please help and if you can explain

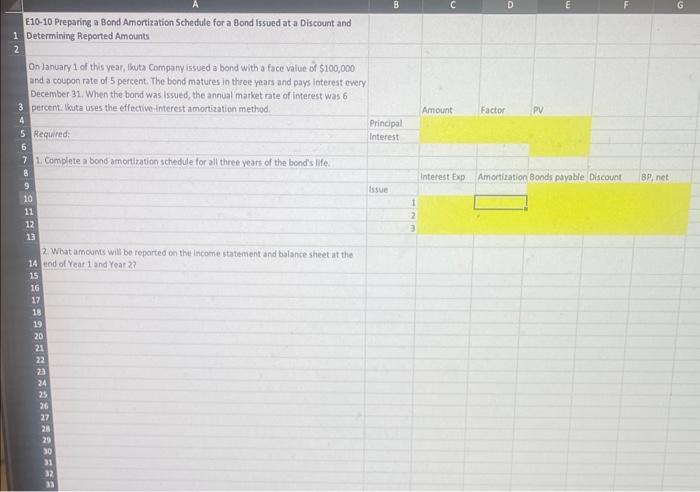

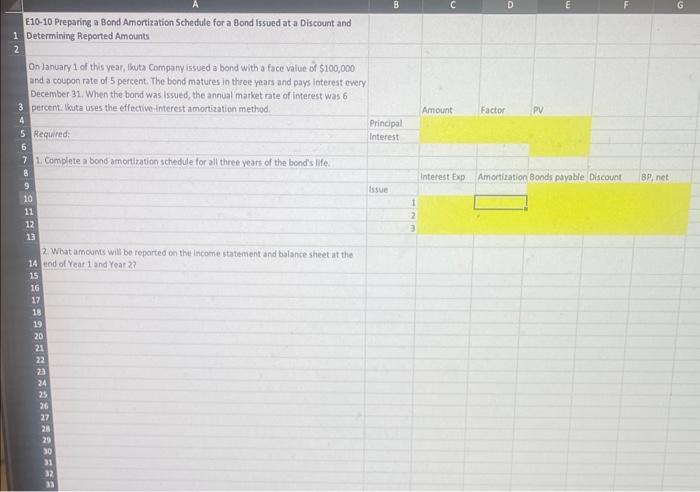

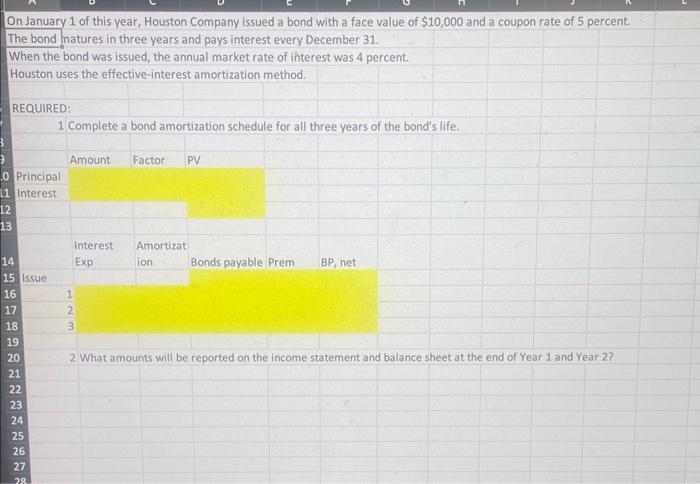

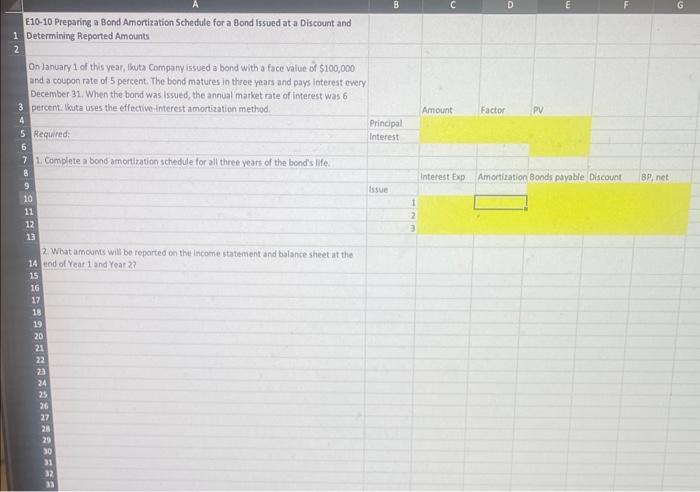

A g E10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Discount and 1 Determining Reported Amounts 2 On January 1 of this year, Hote Company issued a bond with a face value of $100,000 and a coupon rate of 5 percent. The bond matures in three years and pays interest every December 31. When the bond was issued, the annual market nate of interest was 6 3 percenti in 4 5 Amount Factor PV Principal interest 7. Complete a bond amortization schedule for all three vears of the bond's life. 8. Interest Exp Amortiration Boods payable Discount BP, net 9 10 11 12 13 lssue 2. What amounts will be reported on the Income statement and balance sheet at the 14 end of Yeat 1 and Year 2 ? \begin{tabular}{|l} 15 \\ 16 \\ 17 \\ 18 \\ 19 \\ 20 \\ 21 \\ 22 \\ 23 \\ 24 \\ 25 \\ 26 \\ 27 \\ 27 \\ 29 \\ 30 \\ 31 \\ 32 \\ 33 \end{tabular} On January 1 of this year, Houston Company issued a bond with a face value of $10,000 and a coupon rate of 5 percent. The bond matures in three years and pays interest every December 31 . When the bond was issued, the annual market rate of interest was 4 percent. Houston uses the effective-interest amortization method. REQUIRED: 1 Complete a bond amortization schedule for all three years of the bond's life. Amount Factor PV Principal Interest Interest Amortizat Exp Ion Bonds payable Prem BP, net Issue 1 2 3 2 What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2 ? A g E10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Discount and 1 Determining Reported Amounts 2 On January 1 of this year, Hote Company issued a bond with a face value of $100,000 and a coupon rate of 5 percent. The bond matures in three years and pays interest every December 31. When the bond was issued, the annual market nate of interest was 6 3 percenti in 4 5 Amount Factor PV Principal interest 7. Complete a bond amortization schedule for all three vears of the bond's life. 8. Interest Exp Amortiration Boods payable Discount BP, net 9 10 11 12 13 lssue 2. What amounts will be reported on the Income statement and balance sheet at the 14 end of Yeat 1 and Year 2 ? \begin{tabular}{|l} 15 \\ 16 \\ 17 \\ 18 \\ 19 \\ 20 \\ 21 \\ 22 \\ 23 \\ 24 \\ 25 \\ 26 \\ 27 \\ 27 \\ 29 \\ 30 \\ 31 \\ 32 \\ 33 \end{tabular} On January 1 of this year, Houston Company issued a bond with a face value of $10,000 and a coupon rate of 5 percent. The bond matures in three years and pays interest every December 31 . When the bond was issued, the annual market rate of interest was 4 percent. Houston uses the effective-interest amortization method. REQUIRED: 1 Complete a bond amortization schedule for all three years of the bond's life. Amount Factor PV Principal Interest Interest Amortizat Exp Ion Bonds payable Prem BP, net Issue 1 2 3 2 What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2