Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help answer these: Most people's effective tax rate is much lower than their highest marginal tax bracket because: a. Their Adjusted Gross Income minus

Please help answer these:

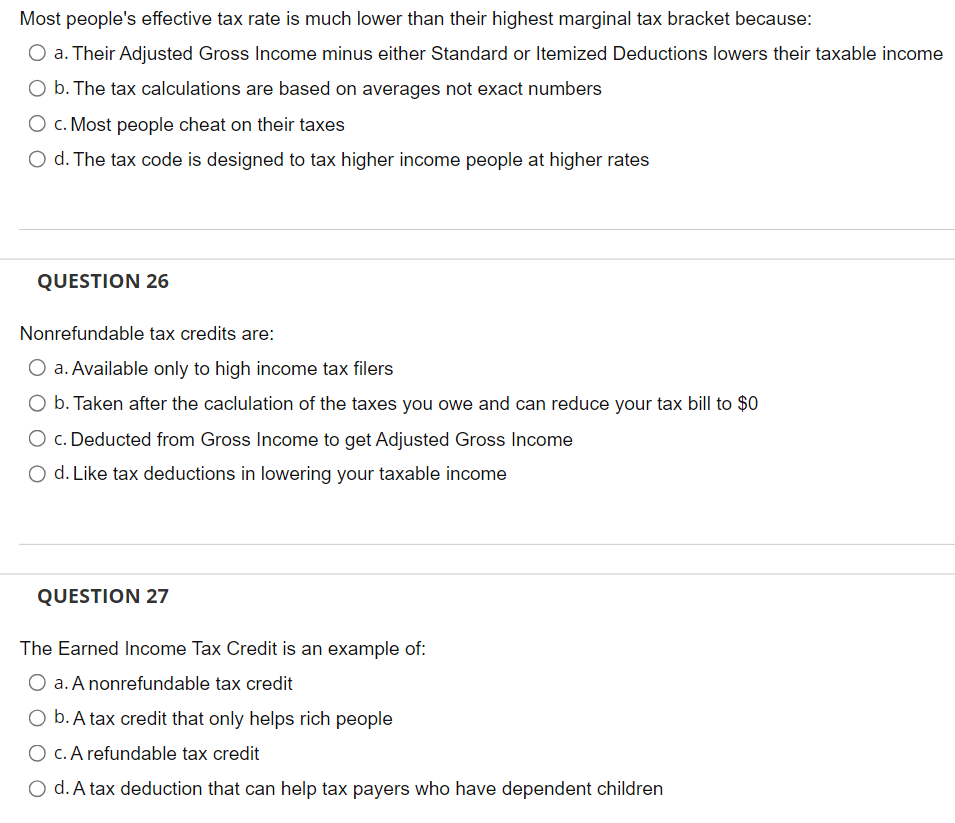

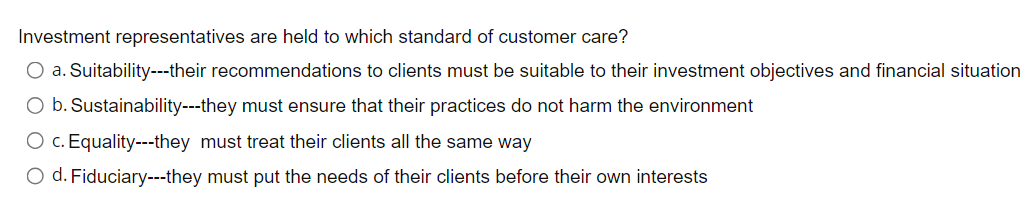

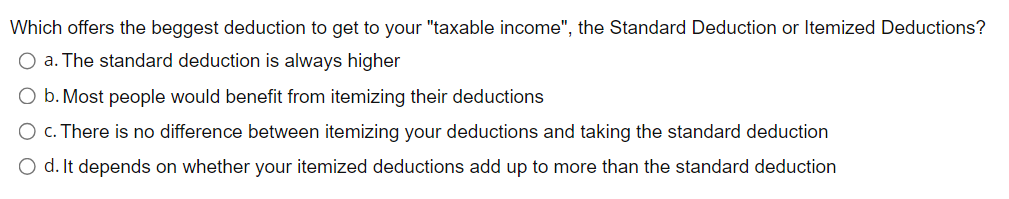

Most people's effective tax rate is much lower than their highest marginal tax bracket because: a. Their Adjusted Gross Income minus either Standard or Itemized Deductions lowers their taxable income b. The tax calculations are based on averages not exact numbers c. Most people cheat on their taxes d. The tax code is designed to tax higher income people at higher rates QUESTION 26 Nonrefundable tax credits are: a. Available only to high income tax filers b. Taken after the caclulation of the taxes you owe and can reduce your tax bill to $0 c. Deducted from Gross Income to get Adjusted Gross Income d. Like tax deductions in lowering your taxable income QUESTION 27 The Earned Income Tax Credit is an example of: a. A nonrefundable tax credit b. A tax credit that only helps rich people c. A refundable tax credit d. A tax deduction that can help tax payers who have dependent children Investment representatives are held to which standard of customer care? a. Suitability---their recommendations to clients must be suitable to their investment objectives and financial situation b. Sustainability---they must ensure that their practices do not harm the environment c. Equality---they must treat their clients all the same way d. Fiduciary---they must put the needs of their clients before their own interests Which offers the beggest deduction to get to your "taxable income", the Standard Deduction or Itemized Deductions? a. The standard deduction is always higher b. Most people would benefit from itemizing their deductions c. There is no difference between itemizing your deductions and taking the standard deduction d. It depends on whether your itemized deductions add up to more than the standard deduction What tax preparer's refer to as "above the line" adjustments to income to derive Adjusted Gross Income (AGI) can include: a. IRS Form 1040. b. All deductions from gross income to derive net income in an individual's paycheck c. Very complicated calculations that may require a tax filing extension d. Quarterly estimated tax payments for certain tax filers QUESTION 18 Which of the following use Adjusted Gross Income (AGI) in determining eligibility for income-related benefits? a. Eligibility for the Earned Income Tax Credit b. Eligibility for Medicaid coverage c. Eligibility to deduct student loan interest on Schedule 1 of your IRS 1040 tax return d. All of the above QUESTION 19 Which of the following are examples of pre-tax contributions that can lower your taxable income? a. Student loan interest payments b. Contributions to a Traditional IRA and/or Health Savings Account c. Schedule C business income d. Online gambling losses

Most people's effective tax rate is much lower than their highest marginal tax bracket because: a. Their Adjusted Gross Income minus either Standard or Itemized Deductions lowers their taxable income b. The tax calculations are based on averages not exact numbers c. Most people cheat on their taxes d. The tax code is designed to tax higher income people at higher rates QUESTION 26 Nonrefundable tax credits are: a. Available only to high income tax filers b. Taken after the caclulation of the taxes you owe and can reduce your tax bill to $0 c. Deducted from Gross Income to get Adjusted Gross Income d. Like tax deductions in lowering your taxable income QUESTION 27 The Earned Income Tax Credit is an example of: a. A nonrefundable tax credit b. A tax credit that only helps rich people c. A refundable tax credit d. A tax deduction that can help tax payers who have dependent children Investment representatives are held to which standard of customer care? a. Suitability---their recommendations to clients must be suitable to their investment objectives and financial situation b. Sustainability---they must ensure that their practices do not harm the environment c. Equality---they must treat their clients all the same way d. Fiduciary---they must put the needs of their clients before their own interests Which offers the beggest deduction to get to your "taxable income", the Standard Deduction or Itemized Deductions? a. The standard deduction is always higher b. Most people would benefit from itemizing their deductions c. There is no difference between itemizing your deductions and taking the standard deduction d. It depends on whether your itemized deductions add up to more than the standard deduction What tax preparer's refer to as "above the line" adjustments to income to derive Adjusted Gross Income (AGI) can include: a. IRS Form 1040. b. All deductions from gross income to derive net income in an individual's paycheck c. Very complicated calculations that may require a tax filing extension d. Quarterly estimated tax payments for certain tax filers QUESTION 18 Which of the following use Adjusted Gross Income (AGI) in determining eligibility for income-related benefits? a. Eligibility for the Earned Income Tax Credit b. Eligibility for Medicaid coverage c. Eligibility to deduct student loan interest on Schedule 1 of your IRS 1040 tax return d. All of the above QUESTION 19 Which of the following are examples of pre-tax contributions that can lower your taxable income? a. Student loan interest payments b. Contributions to a Traditional IRA and/or Health Savings Account c. Schedule C business income d. Online gambling losses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started