please help

please help

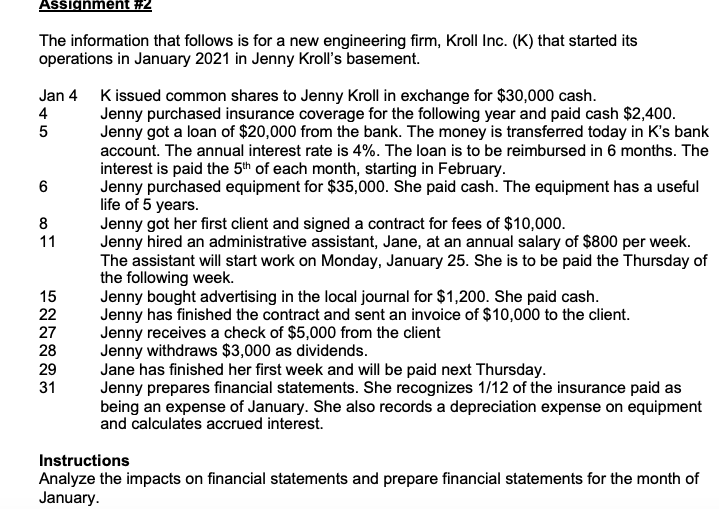

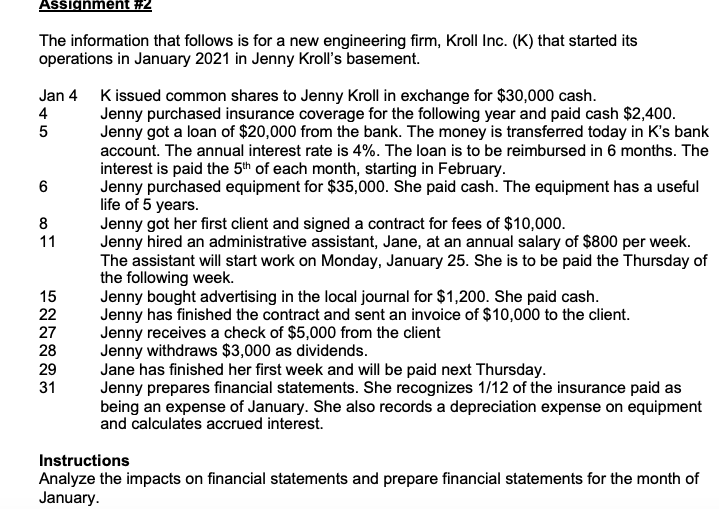

Assignment #2 6 The information that follows is for a new engineering firm, Kroll Inc. (K) that started its operations in January 2021 in Jenny Kroll's basement. Jan 4 Kissued common shares to Jenny Kroll in exchange for $30,000 cash. 4 Jenny purchased insurance coverage for the following year and paid cash $2,400. 5 Jenny got a loan of $20,000 from the bank. The money is transferred today in K's bank account. The annual interest rate is 4%. The loan is to be reimbursed in 6 months. The interest is paid the 5th of each month, starting in February. Jenny purchased equipment for $35,000. She paid cash. The equipment has a useful life of 5 years. 8 Jenny got her first client and signed a contract for fees of $10,000. 11 Jenny hired an administrative assistant, Jane, at an annual salary of $800 per week. The assistant will start work on Monday, January 25. She is to be paid the Thursday of the following week. 15 Jenny bought advertising in the local journal for $1,200. She paid cash. 22 Jenny has finished the contract and sent an invoice of $10,000 to the client. 27 Jenny receives a check of $5,000 from the client Jenny withdraws $3,000 as dividends. 29 Jane has finished her first week and will be paid next Thursday. 31 Jenny prepares financial statements. She recognizes 1/12 of the insurance paid as being an expense of January. She also records a depreciation expense on equipment and calculates accrued interest. 28 Instructions Analyze the impacts on financial statements and prepare financial statements for the month of January Assignment #2 6 The information that follows is for a new engineering firm, Kroll Inc. (K) that started its operations in January 2021 in Jenny Kroll's basement. Jan 4 Kissued common shares to Jenny Kroll in exchange for $30,000 cash. 4 Jenny purchased insurance coverage for the following year and paid cash $2,400. 5 Jenny got a loan of $20,000 from the bank. The money is transferred today in K's bank account. The annual interest rate is 4%. The loan is to be reimbursed in 6 months. The interest is paid the 5th of each month, starting in February. Jenny purchased equipment for $35,000. She paid cash. The equipment has a useful life of 5 years. 8 Jenny got her first client and signed a contract for fees of $10,000. 11 Jenny hired an administrative assistant, Jane, at an annual salary of $800 per week. The assistant will start work on Monday, January 25. She is to be paid the Thursday of the following week. 15 Jenny bought advertising in the local journal for $1,200. She paid cash. 22 Jenny has finished the contract and sent an invoice of $10,000 to the client. 27 Jenny receives a check of $5,000 from the client Jenny withdraws $3,000 as dividends. 29 Jane has finished her first week and will be paid next Thursday. 31 Jenny prepares financial statements. She recognizes 1/12 of the insurance paid as being an expense of January. She also records a depreciation expense on equipment and calculates accrued interest. 28 Instructions Analyze the impacts on financial statements and prepare financial statements for the month of January

please help

please help