PLEASE HELP ASAP!!

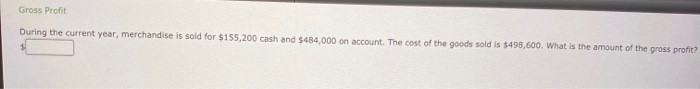

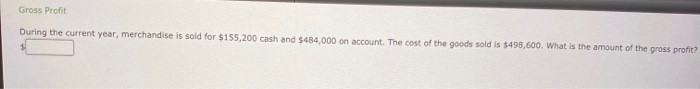

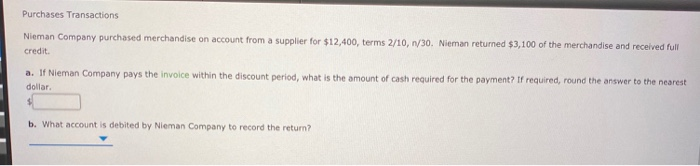

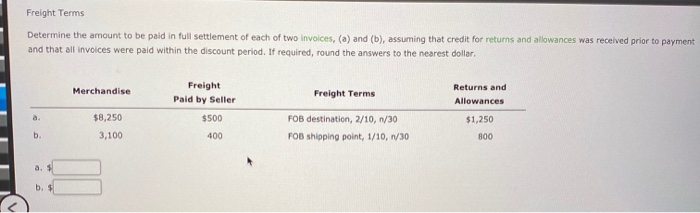

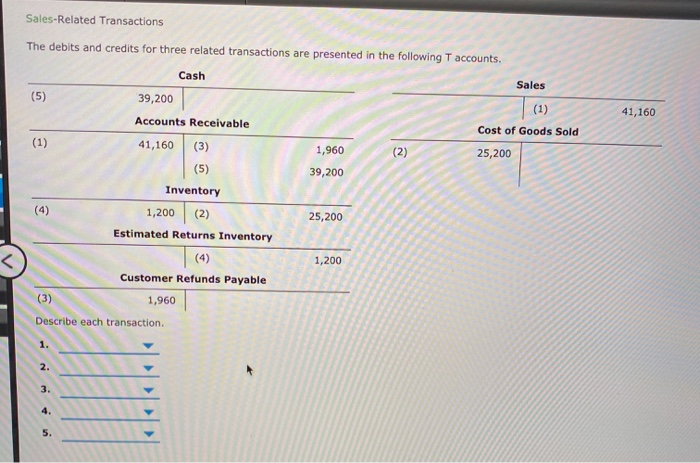

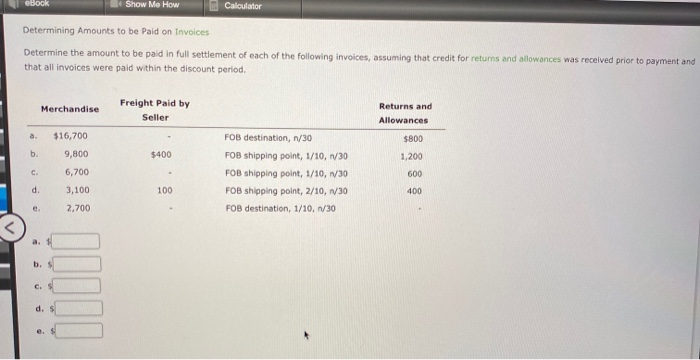

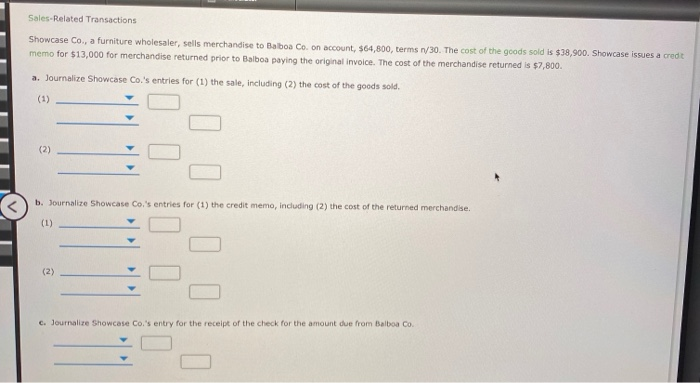

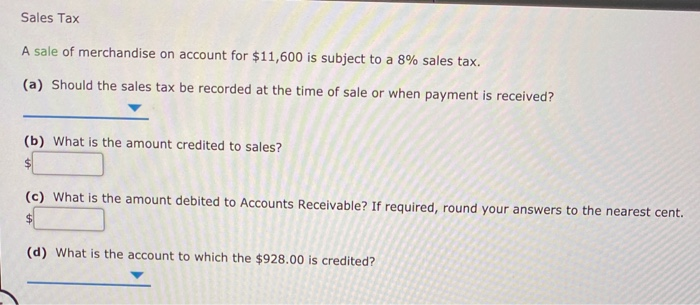

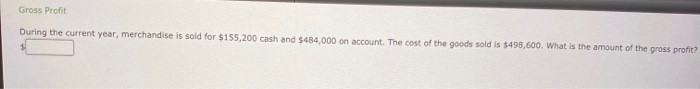

Gross Profit During the current year, merchandise is sold for $155,200 cash and $484,000 on account. The cost of the goods sold is $498,600. What is the amount of the gross profit? Purchases Transactions Nieman Company purchased merchandise on account from a supplier for $12,400, terms 2/10, 1/30. Nieman returned $3,100 of the merchandise and received full credit a. If Nieman Company pays the invoice within the discount period, what is the amount of cash required for the payment? If required, round the answer to the nearest dollar b. What account is debited by Nieman Company to record the return? Freight Terms Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. If required, round the answers to the nearest dollar. Merchandise Freight Terms Freight Paid by Seller $500 Returns and Allowances $8,250 3,100 FOB destination, 2/10, 1/30 FOB shipping point, 1/10, 1/30 $1,250 800 b. 400 b. $ Sales-Related Transactions The debits and credits for three related transactions are presented in the following T accounts. Cash Sales (5) 39,200 (1) 41,160 Accounts Receivable Cost of Goods Sold (1) 1,960 (2) 25,200 39,200 (4) 41,160 (3) (5) Inventory 1,200 (2) Estimated Returns Inventory (4) Customer Refunds Payable 1,960 25,200 1,200 Describe each transaction. 1. 2. 3. 4. 5 eBook Show Me How Calculator Determining amounts to be paid on Invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for retums and allowances was received prior to payment and that all invoices were paid within the discount period. Merchandise Freight Paid by Seller Returns and Allowances a. $800 b. $400 1,200 $16,700 9,800 6,700 3,100 C FOB destination, n/30 FOB shipping point, 1/10, 1/30 FOB shipping point, 1/10, 1/30 FOB shipping point, 2/10, 1/30 FOB destination, 1/10, 1/30 600 d. 100 400 e 2,700 b. d. S Sales-Related Transactions Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account, 564,800, terms n/30. The cost of the goods sold is $38,900. Showcase issues a credt memo for $13,000 for merchandise returned prior to Balboa paying the original invoice. The cost of the merchandise returned is $7,800. a. Journalize Showcase Co.'s entries for (1) the sale, including (2) the cost of the goods sold. (1) (2) b. Journalize Showcase Co.'s entries for (1) the credit memo, including (2) the cost of the returned merchandise (1) (2) c. Journalize Showcase Co.'s entry for the receipt of the check for the amount due from Balboa Co. Sales Tax A sale of merchandise on account for $11,600 is subject to a 8% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received? (b) What is the amount credited to sales? (c) What is the amount debited to Accounts Receivable? If required, round your answers to the nearest cent. (d) What is the account to which the $928.00 is credited