Please help ASAP! There are 3 different questions! Thank you in advance! Will thumbs up if answers are correct or will comment if they need to be tweeked.

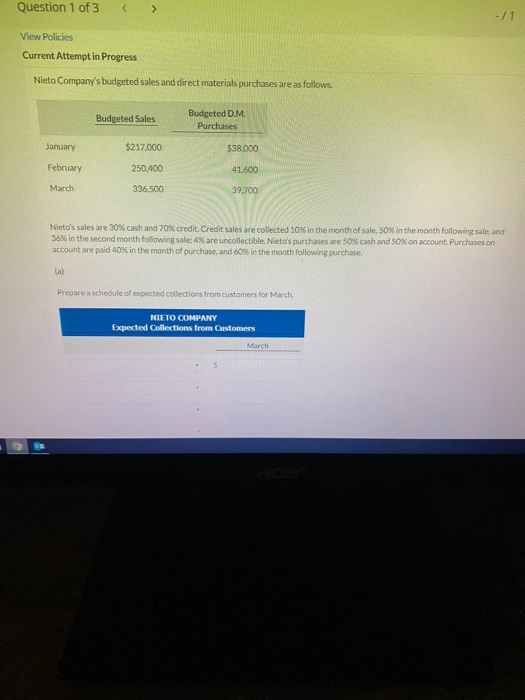

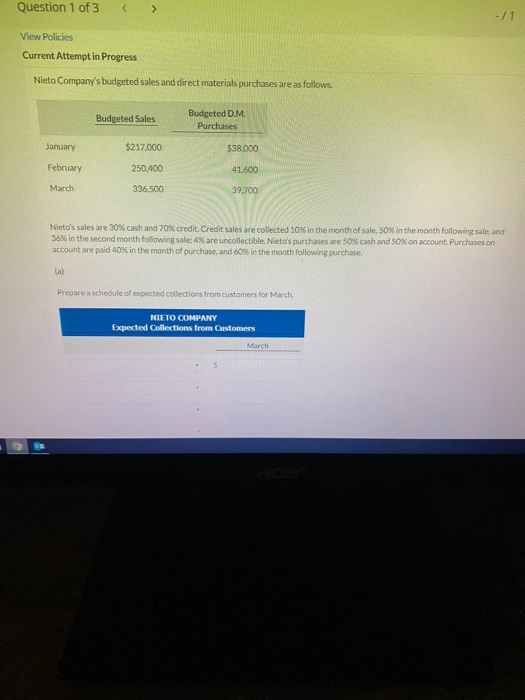

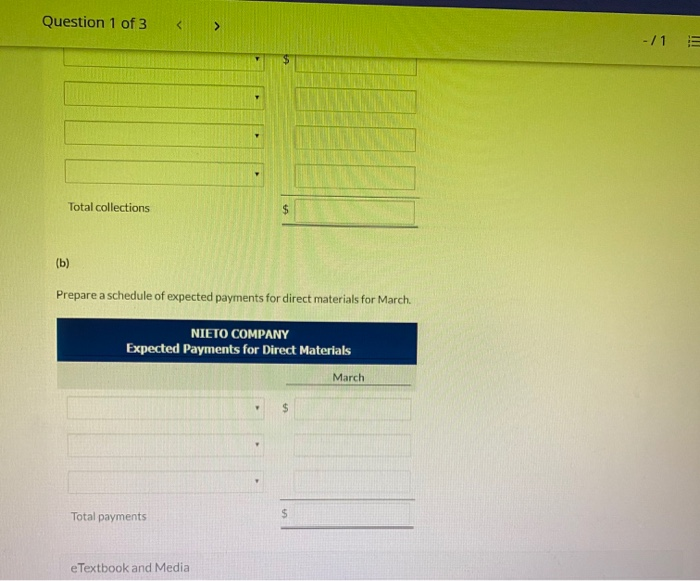

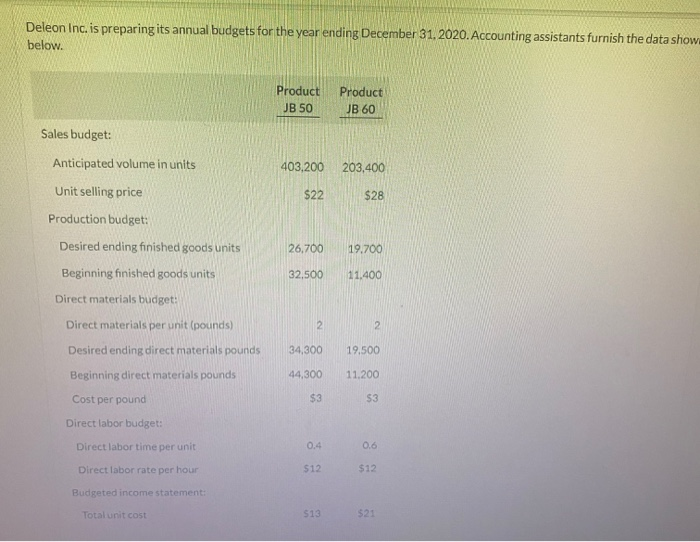

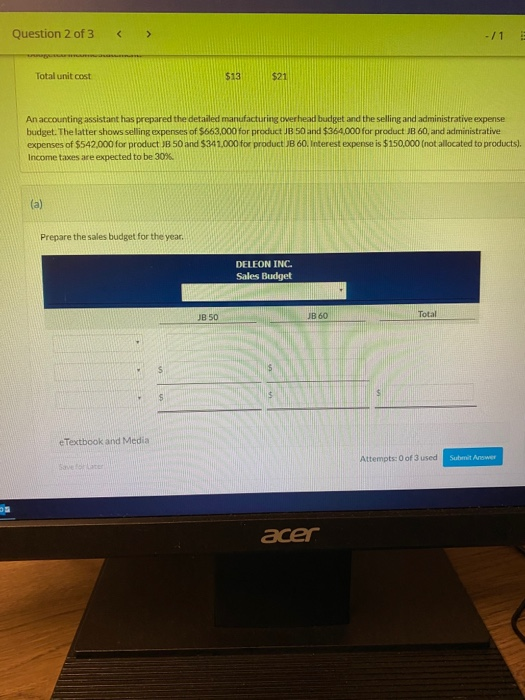

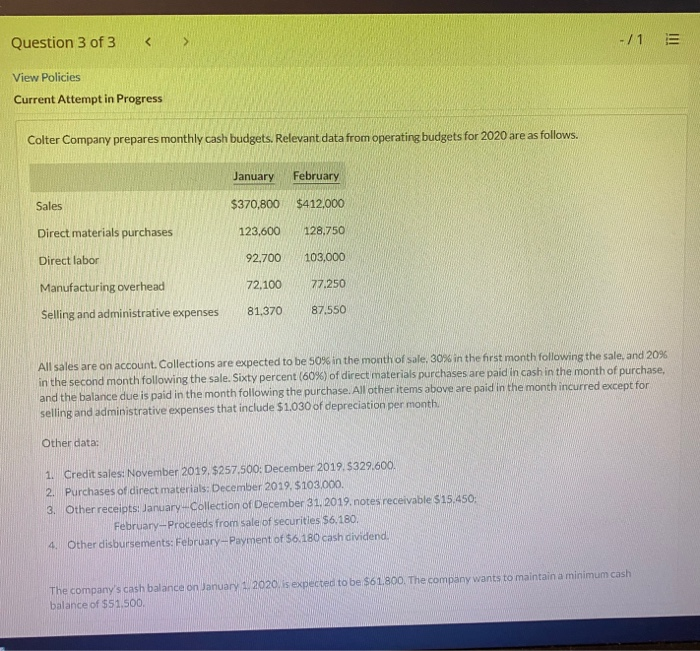

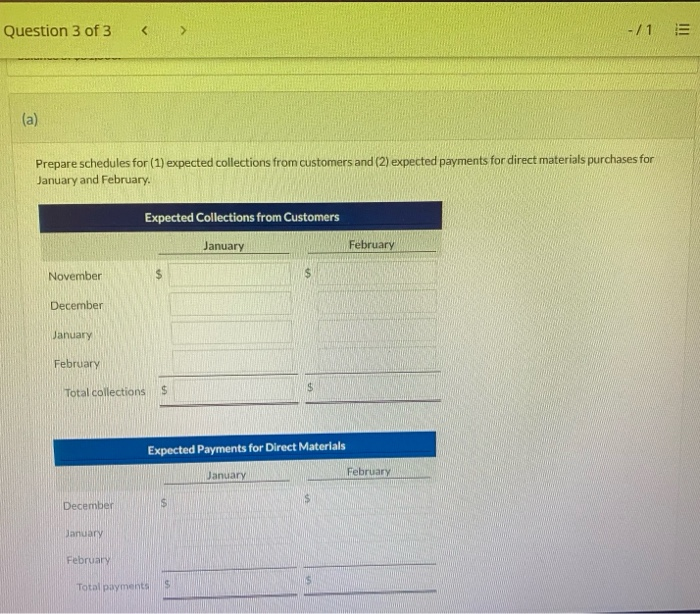

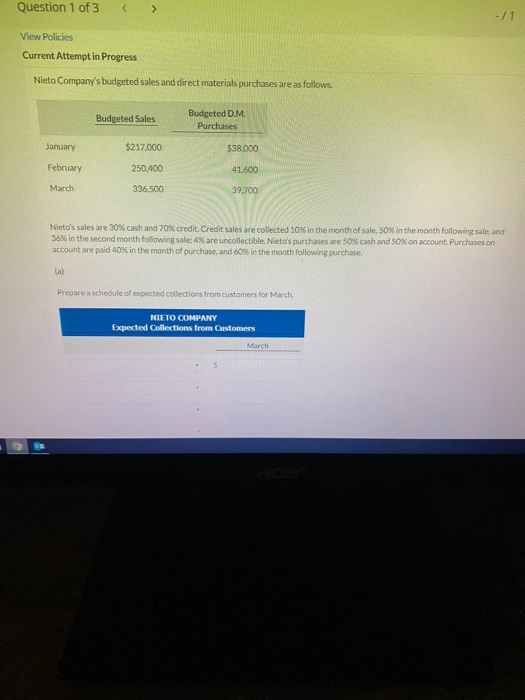

Question 1 of 3 View Policies Current Attempt in Progress Nieto Company's budgeted sales and direct materials purchases are as follows. Budgeted Sales Budgeted D.M. Purchases January $217,000 $38,000 February 250.400 41.600 March 336,500 39.700 Nieto's sales are 30% cash and 70% credit. Credit sales are collected 10% in the month of sale, 50% in the month follow sale, and 36% in the second month following sale: 4% are uncollectible. Nieto's purchases are 50% cash and 50% on account Purchases on account are paid 40% in the month of purchase, and 60% in the month following purchase. (a) Prepare a schedule of expected collections from customers for March NIETO COMPANY Expected Collections from Customers March Question 1 of 3 -/1 II! Total collections $ (b) Prepare a schedule of expected payments for direct materials for March NIETO COMPANY Expected Payments for Direct Materials March $ Total payments $ e Textbook and Media Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data show below. Product JB 50 Product JB 60 Sales budget: 403,200 203,400 $22 $28 Anticipated volume in units Unit selling price Production budget: Desired ending finished goods units Beginning finished goods units Direct materials budget: 26,700 19.700 32,500 11,400 2 2 Direct materials per unit (pounds) Desired ending direct materials pounds Beginning direct materials pounds 34,300 19.500 44,300 11.200 Cost per pound $3 53 Direct labor budget: Direct labor time per unit 0.4 0.6 Direct labor rate per hour 512 $12 Budgeted income statement: Total unit cost S13 $21 Question 2 of 3 -/1 Total unit cost $13 $21 An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $663,000 for product JB 50 and $364 000 for product JB 60, and administrative expenses of $542,000 for product JB 50 and $341,000 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 30%. Prepare the sales budget for the year. DELEON INC. Sales Budget JB 50 JB 60 Total $ $ e Textbook and Media Attempts: 0 of 3 used Submit Answer Sovet acer Question 3 of 3