Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*PLEASE HELP ASAP* For your excel project, you will be creating a partial Master Budget. You must use Excel to complete this project. You will

*PLEASE HELP ASAP* For your excel project, you will be creating a partial Master Budget. You must use Excel to complete this project. You will need to use formulas when performing math operations. Show formulas used in excel.

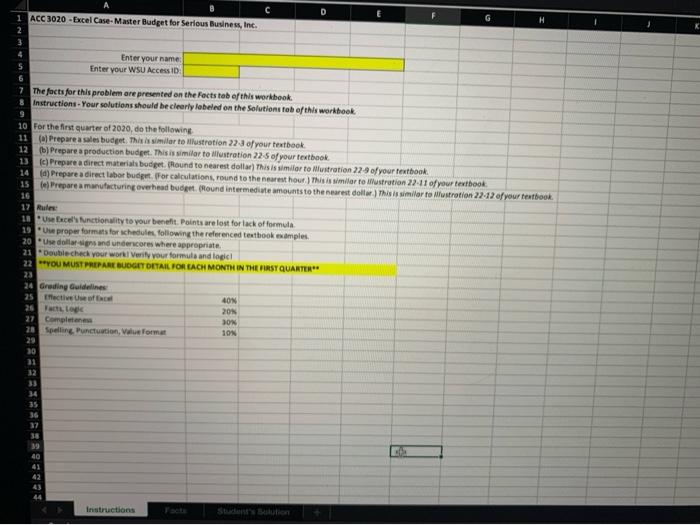

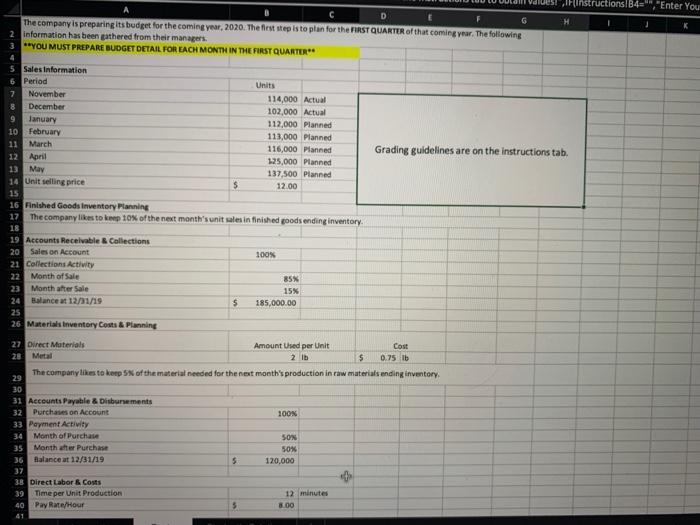

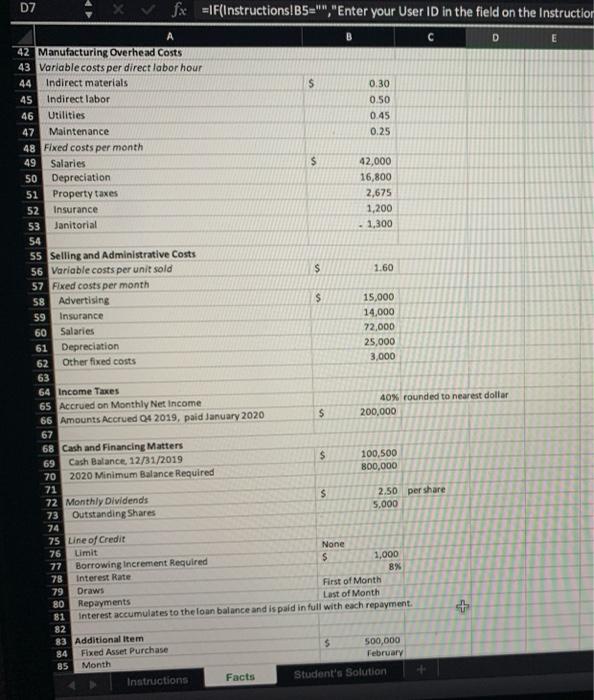

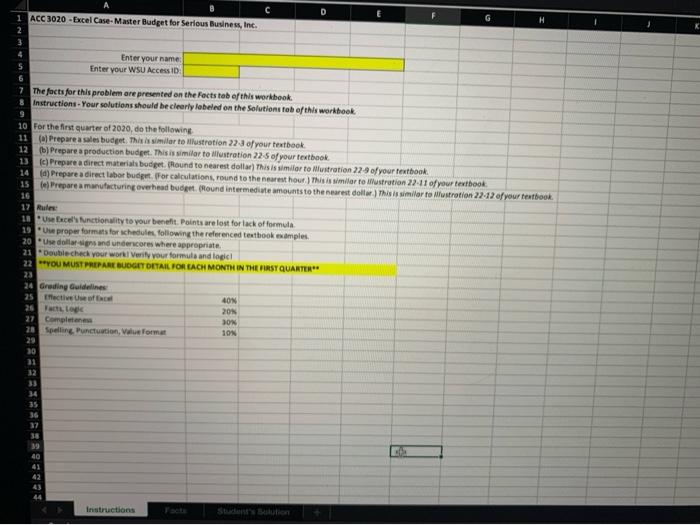

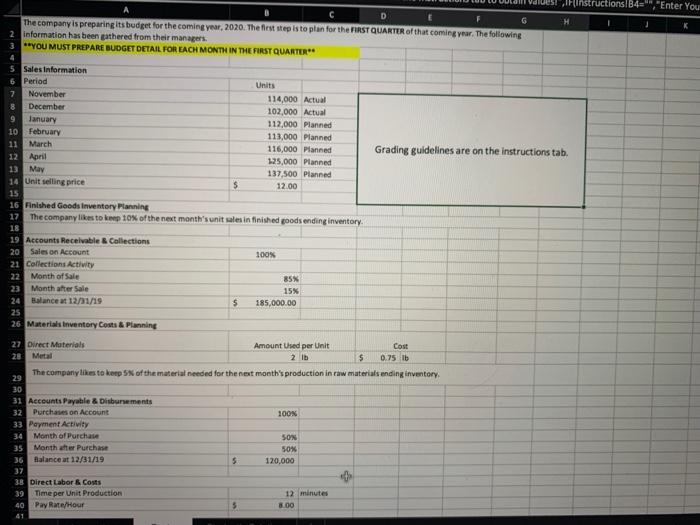

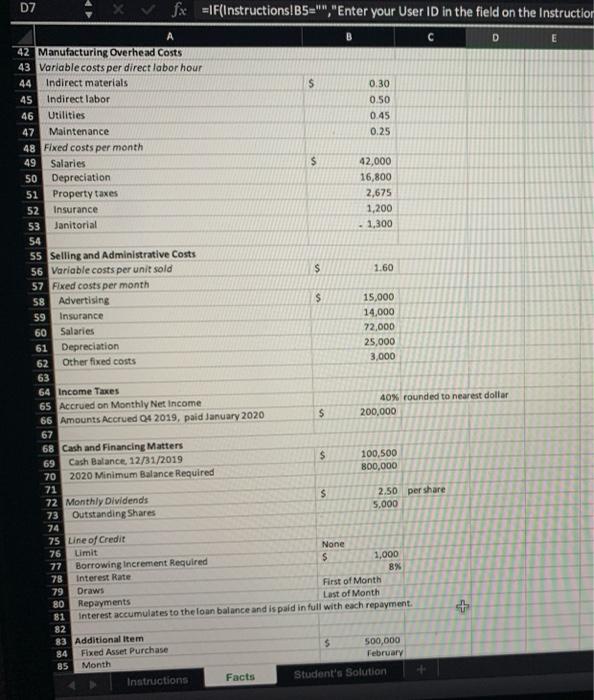

C D ACC 3020 - Excel Case-Master Budget for Serious Business, Inc. H 4 Enter your name: Enter your WSU Access ID: 7 The facts for this problem are presented on the facts tab of this workbook. Instructions - Your solutions should be clearly labeled on the Solutions tab of this workbook 10 for the first quarter of 2020, do the following 11 Prepare a sales budget. This is similar to Mllustration 223 of your textbook 12 ] Prepare a production budget. This is similar to illustration 22-5 of your textbook 13 (c) Prepare a direct materials budget. (Round to nearest dollar) This is similar to Mlustration 22-9 of your textbook 14 (4) Prepare a direct labor budget. (For calculations, round to the nearest hour. This is similar to Austration 22:11 of your textbook 15 Prepare a manufacturing overhead budget. Round intermediate amounts to the nearest dollar. This is similar to lustration 22.12 of your textbook 16 17 Rules 11 Usbece's Nunctionality to your benefit. Points are lost for lack of formula 19 Uw proper formats for schedules, following the referenced textbook examples 20 Use dollars and underscores where appropriate 21 Double check your work! Verify your formula and logic 22 YOU MUST PREPARE BUDGET DETAIL FOR EACH MONTH IN THE FIRST QUARTER 23 24 Grading Guidelines 25 hective Use of 40N 26 TL 20N 27 Complete SON 20 Spelling Punctuation, Value Format 10N 29 30 31 33 34 35 36 39 40 41 44 Instructions If instructions!B4= "Enter You H C D F The company is preparing its budget for the coming year, 2020. The flest step is to plan for the FIRST QUARTER of that coming year. The following Information has been gathered from their managers. 3 **YOU MUST PREPARE BUDGET DETAIL FOR EACH MONTH IN THE FIRST QUARTER** Grading guidelines are on the instructions tab. 5 Sales Information 6 Period Units 7 November 114,000 Actual December 102,000 Actual 9 January 112,000 Planned 10 February 113,000 Planned 11 March 116,000 Planned 12 April 125,000 Planned 13 May 137,500 Planned 14 Unit selling price $ 12.00 15 16 Finished Goods Inventory Planning 17 The company likes to keep 10% of the next month's unit ales in finished goods ending inventory. 18 19 Accounts Receivable & Collections 20 Sales on Account 100% 21 Collections Activity 22 Month of Sale 85% 23 Month after Sale 15% 24 Balance at 12/11/19 $ 185,000.00 25 26 Materials inventory Costs & Planning 27 Direct Muterials Amount Used per Unit Cost 28 Metal 2 lb $ 0.75 lb 29 The company likes to keep of the material needed for the next month's production in raw materials ending inventory 30 31 Accounts Payable & Disbursements 32 Purchases on Account 100N 33 Payment Activity 34 Month of Purchase SON 35 Month after Purchase 50% 36 Balance at 12/31/19 5 120,000 37 38 Direct Labor & Costs 39 Time per Unit Production 12 minutes 40 Pay Rate/hour 5 8.00 D7 fx =IF(Instructions!B5"","Enter your User ID in the field on the Instruction E 58 B C D 42 Manufacturing Overhead Costs 43 Variable costs per direct labor hour 44 Indirect materials $ 0.30 45 Indirect labor 0.50 46 Utilities 0.45 47 Maintenance 0.25 48 Fixed costs per month 49 Salaries $ 42,000 50 Depreciation 16,800 51 Property taxes 2,675 52 Insurance 1,200 53 Janitorial - 1,300 54 55 Selling and Administrative Costs 56 Variable costs per unit sold $ 1.60 57 Fixed costs per month Advertising $ 15,000 59 Insurance 14.000 60 Salaries 72,000 61 Depreciation 25,000 62 Other fixed costs 3,000 63 64 Income Taxes 65 Accrued on Monthly Net Income 40% rounded to nearest dollar 66 Amounts Accrued Q4 2019, paid January 2020 $ 200,000 67 68 Cash and Financing Matters 69 Cash Balance, 12/31/2019 $ 100,500 70 2020 Minimum Balance Required 800,000 71 $ 2.50 per share 72 Monthly Dividends 73 Outstanding Shares 5,000 74 75 Line of Credit None 76 Limit 1,000 77 $ Borrowing increment Required BX 78 Interest Rate 79 Draws First of Month 80 Repayments Last of Month 81 Interest accumulates to the loan balance and is paid in full with each repayment + 82 83 Additional item $ 500,000 84 Fixed Asset Purchase February 85 Month Instructions Facts Student's Solution per share F G H 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Instructions Facts Student's Solution Ready C D ACC 3020 - Excel Case-Master Budget for Serious Business, Inc. H 4 Enter your name: Enter your WSU Access ID: 7 The facts for this problem are presented on the facts tab of this workbook. Instructions - Your solutions should be clearly labeled on the Solutions tab of this workbook 10 for the first quarter of 2020, do the following 11 Prepare a sales budget. This is similar to Mllustration 223 of your textbook 12 ] Prepare a production budget. This is similar to illustration 22-5 of your textbook 13 (c) Prepare a direct materials budget. (Round to nearest dollar) This is similar to Mlustration 22-9 of your textbook 14 (4) Prepare a direct labor budget. (For calculations, round to the nearest hour. This is similar to Austration 22:11 of your textbook 15 Prepare a manufacturing overhead budget. Round intermediate amounts to the nearest dollar. This is similar to lustration 22.12 of your textbook 16 17 Rules 11 Usbece's Nunctionality to your benefit. Points are lost for lack of formula 19 Uw proper formats for schedules, following the referenced textbook examples 20 Use dollars and underscores where appropriate 21 Double check your work! Verify your formula and logic 22 YOU MUST PREPARE BUDGET DETAIL FOR EACH MONTH IN THE FIRST QUARTER 23 24 Grading Guidelines 25 hective Use of 40N 26 TL 20N 27 Complete SON 20 Spelling Punctuation, Value Format 10N 29 30 31 33 34 35 36 39 40 41 44 Instructions If instructions!B4= "Enter You H C D F The company is preparing its budget for the coming year, 2020. The flest step is to plan for the FIRST QUARTER of that coming year. The following Information has been gathered from their managers. 3 **YOU MUST PREPARE BUDGET DETAIL FOR EACH MONTH IN THE FIRST QUARTER** Grading guidelines are on the instructions tab. 5 Sales Information 6 Period Units 7 November 114,000 Actual December 102,000 Actual 9 January 112,000 Planned 10 February 113,000 Planned 11 March 116,000 Planned 12 April 125,000 Planned 13 May 137,500 Planned 14 Unit selling price $ 12.00 15 16 Finished Goods Inventory Planning 17 The company likes to keep 10% of the next month's unit ales in finished goods ending inventory. 18 19 Accounts Receivable & Collections 20 Sales on Account 100% 21 Collections Activity 22 Month of Sale 85% 23 Month after Sale 15% 24 Balance at 12/11/19 $ 185,000.00 25 26 Materials inventory Costs & Planning 27 Direct Muterials Amount Used per Unit Cost 28 Metal 2 lb $ 0.75 lb 29 The company likes to keep of the material needed for the next month's production in raw materials ending inventory 30 31 Accounts Payable & Disbursements 32 Purchases on Account 100N 33 Payment Activity 34 Month of Purchase SON 35 Month after Purchase 50% 36 Balance at 12/31/19 5 120,000 37 38 Direct Labor & Costs 39 Time per Unit Production 12 minutes 40 Pay Rate/hour 5 8.00 D7 fx =IF(Instructions!B5"","Enter your User ID in the field on the Instruction E 58 B C D 42 Manufacturing Overhead Costs 43 Variable costs per direct labor hour 44 Indirect materials $ 0.30 45 Indirect labor 0.50 46 Utilities 0.45 47 Maintenance 0.25 48 Fixed costs per month 49 Salaries $ 42,000 50 Depreciation 16,800 51 Property taxes 2,675 52 Insurance 1,200 53 Janitorial - 1,300 54 55 Selling and Administrative Costs 56 Variable costs per unit sold $ 1.60 57 Fixed costs per month Advertising $ 15,000 59 Insurance 14.000 60 Salaries 72,000 61 Depreciation 25,000 62 Other fixed costs 3,000 63 64 Income Taxes 65 Accrued on Monthly Net Income 40% rounded to nearest dollar 66 Amounts Accrued Q4 2019, paid January 2020 $ 200,000 67 68 Cash and Financing Matters 69 Cash Balance, 12/31/2019 $ 100,500 70 2020 Minimum Balance Required 800,000 71 $ 2.50 per share 72 Monthly Dividends 73 Outstanding Shares 5,000 74 75 Line of Credit None 76 Limit 1,000 77 $ Borrowing increment Required BX 78 Interest Rate 79 Draws First of Month 80 Repayments Last of Month 81 Interest accumulates to the loan balance and is paid in full with each repayment + 82 83 Additional item $ 500,000 84 Fixed Asset Purchase February 85 Month Instructions Facts Student's Solution per share F G H 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Instructions Facts Student's Solution Ready The facts for this problem are presented on the Facts tab of this workbook.

Instructions - Your solutions should be clearly labeled on the Solutions tab of this workbook.

For the first quarter of 2020, do the following.

(a) Prepare a sales budget. This is similar to Illustration 22-3 of your textbook.

(b) Prepare a production budget. This is similar to Illustration 22-5 of your textbook.

(c) Prepare a direct materials budget. (Round to nearest dollar) This is similar to Illustration 22-9 of your textbook.

(d) Prepare a direct labor budget. (For calculations, round to the nearest hour.) This is similar to Illustration 22-11 of your textbook.

(e) Prepare a manufacturing overhead budget. (Round intermediate amounts to the nearest dollar.) This is similar to Illustration 22-12 of your textbook.

Rules:

* Use Excel's functionality to your benefit. Points are lost for lack of formula.

* Use proper formats for schedules, following the referenced textbook examples.

* Use dollar-signs and underscores where appropriate

* Double-check your work! Verify your formula and logic!

**YOU MUST PREPARE BUDGET DETAIL FOR EACH MONTH IN THE FIRST QUARTER**

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started