please help ASAP

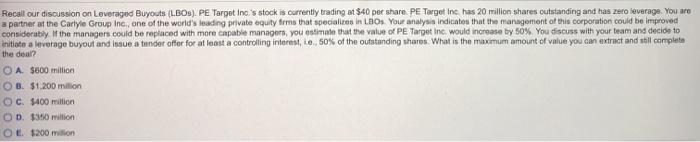

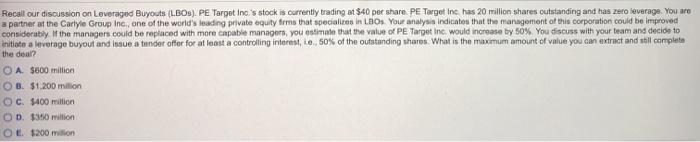

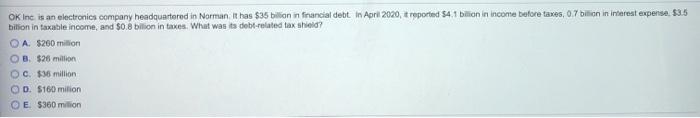

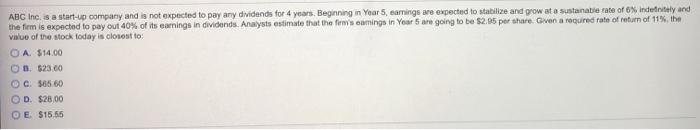

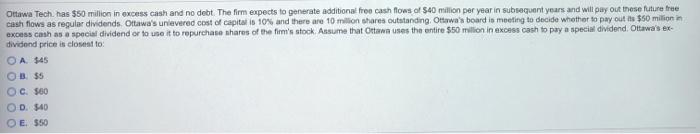

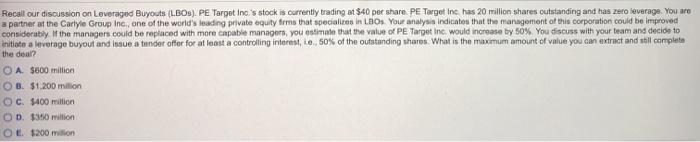

Recall our discussion on Leveraged Buyouts (LBOS). PE Target Inc.'s stock is currently trading at $40 per share. PE Torget Inc. has 20 million shares outstanding and has zero leverage. You are a partner at the Carlyle Group Inc., one of the world's leading private equity firms that specializes in LBOS. Your analysis indicates that the management of this corporation could be improved considerably of the managers could be replaced with more capable managers, you stimate that the value of PE Target Inc would increase by 50%. You discuss with your team and decide to initiate a leverage buyout and issue atender offer for at least a controlling interest, Le 50% of the outstanding shares. What is the maximum amount of value you can extract and still completa the deal? O A. $600 million OB. $1,200 milion OC. $400 million OD. $0 million OE 1200 million OK Inc is an electronics company headquartered in Norman It has $35 billion in financial debt. in April 2020, reported 541 billion in income before taxes, 0.7 billion in interest expense, $3.5 bilion in taxable income, and $0.8 bilion in taxes. What was its debt-related tax shield? A. $200 million OB. $20 million DC $36 million OD. $160 milion OE $360 milion ABC Inc. is a start-up company and is not expected to pay any dividends for 4 years. Beginning in Year, earnings we expected to stabilize and grow at a sustanatie rate of 6% indefinitely and the firm is expected to pay out 40% of its earnings in dividends. Analysts estimate that the firm's coming in Your 5 are going to be $2,95 per share. Given a required rate of return of 11%. the value of the stock today is closest to O A $14.00 D. $23.00 C: 565 60 D. $28.00 O E $15.55 Ottawa Tech has $50 million in excess cash and no debt. The firm expects to generate additional free cash flow of 540 million per year in subsequent years and will pay out these future free cash flows as regular dividends. Ottawa's unlevered cost of capital is 10% and there are 10 million shares outstanding, Ottawa's board is meeting to decide whether to pay out the $50 milion in excess cash as a special dividend or to use it to repurchase shares of the firm's stock. Assume that we uses the entire $50 million in excess cash to pay a special dividend. Ottawa's ex- dividend price is closest to O A $45 C. $60 D. $40 OE $50 Recall our discussion on Leveraged Buyouts (LBOS). PE Target Inc.'s stock is currently trading at $40 per share. PE Torget Inc. has 20 million shares outstanding and has zero leverage. You are a partner at the Carlyle Group Inc., one of the world's leading private equity firms that specializes in LBOS. Your analysis indicates that the management of this corporation could be improved considerably of the managers could be replaced with more capable managers, you stimate that the value of PE Target Inc would increase by 50%. You discuss with your team and decide to initiate a leverage buyout and issue atender offer for at least a controlling interest, Le 50% of the outstanding shares. What is the maximum amount of value you can extract and still completa the deal? O A. $600 million OB. $1,200 milion OC. $400 million OD. $0 million OE 1200 million OK Inc is an electronics company headquartered in Norman It has $35 billion in financial debt. in April 2020, reported 541 billion in income before taxes, 0.7 billion in interest expense, $3.5 bilion in taxable income, and $0.8 bilion in taxes. What was its debt-related tax shield? A. $200 million OB. $20 million DC $36 million OD. $160 milion OE $360 milion ABC Inc. is a start-up company and is not expected to pay any dividends for 4 years. Beginning in Year, earnings we expected to stabilize and grow at a sustanatie rate of 6% indefinitely and the firm is expected to pay out 40% of its earnings in dividends. Analysts estimate that the firm's coming in Your 5 are going to be $2,95 per share. Given a required rate of return of 11%. the value of the stock today is closest to O A $14.00 D. $23.00 C: 565 60 D. $28.00 O E $15.55 Ottawa Tech has $50 million in excess cash and no debt. The firm expects to generate additional free cash flow of 540 million per year in subsequent years and will pay out these future free cash flows as regular dividends. Ottawa's unlevered cost of capital is 10% and there are 10 million shares outstanding, Ottawa's board is meeting to decide whether to pay out the $50 milion in excess cash as a special dividend or to use it to repurchase shares of the firm's stock. Assume that we uses the entire $50 million in excess cash to pay a special dividend. Ottawa's ex- dividend price is closest to O A $45 C. $60 D. $40 OE $50