Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help and solve me as much as you can. I will up-vote you lifetime. Refer to the attached financial statements then compute the following:

Please help and solve me as much as you can. I will up-vote you lifetime.

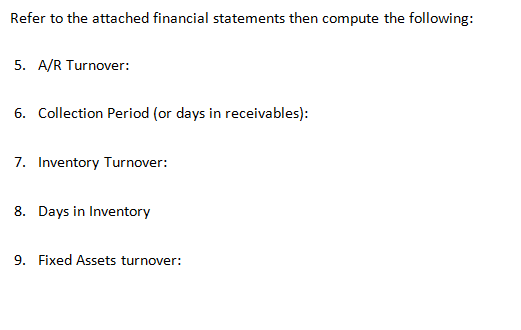

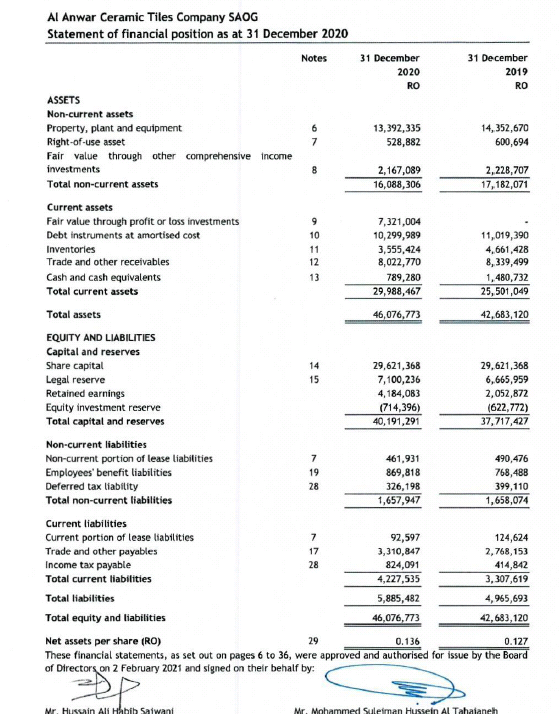

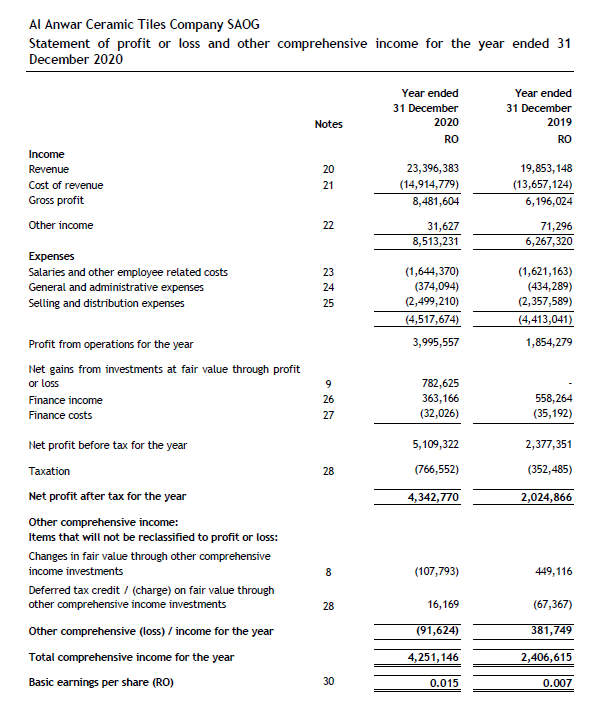

Refer to the attached financial statements then compute the following: 5. A/R Turnover: 6. Collection Period (or days in receivables): 7. Inventory Turnover: 8. Days in Inventory 9. Fixed Assets turnover: Al Anwar Ceramic Tiles Company SAOG Statement of financial position as at 31 December 2020 Notes 31 December 31 December 2020 2019 RO RO ASSETS Non-current assets Property, plant and equipment 13,392,335 14,352,670 Right-of-use asset 7 528,882 600,694 Fair value through other comprehensive Income investments 2,167,089 2,228,707 Total non-current assets 16,088,306 17, 182,071 Current assets Fair value through profit or loss investments 9 7,321,004 Debt instruments at amortised cost 10 10,299,989 11,019,390 Inventories 11 3,555,424 4,661,428 Trade and other receivables 12 8,022,770 8,339,499 Cash and cash equivalents 13 789,280 1,480,732 Total current assets 29,988,467 25,501,049 Total assets 46,076,773 42,683,120 EQUITY AND LIABILITIES Capital and reserves Share capital 14 29,621,368 29,621,368 Legal reserve 15 7,100,236 6,665,959 Retained earnings 4,184,083 2,052,872 Equity investment reserve (714,396) (622,772) Total capital and reserves 40, 191,291 37,717,427 Non-current liabilities Non-current portion of lease Liabilities 461,931 490,476 Employees' benefit liabilities 19 869,818 768,488 Deferred tax liability 28 326,198 399,110 Total non-current liabilities 1,657,947 1,658,074 Current liabilities Current portion of lease liabilities 7 92,597 124,624 Trade and other payables 17 3,310,847 2,768,153 Income tax payable 28 824,091 414,842 Total current liabilities 4,227,535 3,307,619 Total liabilities 5,885,482 4,965,693 Total equity and liabilities 46,076,773 42,683,120 Net assets per share (RO) 29 0.136 0.127 These financial statements, as set out on pages 6 to 36, were approved and authorised for issue by the Board of Directors on 2 February 2021 and signed on their behalf by: 7 Mr. Hussain Al Habib Saiwani Mr. Mohammed Suleiman Hussein Al Tahajaneth Al Anwar Ceramic Tiles Company SAOG Statement of profit or loss and other comprehensive income for the year ended 31 December 2020 Year ended 31 December 2020 RO Year ended 31 December 2019 RO Notes 20 21 Income Revenue Cost of revenue Gross profit Other income 23,396,383 (14,914,779) 8,481,604 19,853, 148 (13,657,124) 6,196,024 22 31,627 8,513,231 71,296 6,267,320 Expenses Salaries and other employee related costs General and administrative expenses Selling and distribution expenses 23 24 25 (1,644,370) (374,094) (2,499,210) (4,517,674) 3,995,557 (1,621, 163) (434,289) (2,357,589) (4,413,041) 1,854,279 Profit from operations for the year Net gains from investments at fair value through profit or loss Finance income Finance costs 9 26 27 782,625 363,166 (32,026) 558,264 (35,192) 2,377,351 5,109,322 (766,552) 28 (352,485) 4,342,770 2,024,866 Net profit before tax for the year Taxation Net profit after tax for the year Other comprehensive income: Items that will not be reclassified to profit or loss: Changes in fair value through other comprehensive income investments Deferred tax credit / (charge) on fair value through other comprehensive income investments Other comprehensive (loss) / income for the year Total comprehensive income for the year Basic earnings per share (RO) 8 (107,793) 449, 116 28 16,169 (67,367) (91,624) 381,749 4,251,146 2,406,615 30 0.015 0.007Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started