Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help answer the questions. The true balance of cash for Collegiate Sports at November 30 , based on the bank reconciliation, is $ Question

please help answer the questions.

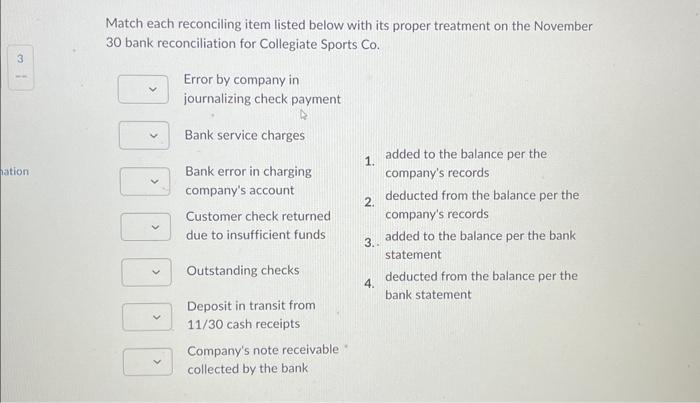

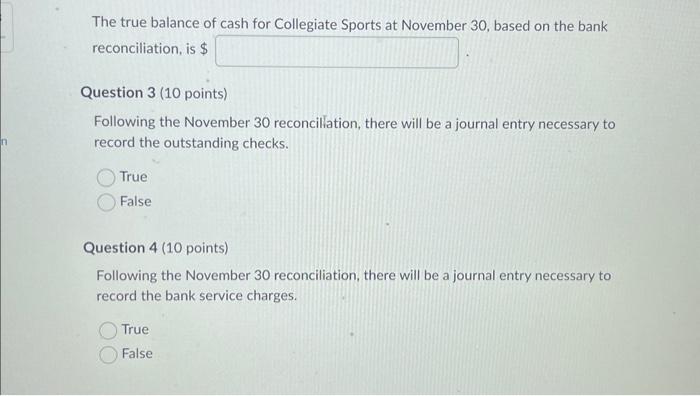

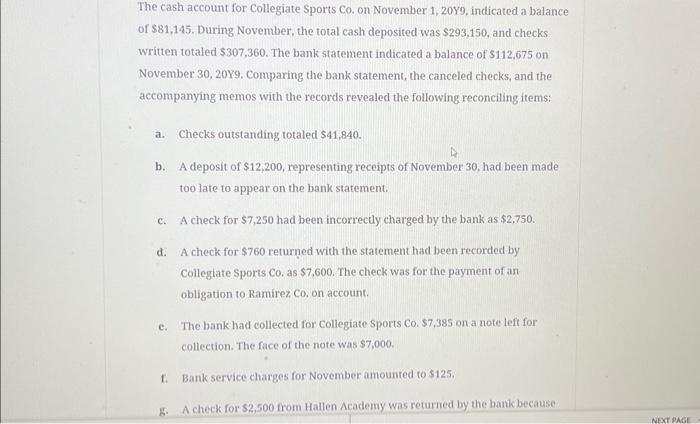

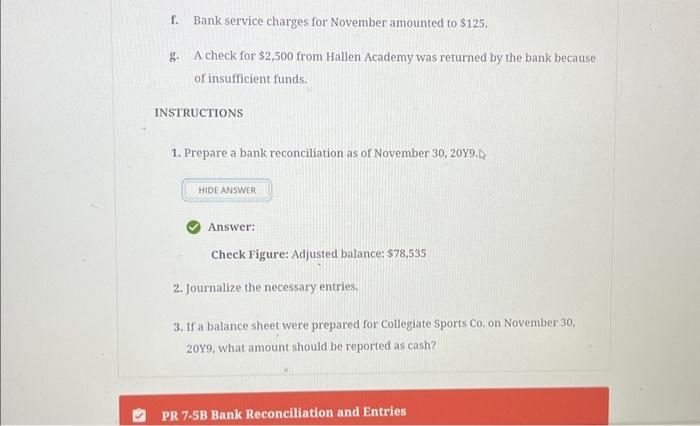

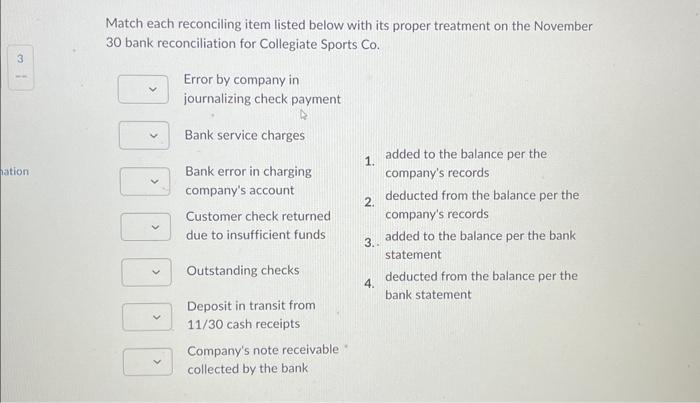

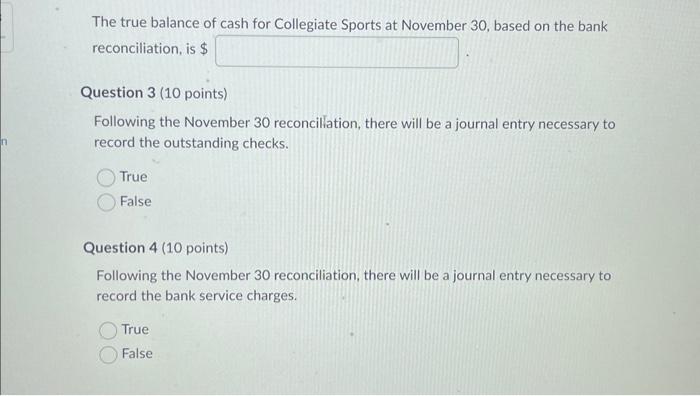

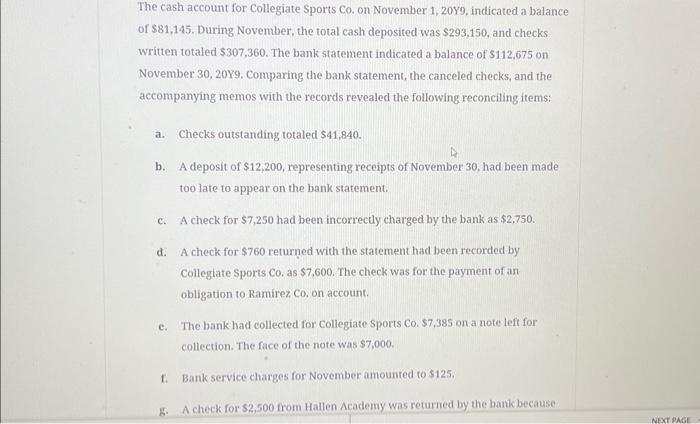

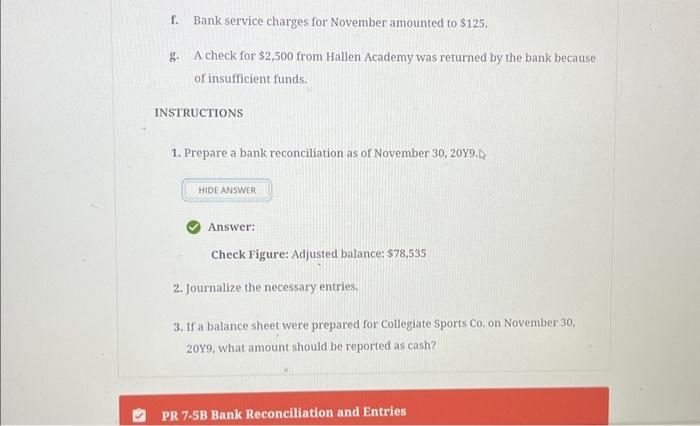

The true balance of cash for Collegiate Sports at November 30 , based on the bank reconciliation, is $ Question 3 (10 points) Following the November 30 reconcillation, there will be a journal entry necessary to record the outstanding checks. True False Question 4 (10 points) Following the November 30 reconciliation, there will be a journal entry necessary to record the bank service charges. True False The cash account for Collegiate Sports Co. on November 1, 20Y9, indicated a balance of $81,145. During November, the total cash deposited was $293,150, and checks. written totaled $307,360. The bank statement indicated a balance of $112,675 on November 30,20Y9. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling ftems: a. Checks outstanding totaled $41,840. b. A deposit of $12,200, representing receipts of November 30 , had been made too late to appear on the bank statement. c. A check for $7,250 had been incorrecly charged by the bank as $2,750. d. A check for $760 returned with the statement had been recorded by Collegiate Sports Co. as $7,600. The check was for the payment of an obligation to Ramirez Co, on account. c. The bank had collected for collegiate Sports C0. $7,385 on a note left for collection. The face of the note was $7,000. f. Bank service charges for November amounted to $125. g. A check for $2,500 from Hallen Academy was returned by the bank because Match each reconciling item listed below with its proper treatment on the November 30 bank reconciliation for Collegiate Sports Co. Error by company in journalizing check payment Bank service charges Bank error in charging company's account Customer check returned due to insufficient funds 1. added to the balance per the company's records 2. deducted from the balance per the company's records 3. added to the balance per the bank statement Outstanding checks 4. deducted from the balance per the Deposit in transit from bank statement 11/30 cash receipts Company's note receivable collected by the bank f. Bank service charges for November amounted to $125. g. A check for $2,500 from Hallen Academy was returned by the bank because of insufficient funds. INSTRUCTIONS 1. Prepare a bank reconciliation as of November 30,20Y9. Answer: Check Figure: Adjusted balance: $78,535 2. Journalize the necessary entries. 3. If a balance sheet were prepared for Collegiate Sports Co. on November 30 , 20Y9, what amount should be reported as cash? PR 7-5B Bank Reconciliation and Entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started