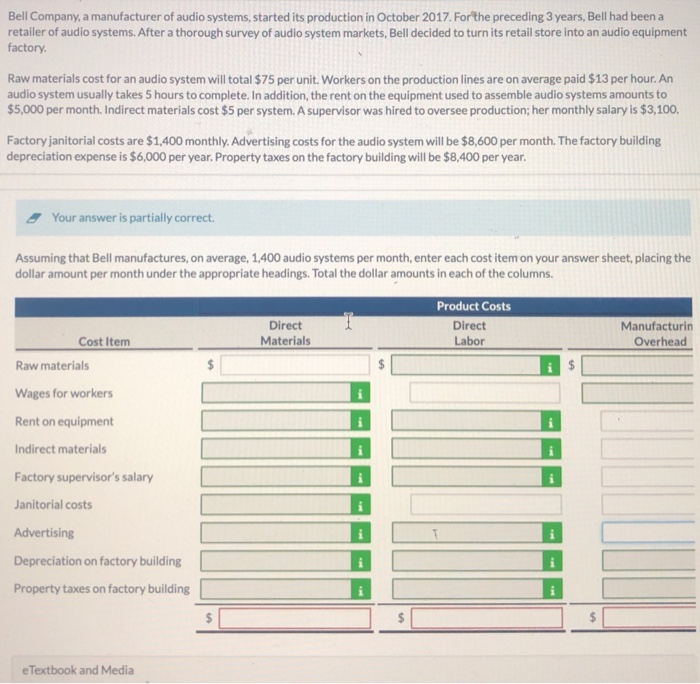

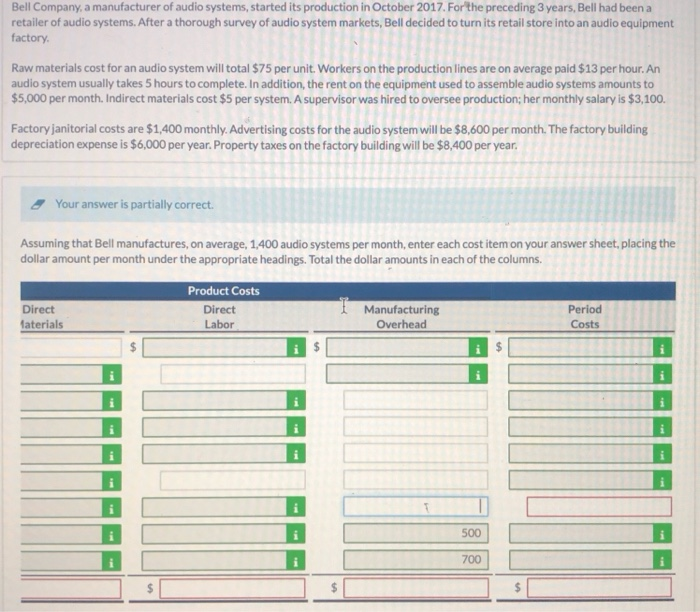

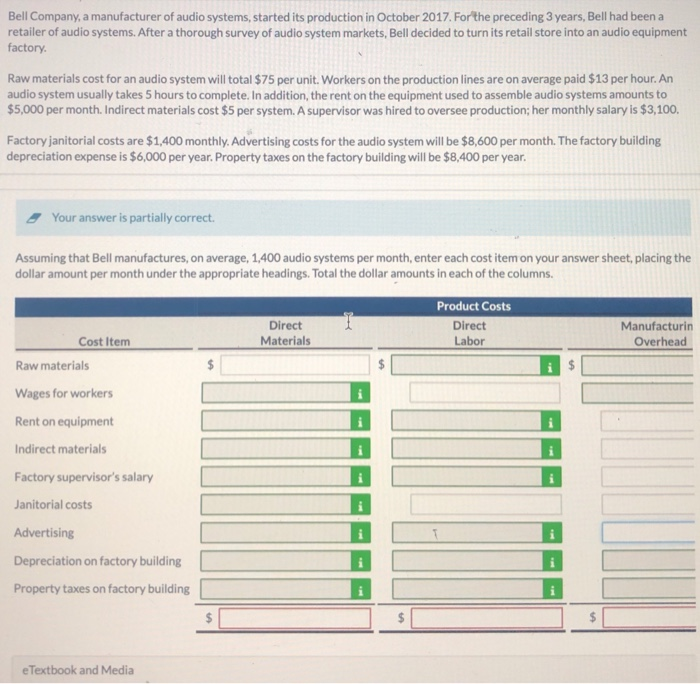

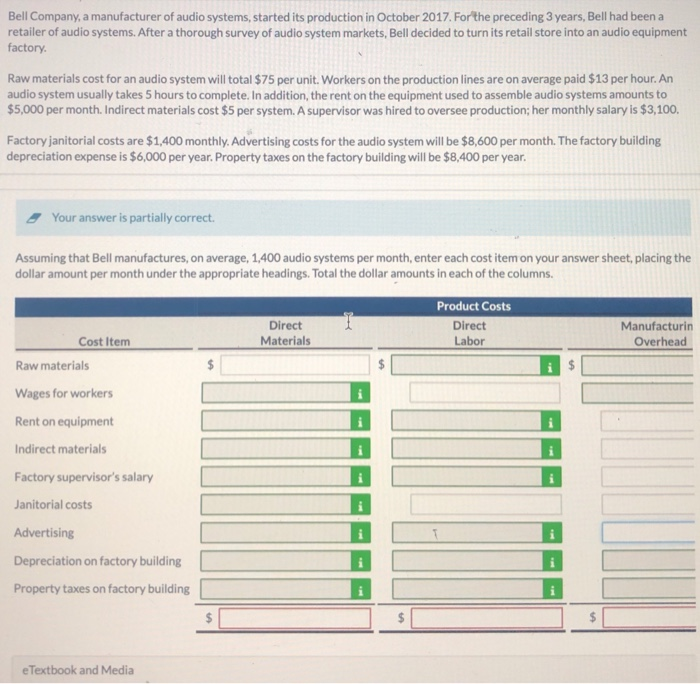

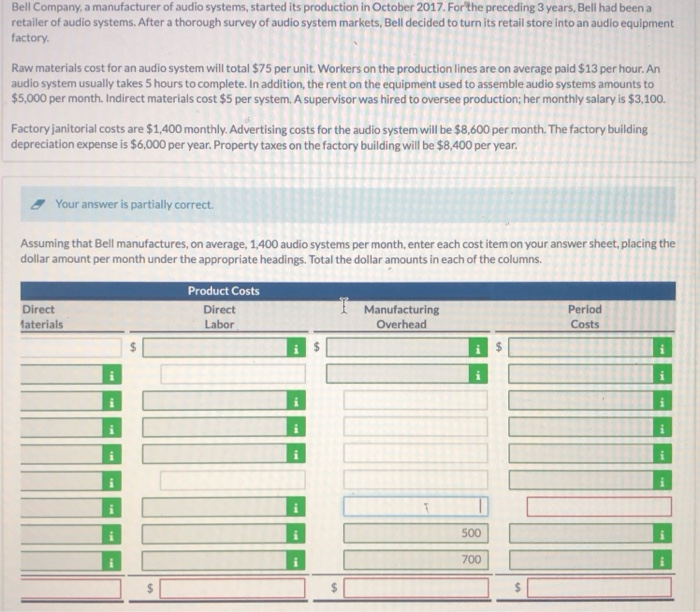

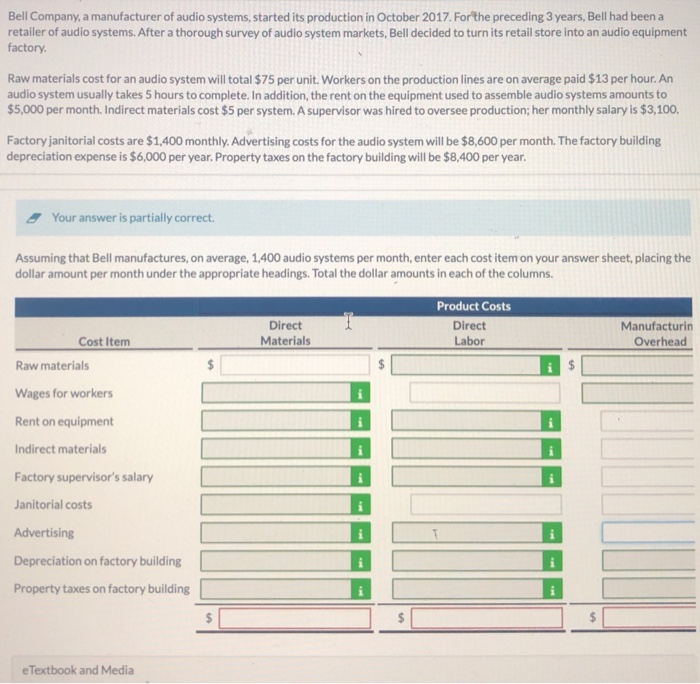

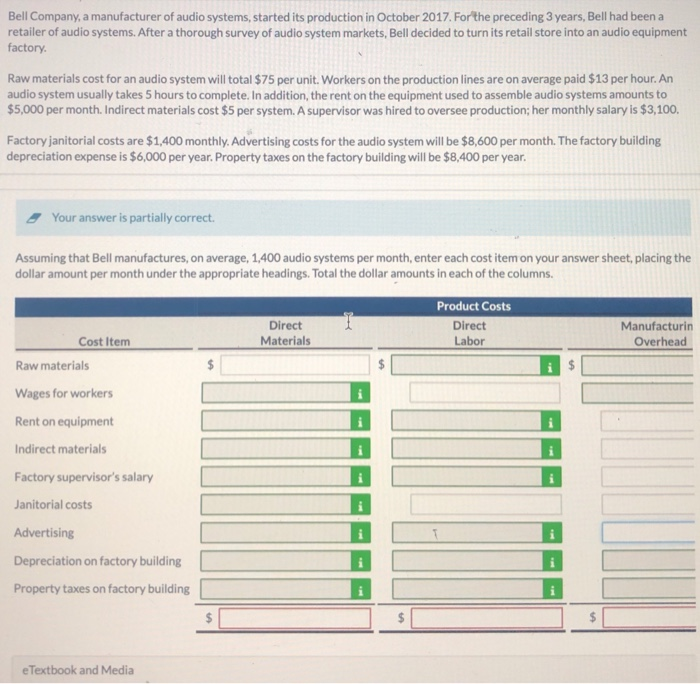

Bell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory. Raw materials cost for an audio system will total $75 per unit. Workers on the production lines are on average paid $13 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,000 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,100. Factory janitorial costs are $1,400 monthly. Advertising costs for the audio system will be $8,600 per month. The factory building depreciation expense is $6,000 per year. Property taxes on the factory building will be $8,400 per year. Your answer is partially correct. Assuming that Bell manufactures, on average, 1,400 audio systems per month, enter each cost item on your answer sheet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns. Direct Materials Product Costs Direct Labor Manufacturin Overhead Cost Item Raw materials Wages for workers Rent on equipment Indirect materials Factory supervisor's salary Janitorial costs Advertising Depreciation on factory building Property taxes on factory building e Textbook and Media Bell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory. Raw materials cost for an audio system will total $75 per unit. Workers on the production lines are on average paid $13 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,000 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,100. Factory janitorial costs are $1,400 monthly. Advertising costs for the audio system will be $8,600 per month. The factory building depreciation expense is $6,000 per year. Property taxes on the factory building will be $8,400 per year. Your answer is partially correct. Assuming that Bell manufactures, on average, 1,400 audio systems per month, enter each cost item on your answer sheet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns. Direct laterials Product Costs Direct Labor Manufacturing Overhead Period Costs 1 500 700 Bell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory. Raw materials cost for an audio system will total $75 per unit. Workers on the production lines are on average paid $13 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,000 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,100. Factory janitorial costs are $1,400 monthly. Advertising costs for the audio system will be $8,600 per month. The factory building depreciation expense is $6,000 per year. Property taxes on the factory building will be $8,400 per year. Your answer is partially correct. Assuming that Bell manufactures, on average, 1,400 audio systems per month, enter each cost item on your answer sheet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns. Direct Materials Product Costs Direct Labor Manufacturin Overhead Cost Item Raw materials Wages for workers Rent on equipment Indirect materials Factory supervisor's salary Janitorial costs Advertising Depreciation on factory building Property taxes on factory building e Textbook and Media Bell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory. Raw materials cost for an audio system will total $75 per unit. Workers on the production lines are on average paid $13 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,000 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,100. Factory janitorial costs are $1,400 monthly. Advertising costs for the audio system will be $8,600 per month. The factory building depreciation expense is $6,000 per year. Property taxes on the factory building will be $8,400 per year. Your answer is partially correct. Assuming that Bell manufactures, on average, 1,400 audio systems per month, enter each cost item on your answer sheet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns. Direct laterials Product Costs Direct Labor Manufacturing Overhead Period Costs 1 500 700