Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! assignment due in 30 mins. Please show work (Analyzing the quality of earnings and sustainability of capital expenditures) Look up the statement of

please help! assignment due in 30

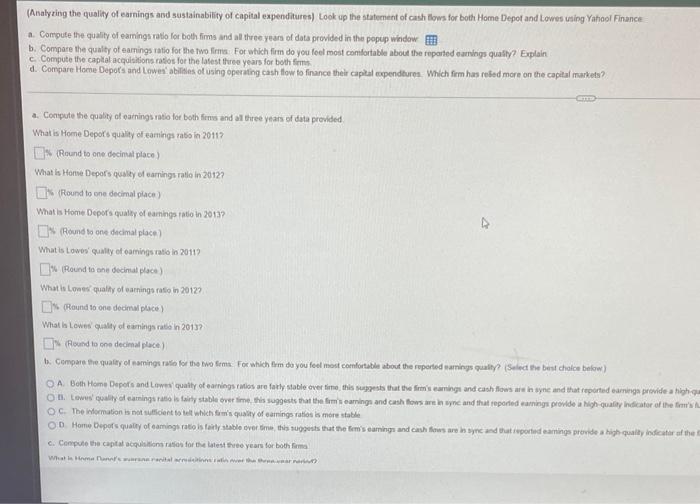

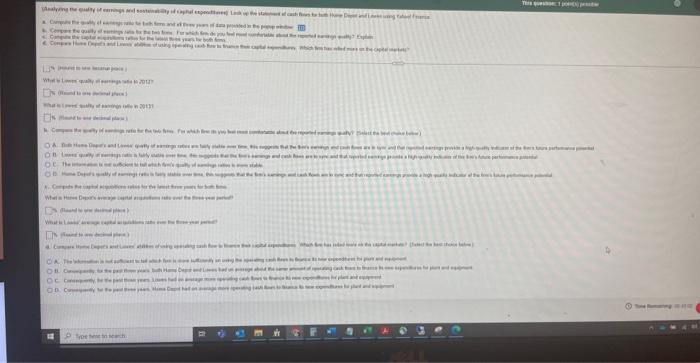

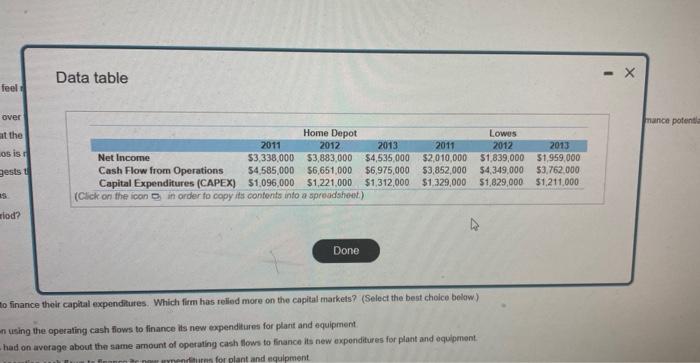

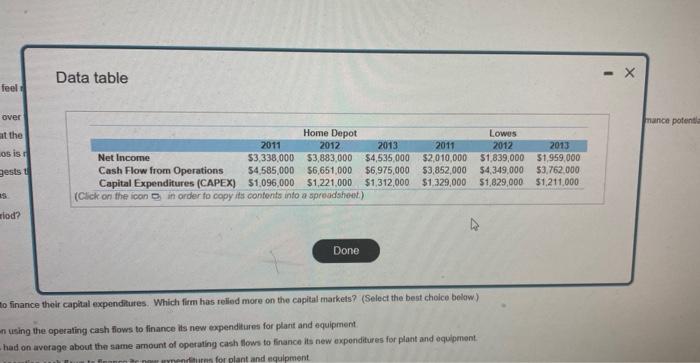

(Analyzing the quality of earnings and sustainability of capital expenditures) Look up the statement of cash flows for both Home Depot and Lowes using Yahool Finance a. Compute the quality of earnings ratio for both firms and all three years of data provided in the popup window b. Compare the quality of earnings ratio for the two firms. For which firm do you feel most comfortable about the reported eamings quality? Explain c. Compute the capital acquisitions ratios for the latest three years for both firms d. Compare Home Depot's and Lowes' abilities of using operating cash flow to finance their capital expenditures. Which firm has reled more on the capital markets? a. Compute the quality of earnings ratio for both firms and all three years of data provided. What is Home Depot's quality of earings ratio in 20117 (Round to one decimal place) What is Home Depor's quality of earnings ratio in 20127 (Round to one decimal place) What is Home Depot's quality of earnings ratio in 2013? (Round to one decimal place) What is Lowes quality of eamings ratio in 2011? (Round to one decimal place) T What is Lowes quality of earnings ratio in 20127 (Round to one decimal place) What is Lowes quality of eamings ratio in 2013? (Round to one decimal place) b. Compare the quality of eamings ratio for the two firms. For which firm do you feel most comfortable about the reported earnings quality? (Select the best choice below) OA. Both Home Depots and Lowes' quality of earnings ratios are fairly stable over time, this suggests that the firm's earnings and cash flows are in sync and that reported earnings provide a high-qua OB. Lowes' quality of earnings ratio is fairly stable over time, this suggests that the firm's eamings and cash flows are in sync and that reported earnings provide a high-quality indicator of the firm's OC. The information is not sufficient to tell which firm's quality of earnings ratios is more stable OD Home Depots quality of eamings ratio is fairly stable over time, this suggests that the fem's earnings and cash flows are in sync and that reported eamings provide a high-quality indicator of the t c. Compute the capital acquisitions ratios for the latest three years for both firma What is Home Nanef's warna ranital arredisitions ran ver the th nathi p HANT Whyarle What ty of agen20131 Compty of ste Ai Dyutatis OU o o Comp Wa Bh What JUN CATH otICyn OC C 110. ibaume je lepo sp Petosearch for which areeong "alleel Frarie Exp thoptal me high pens for partn aitet feel over at the os is gests t iod? Data table Lowes 2012 2013 2011 2013 Net Income Home Depot 2011 2012 $3,338,000 $3,883,000 $4,535,000 $2,010,000 $1,839,000 $1,959,000 Cash Flow from Operations $4,585,000 $6,651,000 $6,975,000 $3,852,000 $4,349,000 $3,762,000 Capital Expenditures (CAPEX) $1,096,000 $1,221,000 $1,312,000 $1,329,000 $1,829,000 $1,211,000 (Click on the icon in order to copy its contents into a spreadsheet.) Done to finance their capital expenditures. Which firm has relled more on the capital markets? (Select the best choice below) n using the operating cash flows to finance its new expenditures for plant and equipment. had on average about the same amount of operating cash flows to finance its new expenditures for plant and equipment. menditures for plant and equipment X mance potentia mins. Please show work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started