Answered step by step

Verified Expert Solution

Question

1 Approved Answer

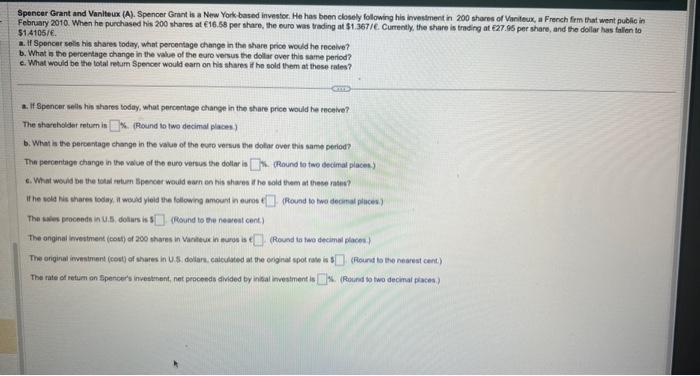

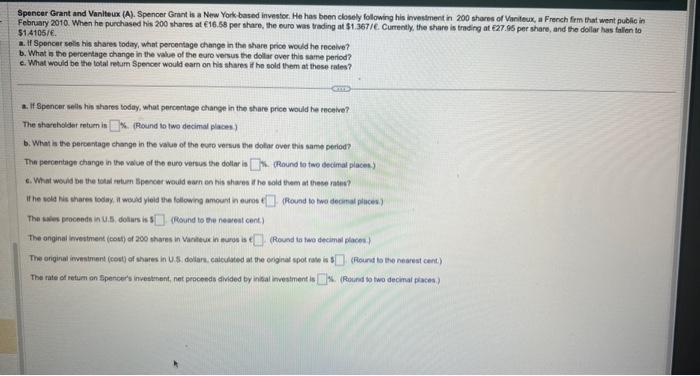

PLEASE HELP ASAP, WILL UPVOTE THANK YOU! please answer ALL SECTIONS OF THE QUESTION!! THANK YOU THANK YOU!! Speneer Grant and Vaniteux (A). Spencer Grant

PLEASE HELP ASAP, WILL UPVOTE THANK YOU! please answer ALL SECTIONS OF THE QUESTION!! THANK YOU THANK YOU!!

Speneer Grant and Vaniteux (A). Spencer Grant is a New Yorkbased investoc. He has been closely following his imvestment in 200 shores of Vanileux, a French frm that went public in February 2010 . When he purchased his 200 shares at 616.59 per share, the euro was troding at $1.367/C. Curreotly, the share is trading at E27.95 per share, and the dollar has fallen io $1,4105/. a. If Spencer selis his shares today, what percentage change in the share price would he recelve? b. What is the percertage change in the value of the eure versus the dollar over this same period? c. What would be the total return Spenoer would earn on his shares if he sold them at these rales? 2. If Spencer sells his thares today, what percentage change in the share price would he recelve? The shareholdent tetum is 6. (Round is two decimal places) b. What is the percentage change in the value of the euep versus the doltar over this same period? The percontage change in the value of the euno varsus the dollar is 4. (Round to two decimal places.) 6. What would be the toul retum Spencer would earn en his shares it he sold them at these rasev? The onginal invettnent (cotf) of 200 thares in Varkteur in auros is (Round ta teo decimal places?) (Fround to the nearest cent) The rate of retum an Spencer's investenent, net prpcoeds divided by infal imvestment is 5. (Rovinat so two decinal paces)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started