Answered step by step

Verified Expert Solution

Question

1 Approved Answer

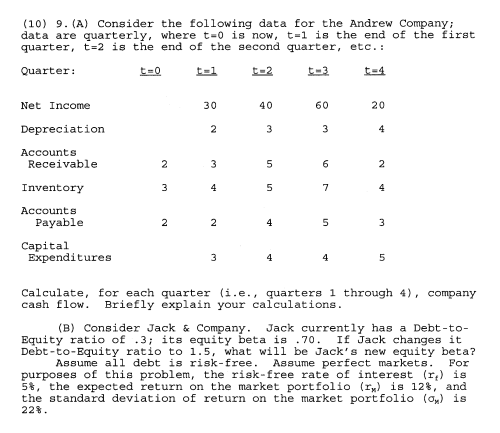

Please help ASAP (10) 9. (A) Consider the following data for the Andrew Company, data are quarterly, where t=0 is now, t=1 is the end

Please help ASAP

(10) 9. (A) Consider the following data for the Andrew Company, data are quarterly, where t=0 is now, t=1 is the end of the first quarter, t=2 is the end of the second quarter, etc.: Quarter: t=0 t-2 t3 Net Income 30 40 60 20 Depreciation 2 3 3 4 2 3 5 6 2 3 4 5 7 4 Accounts Receivable Inventory Accounts Payable Capital Expenditures 2 2 4 5 3 3 4 4 5 Calculate, for each quarter (i.e., quarters 1 through 4), company cash flow. Briefly explain your calculations. (B) Consider Jack & Company. Jack currently has a Debt-to- Equity ratio of .3; its equity beta is .70. If Jack changes it Debt-to-Equity ratio to 1.5, what will be Jack's new equity beta? Assume all debt is risk-free. Assume perfect markets. purposes of this problem, the risk-free rate of interest (F) is 5, the expected return on the market portfolio (1x) is 12%, and the standard deviation of return on the market portfolio (0) is 22%. Por (10) 9. (A) Consider the following data for the Andrew Company, data are quarterly, where t=0 is now, t=1 is the end of the first quarter, t=2 is the end of the second quarter, etc.: Quarter: t=0 t-2 t3 Net Income 30 40 60 20 Depreciation 2 3 3 4 2 3 5 6 2 3 4 5 7 4 Accounts Receivable Inventory Accounts Payable Capital Expenditures 2 2 4 5 3 3 4 4 5 Calculate, for each quarter (i.e., quarters 1 through 4), company cash flow. Briefly explain your calculations. (B) Consider Jack & Company. Jack currently has a Debt-to- Equity ratio of .3; its equity beta is .70. If Jack changes it Debt-to-Equity ratio to 1.5, what will be Jack's new equity beta? Assume all debt is risk-free. Assume perfect markets. purposes of this problem, the risk-free rate of interest (F) is 5, the expected return on the market portfolio (1x) is 12%, and the standard deviation of return on the market portfolio (0) is 22%. PorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started