Please help answer the question below.

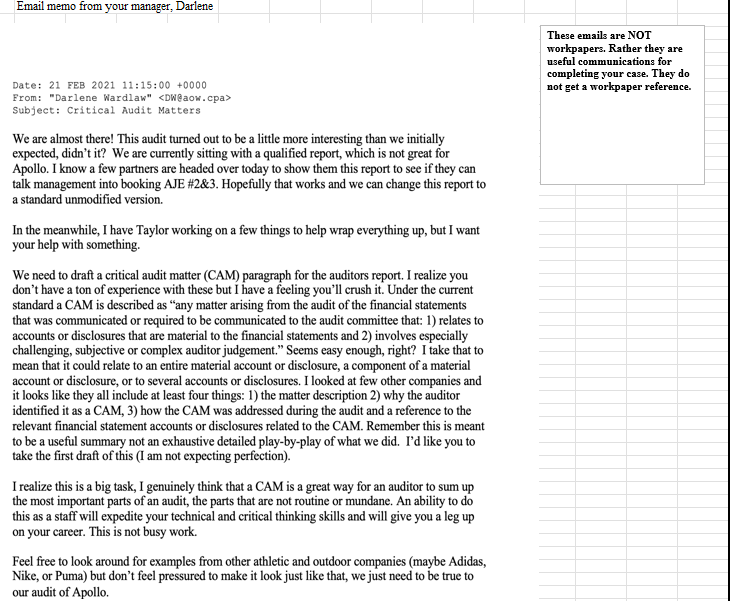

In this mini-case you will help create documents related to the auditors report of the Apollo audit. Instructions: Read and respond to all emails and requests from your manager. Email memo from your manager, Darlene These emails are NOT workpapers. Rather they are useful communications for completing your case. They do not get a workpaper reference. Date: 21 FEB 2021 11:15:00 +0000 From: "Darlene Wardlaw"

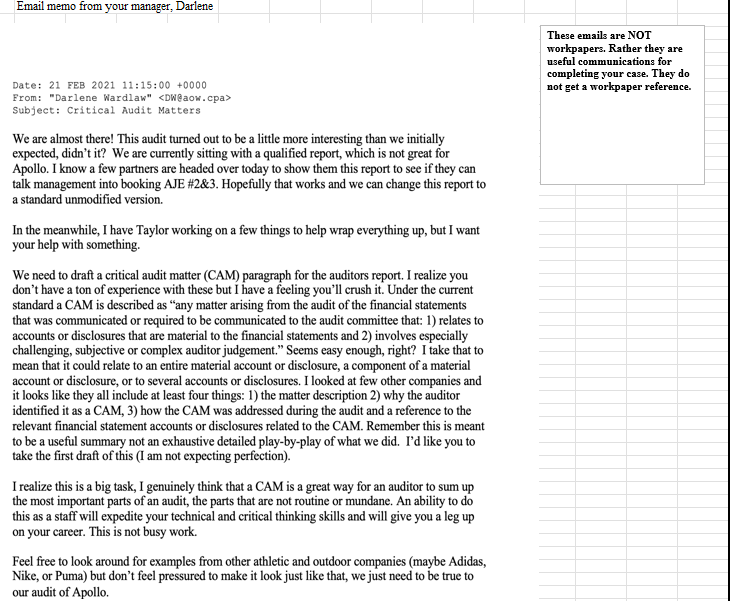

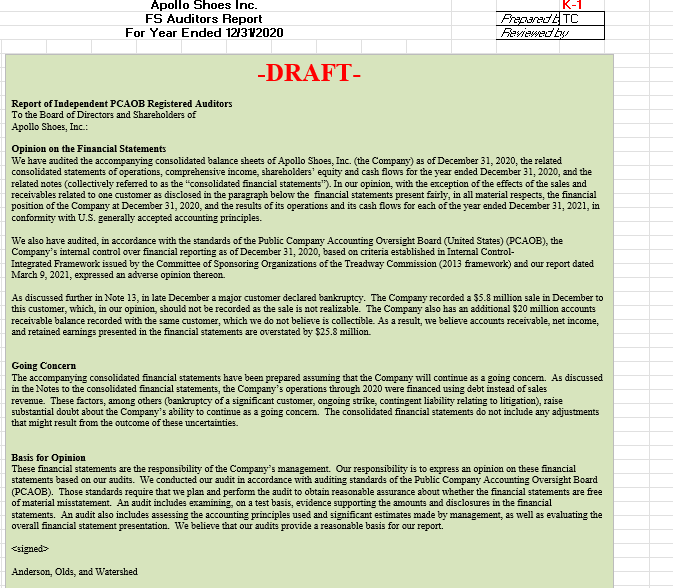

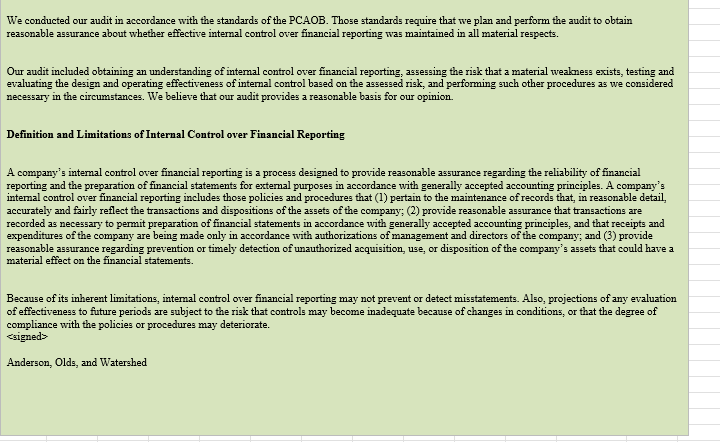

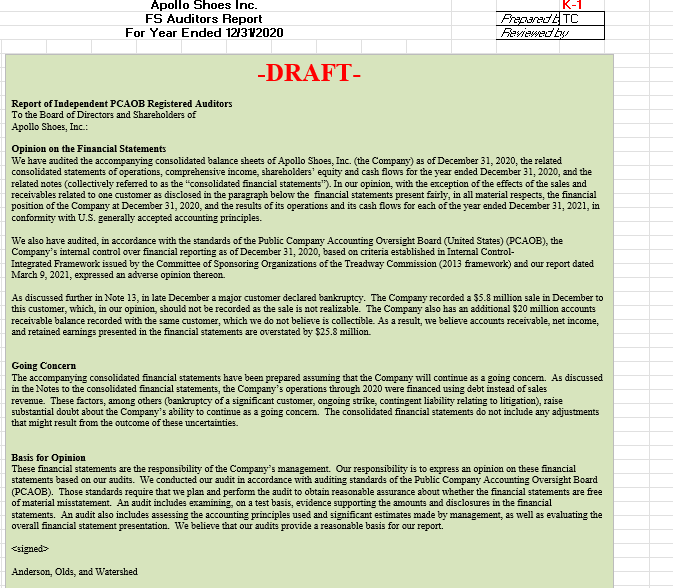

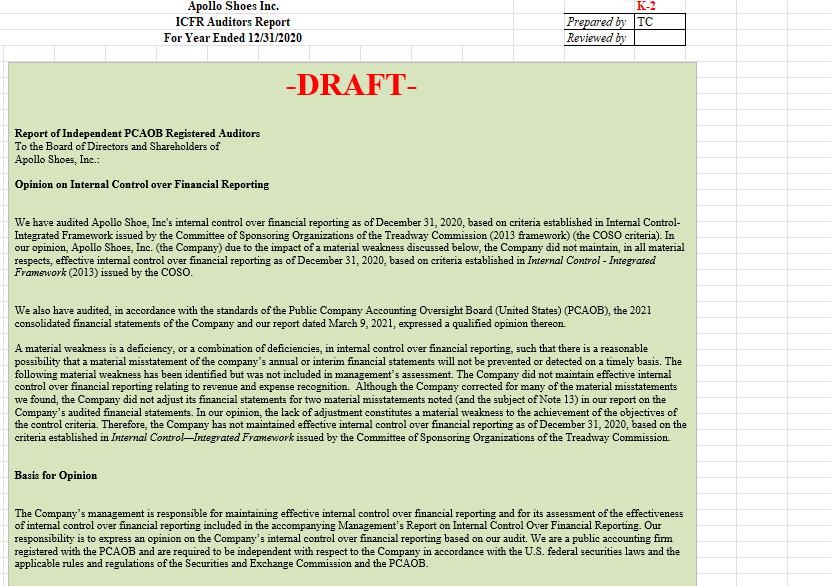

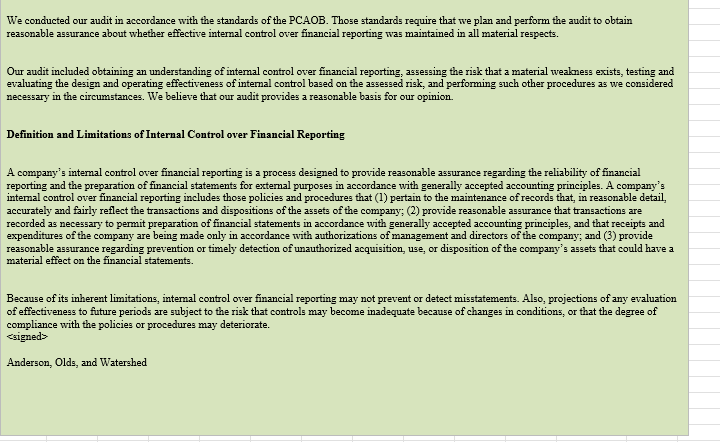

Subject: Critical Audit Matters We are almost there! This audit turned out to be a little more interesting than we initially expected, didn't it? We are currently sitting with a qualified report, which is not great for Apollo. I know a few partners are headed over today to show them this report to see if they can talk management into booking AJE #2&3. Hopefully that works and we can change this report to a standard unmodified version. In the meanwhile, I have Taylor working on a few things to help wrap everything up, but I want your help with something. We need to draft a critical audit matter (CAM) paragraph for the auditors report. I realize you don't have a ton of experience with these but I have a feeling you'll crush it. Under the current standard a CAM is described as any matter arising from the audit of the financial statements that was communicated or required to be communicated to the audit committee that: 1) relates to accounts or disclosures that are material to the financial statements and 2) involves especially challenging, subjective or complex auditor judgement." Seems easy enough, right? I take that to mean that it could relate to an entire material account or disclosure, a component of a material account or disclosure, or to several accounts or disclosures. I looked at few other companies and it looks like they all include at least four things: 1) the matter description 2) why the auditor identified it as a CAM, 3) how the CAM was addressed during the audit and a reference to the ) relevant financial statement accounts or disclosures related to the CAM. Remember this is meant to be a useful summary not an exhaustive detailed play-by-play of what we did. I'd like you to take the first draft of this (I am not expecting perfection). I realize this is a big task, I genuinely think that a CAM is a great way for an auditor to sum up the most important parts of an audit, the parts that are not routine or mundane. An ability to do this as a staff will expedite your technical and critical thinking skills and will give you a leg up on your career. This is not busy work. Feel free to look around for examples from other athletic and outdoor companies (maybe Adidas, Nike, or Puma) but don't feel pressured to make it look just like that, we just need to be true to our audit of Apollo. Apollo Shoes Inc. FS Auditors Report For Year Ended 12/312020 K-1 FEJLTC Reviews -DRAFT- Report of Independent PCAOB Registered Auditors To the Board of Directors and Shareholders of Apollo Shoes, Inc.: Opinion on the Financial Statements We have audited the accompanying consolidated balance sheets of Apollo Shoes, Inc. (the Company) as of December 31, 2020, the related consolidated statements of operations, comprehensive income, shareholders' equity and cash flows for the year ended December 31, 2020, and the related notes (collectively referred to as the "consolidated financial statements"). In our opinion, with the exception of the effects of the sales and receivables related to one customer as disclosed in the paragraph below the financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2020, and the results of its operations and its cash flows for each of the year ended December 31, 2021, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's intemal control over financial reporting as of December 31, 2020, based on criteria established in Internal Control- Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated March 9, 2021, expressed an adverse opinion thereon. As discussed further in Note 13, in late December a major customer declared bankruptcy. The Company recorded a $5.8 million sale in December to this customer, which, in our opinion should not be recorded as the sale is not realizable. The Company also has an additional $20 million accounts receivable balance recorded with the same customer, which we do not believe is collectible. As a result, we believe accounts receivable, net income, and retained earnings presented in the financial statements are overstated by $25.8 million Going Concern The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in the Notes to the consolidated financial statements, the Company's operations through 2020 were financed using debt instead of sales revenue. These factors, among others (bankruptcy of a significant customer, ongoing strike, contingent liability relating to litigation), raise substantial doubt about the Company's ability to continue as a going concem. The consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties. Basis for Opinion These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audit in accordance with auditing standards of the Public Company Accounting Oversight Board (PCAOB). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, om a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our report. Anderson, Olds, and Watershed To: "Darlene Wardlaw" Subject: Apollo CAM First Draft Darlene, RESPOND HERE TO DARLENE'S REQUEST FOR AN ATTEMPTED CRITICAL AUDIT MATTER PARAGRAPH. In this mini-case you will help create documents related to the auditors report of the Apollo audit. Instructions: Read and respond to all emails and requests from your manager. Email memo from your manager, Darlene These emails are NOT workpapers. Rather they are useful communications for completing your case. They do not get a workpaper reference. Date: 21 FEB 2021 11:15:00 +0000 From: "Darlene Wardlaw" Subject: Critical Audit Matters We are almost there! This audit turned out to be a little more interesting than we initially expected, didn't it? We are currently sitting with a qualified report, which is not great for Apollo. I know a few partners are headed over today to show them this report to see if they can talk management into booking AJE #2&3. Hopefully that works and we can change this report to a standard unmodified version. In the meanwhile, I have Taylor working on a few things to help wrap everything up, but I want your help with something. We need to draft a critical audit matter (CAM) paragraph for the auditors report. I realize you don't have a ton of experience with these but I have a feeling you'll crush it. Under the current standard a CAM is described as any matter arising from the audit of the financial statements that was communicated or required to be communicated to the audit committee that: 1) relates to accounts or disclosures that are material to the financial statements and 2) involves especially challenging, subjective or complex auditor judgement." Seems easy enough, right? I take that to mean that it could relate to an entire material account or disclosure, a component of a material account or disclosure, or to several accounts or disclosures. I looked at few other companies and it looks like they all include at least four things: 1) the matter description 2) why the auditor identified it as a CAM, 3) how the CAM was addressed during the audit and a reference to the ) relevant financial statement accounts or disclosures related to the CAM. Remember this is meant to be a useful summary not an exhaustive detailed play-by-play of what we did. I'd like you to take the first draft of this (I am not expecting perfection). I realize this is a big task, I genuinely think that a CAM is a great way for an auditor to sum up the most important parts of an audit, the parts that are not routine or mundane. An ability to do this as a staff will expedite your technical and critical thinking skills and will give you a leg up on your career. This is not busy work. Feel free to look around for examples from other athletic and outdoor companies (maybe Adidas, Nike, or Puma) but don't feel pressured to make it look just like that, we just need to be true to our audit of Apollo. Apollo Shoes Inc. FS Auditors Report For Year Ended 12/312020 K-1 FEJLTC Reviews -DRAFT- Report of Independent PCAOB Registered Auditors To the Board of Directors and Shareholders of Apollo Shoes, Inc.: Opinion on the Financial Statements We have audited the accompanying consolidated balance sheets of Apollo Shoes, Inc. (the Company) as of December 31, 2020, the related consolidated statements of operations, comprehensive income, shareholders' equity and cash flows for the year ended December 31, 2020, and the related notes (collectively referred to as the "consolidated financial statements"). In our opinion, with the exception of the effects of the sales and receivables related to one customer as disclosed in the paragraph below the financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2020, and the results of its operations and its cash flows for each of the year ended December 31, 2021, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's intemal control over financial reporting as of December 31, 2020, based on criteria established in Internal Control- Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated March 9, 2021, expressed an adverse opinion thereon. As discussed further in Note 13, in late December a major customer declared bankruptcy. The Company recorded a $5.8 million sale in December to this customer, which, in our opinion should not be recorded as the sale is not realizable. The Company also has an additional $20 million accounts receivable balance recorded with the same customer, which we do not believe is collectible. As a result, we believe accounts receivable, net income, and retained earnings presented in the financial statements are overstated by $25.8 million Going Concern The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in the Notes to the consolidated financial statements, the Company's operations through 2020 were financed using debt instead of sales revenue. These factors, among others (bankruptcy of a significant customer, ongoing strike, contingent liability relating to litigation), raise substantial doubt about the Company's ability to continue as a going concem. The consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties. Basis for Opinion These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audit in accordance with auditing standards of the Public Company Accounting Oversight Board (PCAOB). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, om a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our report. Anderson, Olds, and Watershed To: "Darlene Wardlaw" Subject: Apollo CAM First Draft Darlene, RESPOND HERE TO DARLENE'S REQUEST FOR AN ATTEMPTED CRITICAL AUDIT MATTER PARAGRAPH