Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!! and please show step by step so I understand! Two of the newer partners of BBP,LLC are looking at these forecasts and realize

Please help!! and please show step by step so I understand!

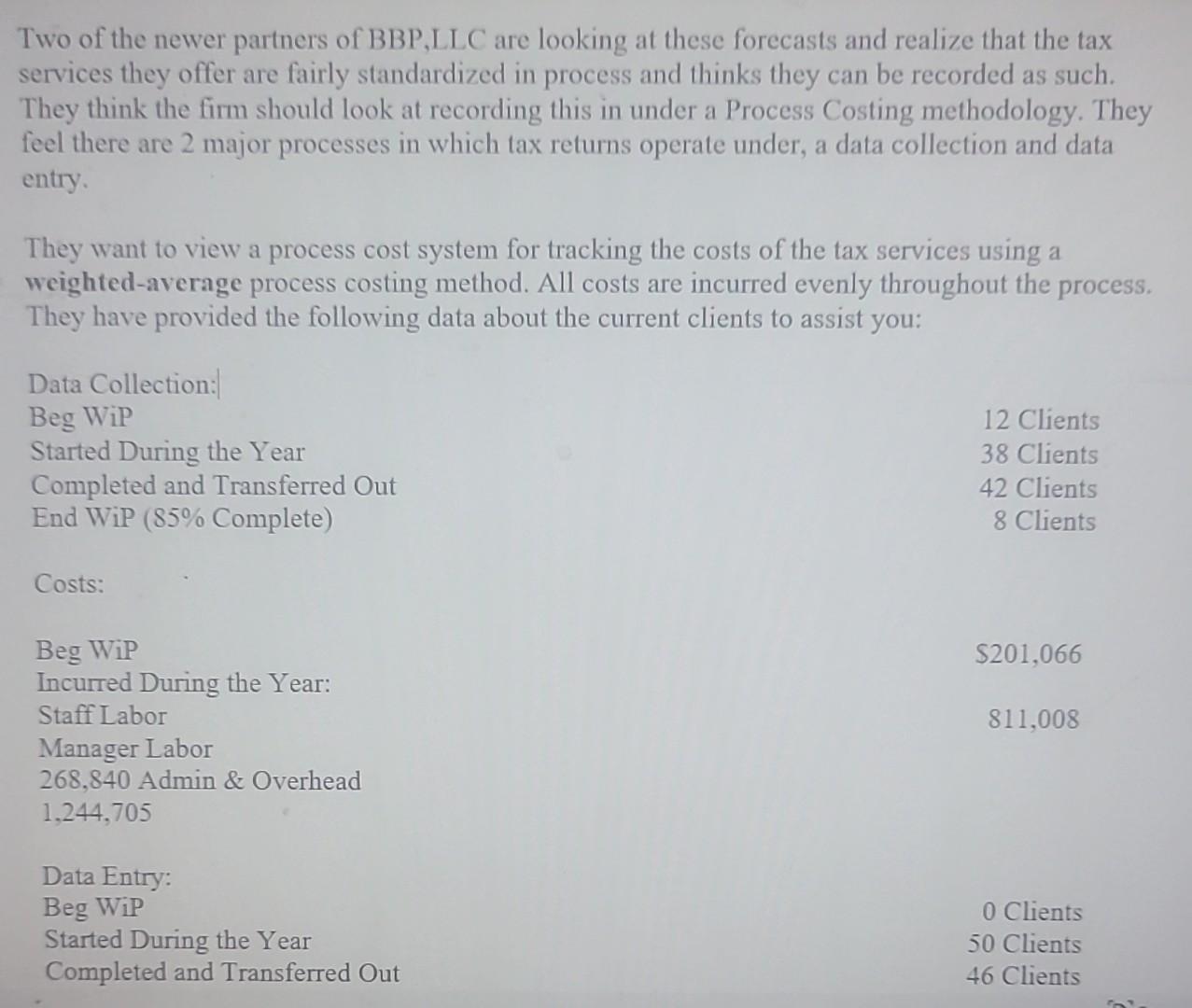

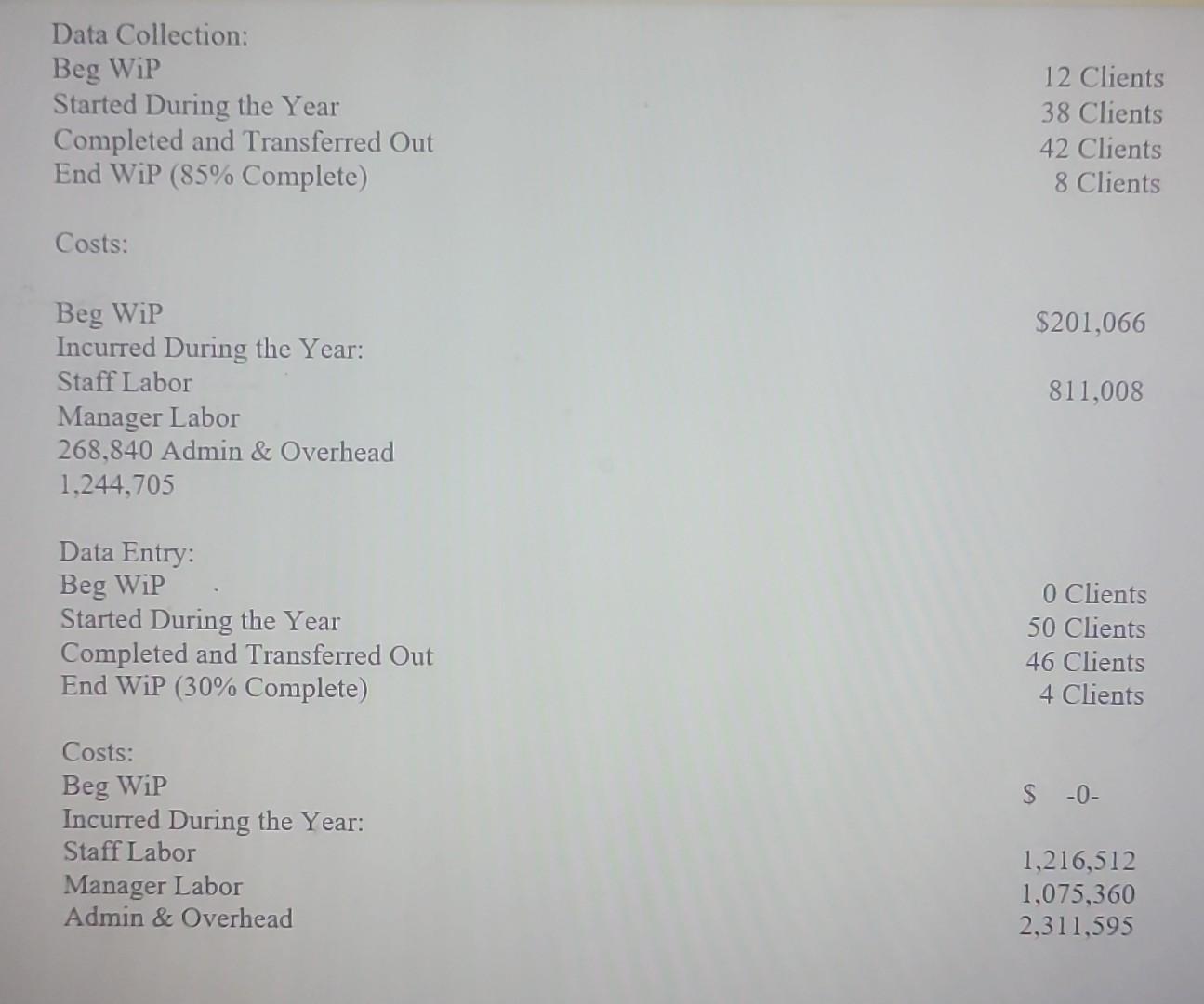

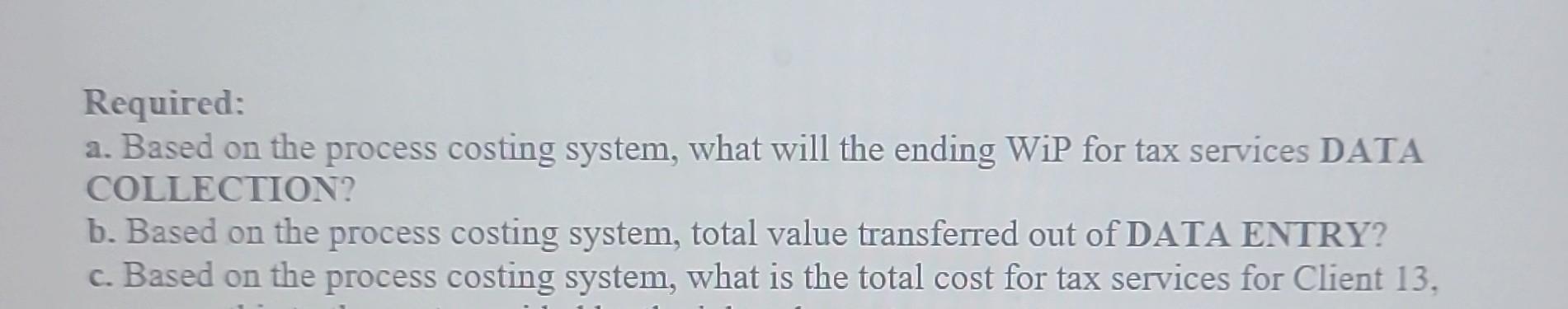

Two of the newer partners of BBP,LLC are looking at these forecasts and realize that the tax services they offer are fairly standardized in process and thinks they can be recorded as such. They think the firm should look at recording this in under a Process Costing methodology. They feel there are 2 major processes in which tax returns operate under, a data collection and data entry. They want to view a process cost system for tracking the costs of the tax services using a weighted-average process costing method. All costs are incurred evenly throughout the process. They have provided the following data about the current clients to assist you: Costs: \begin{tabular}{l|l} Beg WiP & $201,066 \\ Incurred During the Year: & $11,008 \\ Staff Labor & \\ Manager Labor \\ 268,840 Admin \& Overhead & \\ 1,244,705 & \\ Data Entry: & \\ Beg WiP & \\ Started During the Year & \\ Completed and Transferred Out & 0 Clients \end{tabular} Data Collection: Beg WiP Started During the Year Completed and Transferred Out End WiP (85% Complete) 12 Clients 38 Clients 42 Clients 8 Clients Costs: Beg WiP Incurred During the Year: Staff Labor Manager Labor 268,840 Admin \& Overhead 1,244,705 Data Entry: Beg WiP Started During the Year Completed and Transferred Out End WiP (30% Complete ) 0 Clients 50 Clients 46 Clients Costs: Beg WiP Incurred During the Year: $0 Staff Labor 1,216,512 Manager Labor 1,075,360 2,311,595 Admin \& Overhead Required: a. Based on the process costing system, what will the ending WiP for tax services DATA COLLECTION? b. Based on the process costing system, total value transferred out of DATA ENTRY? c. Based on the process costing system, what is the total cost for tax services for Client 13 , Two of the newer partners of BBP,LLC are looking at these forecasts and realize that the tax services they offer are fairly standardized in process and thinks they can be recorded as such. They think the firm should look at recording this in under a Process Costing methodology. They feel there are 2 major processes in which tax returns operate under, a data collection and data entry. They want to view a process cost system for tracking the costs of the tax services using a weighted-average process costing method. All costs are incurred evenly throughout the process. They have provided the following data about the current clients to assist you: Costs: \begin{tabular}{l|l} Beg WiP & $201,066 \\ Incurred During the Year: & $11,008 \\ Staff Labor & \\ Manager Labor \\ 268,840 Admin \& Overhead & \\ 1,244,705 & \\ Data Entry: & \\ Beg WiP & \\ Started During the Year & \\ Completed and Transferred Out & 0 Clients \end{tabular} Data Collection: Beg WiP Started During the Year Completed and Transferred Out End WiP (85% Complete) 12 Clients 38 Clients 42 Clients 8 Clients Costs: Beg WiP Incurred During the Year: Staff Labor Manager Labor 268,840 Admin \& Overhead 1,244,705 Data Entry: Beg WiP Started During the Year Completed and Transferred Out End WiP (30% Complete ) 0 Clients 50 Clients 46 Clients Costs: Beg WiP Incurred During the Year: $0 Staff Labor 1,216,512 Manager Labor 1,075,360 2,311,595 Admin \& Overhead Required: a. Based on the process costing system, what will the ending WiP for tax services DATA COLLECTION? b. Based on the process costing system, total value transferred out of DATA ENTRY? c. Based on the process costing system, what is the total cost for tax services for Client 13Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started