please help!!!! and explain. thank you so much

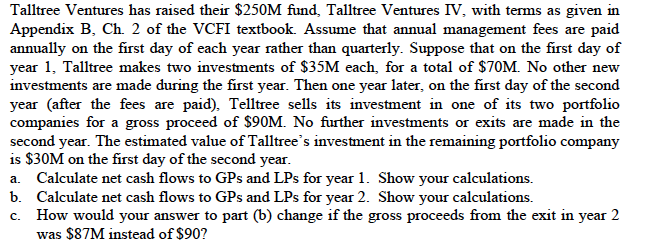

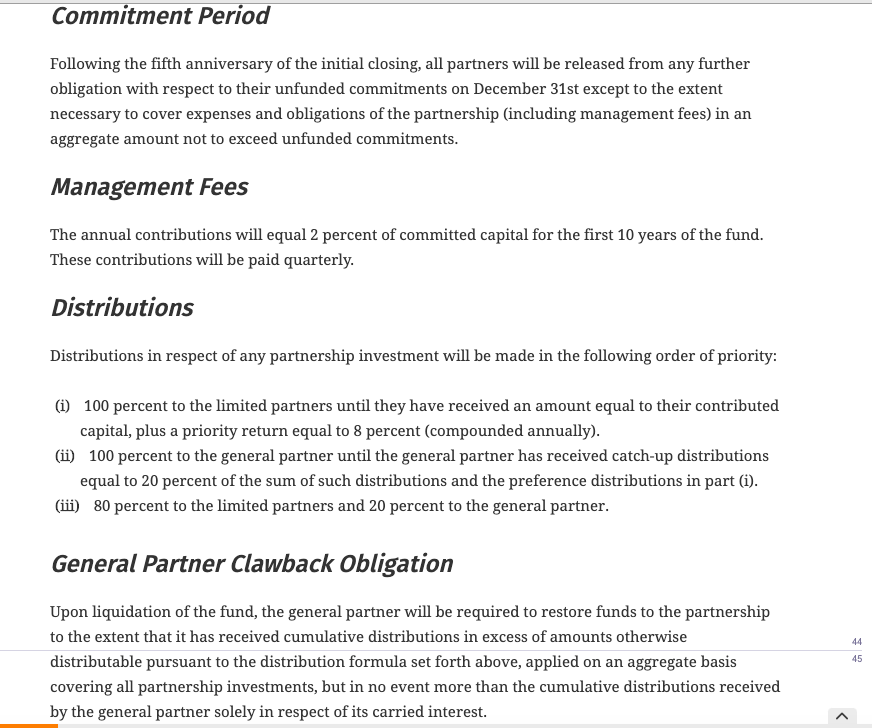

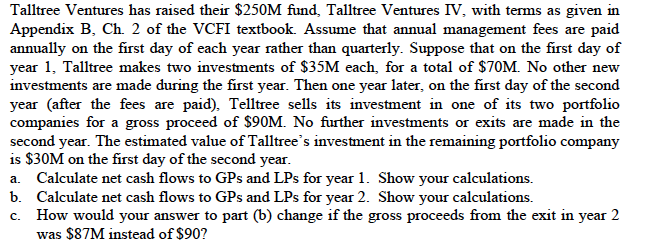

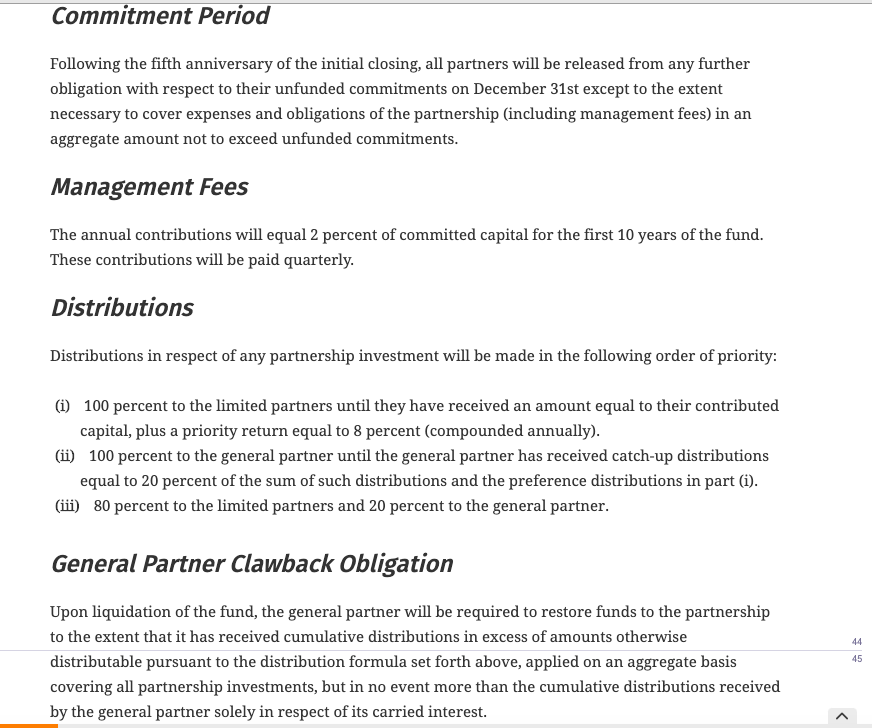

Talltree Ventures has raised their $250M fund, Talltree Ventures IV, with terms as given in Appendix B, Ch. 2 of the VCFI textbook. Assume that annual management fees are paid annually on the first day of each year rather than quarterly. Suppose that on the first day of year 1, Talltree makes two investments of $35M each, for a total of $70M. No other new investments are made during the first year. Then one year later, on the first day of the second year (after the fees are paid), Telltree sells its investment in one of its two portfolio companies for a gross proceed of $90M. No further investments or exits are made in the second year. The estimated value of Talltree's investment in the remaining portfolio company is $30M on the first day of the second year. a. Calculate net cash flows to GPs and LPs for year 1. Show your calculations. b. Calculate net cash flows to GPs and LPs for year 2. Show your calculations. c. How would your answer to part (b) change if the gross proceeds from the exit in year 2 was $87M instead of $90? Commitment Period Following the fifth anniversary of the initial closing, all partners will be released from any further obligation with respect to their unfunded commitments on December 31st except to the extent necessary to cover expenses and obligations of the partnership (including management fees) in an aggregate amount not to exceed unfunded commitments. Management Fees The annual contributions will equal 2 percent of committed capital for the first 10 years of the fund. These contributions will be paid quarterly. Distributions Distributions in respect of any partnership investment will be made in the following order of priority: (i) 100 percent to the limited partners until they have received an amount equal to their contributed capital, plus a priority return equal to 8 percent (compounded annually). (i) 100 percent to the general partner until the general partner has received catch-up distributions equal to 20 percent of the sum of such distributions and the preference distributions in part (i). (ii) 80 percent to the limited partners and 20 percent to the general partner. General Partner Clawback Obligation Upon liquidation of the fund, the general partner will be required to restore funds to the partnership to the extent that it has received cumulative distributions in excess of amounts otherwise distributable pursuant to the distribution formula set forth above, applied on an aggregate basis covering all partnership investments, but in no event more than the cumulative distributions received by the general partner solely in respect of its carried interest. Talltree Ventures has raised their $250M fund, Talltree Ventures IV, with terms as given in Appendix B, Ch. 2 of the VCFI textbook. Assume that annual management fees are paid annually on the first day of each year rather than quarterly. Suppose that on the first day of year 1, Talltree makes two investments of $35M each, for a total of $70M. No other new investments are made during the first year. Then one year later, on the first day of the second year (after the fees are paid), Telltree sells its investment in one of its two portfolio companies for a gross proceed of $90M. No further investments or exits are made in the second year. The estimated value of Talltree's investment in the remaining portfolio company is $30M on the first day of the second year. a. Calculate net cash flows to GPs and LPs for year 1. Show your calculations. b. Calculate net cash flows to GPs and LPs for year 2. Show your calculations. c. How would your answer to part (b) change if the gross proceeds from the exit in year 2 was $87M instead of $90? Commitment Period Following the fifth anniversary of the initial closing, all partners will be released from any further obligation with respect to their unfunded commitments on December 31st except to the extent necessary to cover expenses and obligations of the partnership (including management fees) in an aggregate amount not to exceed unfunded commitments. Management Fees The annual contributions will equal 2 percent of committed capital for the first 10 years of the fund. These contributions will be paid quarterly. Distributions Distributions in respect of any partnership investment will be made in the following order of priority: (i) 100 percent to the limited partners until they have received an amount equal to their contributed capital, plus a priority return equal to 8 percent (compounded annually). (i) 100 percent to the general partner until the general partner has received catch-up distributions equal to 20 percent of the sum of such distributions and the preference distributions in part (i). (ii) 80 percent to the limited partners and 20 percent to the general partner. General Partner Clawback Obligation Upon liquidation of the fund, the general partner will be required to restore funds to the partnership to the extent that it has received cumulative distributions in excess of amounts otherwise distributable pursuant to the distribution formula set forth above, applied on an aggregate basis covering all partnership investments, but in no event more than the cumulative distributions received by the general partner solely in respect of its carried interest